S.Korean fund becomes major shareholder in leading Vietnamese stationery maker Thien Long

S.Korean fund becomes major shareholder in leading Vietnamese stationery maker Thien Long

Thien Long Group Corporation, listed on the Ho Chi Minh Stock Exchange (HoSE) as TLG, recently announced a South Korean fund as a new significant shareholder.

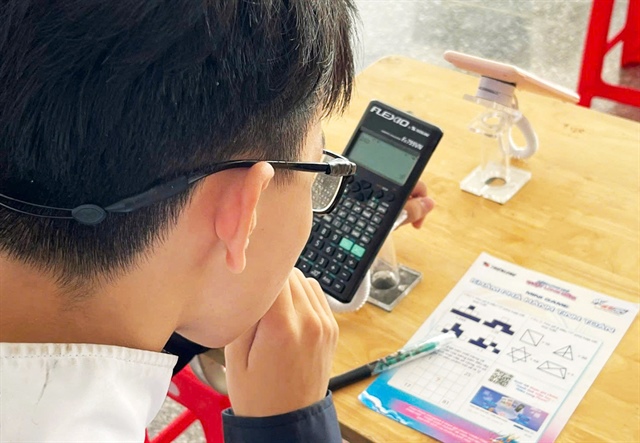

A student uses a Thien Long pen and calculator. Photo: Thien Long Group Corporation |

On Monday, the KITMC Worldwide Vietnam RSP Balanced Fund, under KIM Vietnam Fund Management, increased its stake in Thien Long to 3.75 percent after purchasing an additional 200,000 TLG shares.

With this development, KIM Vietnam, through four funds that collectively own 5.13 percent of Thien Long’s capital, become a major shareholder in the leading Vietnamese stationery company.

Two familiar major shareholders of Thien Long include chairman Co Gia Tho and Thien Long An Thinh Investment Corporation, another company represented by Co Gia Tho.

According to self-disclosed information, KIM Vietnam originated from Korea Investment Management Co., Ltd (KIM), which has been involved in the Vietnamese market since 2006, when it opened a representative office in Ho Chi Minh City.

In early 2020, KIM acquired shares from the shareholders of Hung Viet Fund Management JSC and was granted a license to establish its fund management company in Vietnam by the State Securities Commission in October of the same year.

As of the end of 2023, KIM Vietnam’s total assets under management exceeded VND24.7 trillion (US$973.42 million).

The company’s portfolio is focused on top-listed companies in the market.

Currently, KIM Vietnam’s charter capital is VND55 billion ($2.17 million), and as of September 2024, the company employed 32 staff members.

From January to September 2024, KIM Vietnam reported a profit of over VND16 billion ($630,600), up 81 percent compared to the same period in 2023.

As for Thien Long, from January to November 2024, the company recorded revenues of more than VND3.4 trillion ($134 million) and a net profit of VND448 billion ($17.66 million), an increase of 24 percent compared to the same period in 2023.

In an interview with Tuoi Tre (Youth) newspaper, Tran Phuong Nga, CEO of Thien Long, shared some of the challenges the company is currently facing.

Domestically, consumer demand has been affected by the unstable economic situation, leading to falling purchasing power in the general consumer segments.

Currently, it is also a low season for Thien Long’s products.

Additionally, competition within the industry has been intensifying, especially during the year-end period when competitors ramp up discount campaigns and promotions.

On the international front, the company faces challenges due to the complex global economic and geopolitical situation.

High logistics and international shipping costs continue to impact operational efficiency.

Consumers are becoming increasingly demanding in terms of product quality, design, and functionality.

Moreover, the fierce price competition and the habit of buying cheap goods have made it difficult for the e-commerce channel to generate effective profit growth.