Banks deliver bright profit picture

Banks deliver bright profit picture

Banks have continued to post promising profits for 2024, buoyed by strong credit growth in the latter half of the year.

Preliminary business results from several banks have begun to surface, albeit 2024 has yet to close.

There persists a clear polarisation in profit figures among banks in 2024. Photo: baodautu.vn |

As of November 30, TPBank had reported profits exceeding $295 million, up nearly 28 per cent from last year. Full-year profits are projected to grow by 34 per cent compared to 2023, driven by its 17 per cent credit growth rate, significantly outpacing the industry average.

The big four state-owned banks – Vietcombank, VietinBank, BIDV, and Agribank – have yet to release detailed profit results, but have provided initial estimates of credit growth, a key driver of profitability in the banking sector.

Agribank CEO Pham Toan Vuong stated that by the end of 2024, the bank expects an 8 per cent increase in pre-tax profits, a 7.9 per cent rise in total assets, and an 11 per cent growth in outstanding balances compared to 2023.

Meanwhile, BIDV anticipates surpassing $108.3 billion in total assets and achieving around $83.3 billion in outstanding balances, showing a 14 per cent on-year increase. Vietcombank also projects a 13 per cent credit growth rate for the year.

According to analysts, these major state lenders’ profits are expected to grow by 8-12 per cent this year, depending on their provisions for credit risk.

Among the big four, VietinBank boasts the highest credit growth rate.

Tran Minh Binh, VietinBank chairman, revealed that as of December 10, the bank's credit growth had reached 14.8 per cent compared to end of 202.

VietinBank has set an 8.7 per cent profit growth target for 2024, with a cumulative 12 per cent increase in profits over the first nine months.

Forecasts from Vietcombank Securities (VCBS) suggest that in 2024, Vietcombank will achieve a 10 per cent profit growth rate. Meanwhile, the figures for BIDV and VietinBank will be 13.8, and 12.4 per cent, respectively.

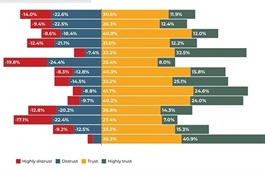

The banking sector’s overall profit growth is projected to exceed 16 per cent this year, with clear polarisation.

Beyond the big four’s steady 8-15 per cent profit growth, private commercial banks will diverge into two groups: high-growth performers like LPBank, Techcombank, VPBank, HDBank, and Sacombank, and struggling banks such as PGBank, Saigonbank, and ABBank.

Senior economist Le Xuan Nghia said that banking sector profits in 2025 would remain stable, similar to 2024, as the economic outlook has not significantly changed.

Credit absorption remains sluggish due to persistent difficulties in the stock and real estate markets.

Nghia added that interest rates in 2025 are unlikely to change significantly as credit demand has yet to accelerate.

Investment channels will remain challenging, preventing pressure on deposits and lending rates. Consequently, the banking sector is expected to maintain stability. Under these circumstances, banking stocks will offer a safe haven for investors in 2025, although strong growth should not be anticipated.

Analysts from ACB Securities predicted that profit growth in the banking sector could slow to 14.9 per cent in 2025.

The sector’s total operating income is forecast to rise 15.3 per cent on-year, driven primarily by credit, while non-interest income is expected to grow more modestly at 8.5 per cent due to continued challenges in the bancassurance segment.

Banks poised for robust profit growth in 2025 include Vietcombank at 12 per cent, BIDV at 16.7 per cent, VietinBank at 17.9 per cent, Techcombank at 17 per cent, MB at 15.5 per cent, and Sacombank at 17.8 per cent.

According to Do Hong Van, head of analysis at FiinGroup, a leading integrated financial data and information services provider, banking stocks remain attractively valued, with positive profit prospects in 2025.

“Banking stocks could benefit from a rebound in private investment and credit growth in 2025. Additionally, valuations are currently at relatively low levels, comparable to the five-year average,” Van noted.