Vietnam’s stand-out tax outlook

Vietnam’s stand-out tax outlook

Vietnam’s tax environment stands out with high morale, trust in authorities, and a strong commitment to national development, which make it a magnet for foreign investors seeking predictability.

|

On December 12, the Public Trust in Tax 2024 report was published by the Association of Chartered Certified Accountants (ACCA). The survey covered 26 countries across Asia, Latin America, and Africa, involving over 10,000 respondents from diverse age groups, income levels, and education backgrounds, with an equal gender split.

The report, also with the involvement of the International Federation of Accountants (IFAC) and Organisation for Economic Cooperation and Development (OECD), provides detailed insights into public perceptions of Vietnam’s tax system, highlighting an exceptional level of trust in tax authorities, surpassing many other countries. It focuses on the “fiscal contract”, the idea that citizens are willing to pay taxes in exchange for efficient public services.

ACCA chief executive Helen Brand added, “This year’s survey and report mark the most significant expansion in the initiative since it began in 2017. In the years since, the scope has expanded from G20 countries, plus New Zealand, to include a cross-section of the largest countries by population in the different regions of the world.”

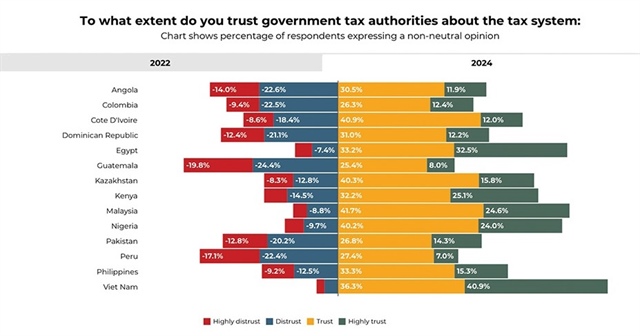

According to the results, Vietnamese respondents demonstrate remarkably high trust in their tax authorities, surpassing all other surveyed countries. Some 77.2 per cent of those surveyed express trust, indicating a strong public belief in the government's effective and fair management of tax revenue. This high level of trust fosters a culture of voluntary compliance and reduces reliance on expensive enforcement measures.

A robust belief in tax equity is prevalent in Vietnam, with 62 per cent of respondents believing that their tax system collects taxes proportionally to the ability to pay.

This figure significantly surpasses the global average of 32 per cent, highlighting a strong perception of fairness within the Vietnamese tax system.

Vietnamese respondents show a strong commitment to their country's future, with 60.6 per cent acknowledging the crucial role of taxes in sustainable development and expressing a willingness to contribute more to achieve these goals. This underscores a deep sense of collective responsibility and dedication towards national progress.

Mirroring global trends, professional tax accountants are the most trusted source for tax information among Vietnamese citizens. This suggests a valuable opportunity for collaboration between tax authorities and accountants to further solidify taxpayer confidence and promote a transparent and reliable tax environment.

“The survey has highlighted some of the challenges faced by governments and tax authorities. The survey results illuminate the issues that need to be addressed in an ongoing conversation about how to best support trust in tax systems and thereby support sustainable development,” said ACCA representatives in the report. “It allows engagement with policymakers, tax authorities, civil society and the accountancy profession, among others, to drive evidence-based policy initiatives to support trust.”

The data in the report also indicates that while Vietnam is among the few countries where trust in politicians outweighs distrust, this trust level has declined compared to 2022. This trend emphasises the need for continued efforts to maintain transparency and accountability in governance, further strengthening public trust in all aspects of the tax system.

“The findings regarding trust in professional tax accountants remain extremely important, and remind us of the unique role that the accountancy profession plays in the trust ecosystem,” said IFAC chief executive Lee White.

Manal Corwin, director of the OECD Centre for Tax Policy and Administration, added, “As the OECD’s work on tax morale has shown, trust is pivotal in establishing effective tax systems, but further work is needed to both measure trust in tax, and understand how to build it. Indeed, all the data presented here is meant to facilitate an ongoing conversation about how to best support trust in tax systems and thereby support sustainable development.”