CBRE Q3 report hints at market correction in real estate sector

CBRE Q3 report hints at market correction in real estate sector

Phnom Penh’s real estate market is showing signs of stability and even growth in various key segments during 2024’s third quarter, despite a continued slowdown in the overall construction sector and ongoing muted growth in market rents and sales prices, according to CBRE Cambodia’s ‘Phnom Penh Market Insights Q3 2024 Report’ released yesterday.

However such a slowdown in new launches across the market may allow occupancy and returns to improve for investors, suggested the CBRS’s findings.

The global consultancy’s latest report analyzed key sectors of the capital’s real estate market including hospitality, residential, retail and commercial estate trends, along with broader trends visible in the Cambodian economy influencing demand for property as the end of 2024 nears.

In regards to Phnom Penh’s retail sector, CBRE’s report noted a significant increase in retail podium supply entering the market.

769,000 square meters of retail podium supply is expected to be online by the close of 2024, with 862,000 meters of new space forecast to be completed and open for tenancy by the end of 2025.

Of the 769,000 square meters due to come online this year, 83 percent is completed already as of Q3 2024.

Other major retail property types, including shopping malls, community malls and shopping centre space however have remained similar to 2023 supply trends.

Retail occupancy continued to decrease slightly from the previous quarter of this year in quarter three, dropping from 58.7 percent in quarter two to 58.3 percent in the year’s third quarter.

Market-wide retail occupancy peaked in 2019 with upwards of 80 percent saturation, according to the report, marking an over 20 percent dip in retail tenancy across retail segments as of 2024.

Retail rental rates also remain subdued in quarter three as compared to previous quarters, with the exception of prime retail rates which rose slightly.

However, across the board, rental rates for retail property remain lower than highs seen in 2019, decreasing by close to 30 percent across grades since that year.

Key trends for the retail sector, according to the report, include retail project owners becoming more flexible with their use of space.

The firm stated that retail landlords are increasingly flexible, utilizing space for various categories and even converting unused space into offices.

Landlords are also diversifying tenant mixes, added the findings, being less selective for tenant approvals and more accommodating to local brands looking to set up shop.

In the commercial sector, Phnom Penh office supply was forecasted to reach 1.12 million square meters by the close of 2024, and forecasted to grow to 1.34 million meters by the end of 2025.

Grade A and strata-titled office space have seen the largest bump in new supply in the market in 2024 compared to previous years; meanwhile, Grade B and C witnessed little change.

Across all grades, office occupancy has seen a slight uptick in quarter three of this year, demonstrated the report: up from 61.8 percent occupancy in quarter two to 65.8 percent in quarter three.

Despite improving occupancy, office rental rates have generally witnessed declines this quarter, with Grade A rents dropping over 5 percent since Q2, landing at an average of $25 per square meter.

Grade C office space both inside and outside of the central business district (CBD) also witnessed slight drops in rental rates, a 3.5 percent and 1.5 percent decline respectively.

Grade B rental rates, however, rose 1 percent this quarter, averaging close to $22 per square meter.

The report also noted that Phnom Penh office building landlords are increasingly offering incentive packages for tenant retention.

“Beyond filling vacancies, landlords are considering renegotiations and support to retain existing tenants,” stated the report.

Interestingly, the findings noted that no new strata-titled office developments have been launched in the last two years, suggesting a cooling-off period for the foreigner-driven commercial investments market.

In regards to the hospitality sector, CBRE’s report found that a modest increase has been recorded in the supply of 4-star and 5-star hotel rooms in this quarter.

By the close of 2024, there will be 9,800 4-star rooms online in the market, and 4,200 5-star. This marks a 2 percent overall increase in prime hotel units since 2023.

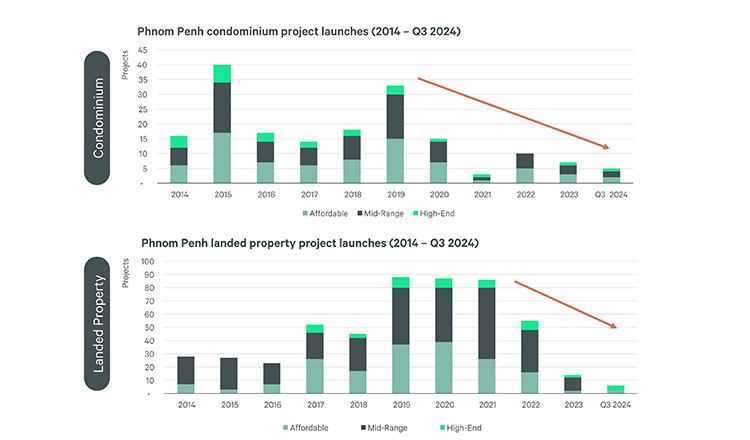

Phnom Penh’s residential property sector is facing few new launches, in both the condominium and landed property segments.

Across segments, new launches of residential property have decreased dramatically compared to previous years, as demonstrated by the firm’s findings.

However, the condominium segment appears more lively than the landed property segment, which has dropped to around 5 new projects launches in 2024, despite boasting almost 90 new landed development projects per year in previous periods of 2019-2022.

Despite around five new condominium launches in 2024, new condominium launches peaked in 2015 and 2019, with 40 and 33 new launches respectively, and have seen slow new supply in all following years.

Kinkesa Kim, Managing Director of CBRE Cambodia, said yesterday that this stark drop-off in supply in the residential property sector is in many ways a sign of an ongoing market correction.

She said that there has been an oversupply of residential property, subduing both occupancy and rental rates for owners, the slowdown now becoming apparent across the market should lead to a market correction whereby occupancy of existing property can increase, along with demand for rentals and resale properties.