HNX: Vietnam Bank for Agriculture and Rural Development applies for listing of corporate bonds

HNX: Vietnam Bank for Agriculture and Rural Development applies for listing of corporate bonds

HNX received the application for bond listing of Vietnam Bank for Agriculture and Rural Development. The following is brief information:

- Name of the company: Vietnam Bank for Agriculture and Rural Development

- Head office: No. 2 Lang Ha, Thanh Cong Ward, Ba Dinh District, Hanoi

- Tel: (024) 3772 2773 Fax: (024) 3831 4069

- Charter capital: VND40,962,923,001,574

- Paid-up charter capital: VND51,615,833,000,000

- Business lines: Receiving term and non-term deposits, Issuing valuable papers, Providing credit, Payment services, Electronic banking services...

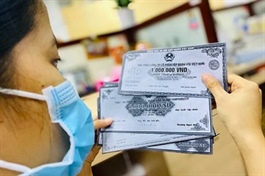

- Name of securities: Vietnam Bank for Agriculture and Rural Development bonds with the maturity in 2034

- Type of securities: Non-convertible, unsecured, unwarranted bonds are Subordinated Debt and satisfy the conditions to be included in the Issuer's Tier 2 capital

- Par value of bonds: VND100,000/bond

- Number of bonds registered for listing: 100,000,000 bonds

HNX