HNX: Ho Chi Minh City Development Joint Stock Commercial Bank applies for listing of corporate bonds

HNX: Ho Chi Minh City Development Joint Stock Commercial Bank applies for listing of corporate bonds

HNX received the application for bond listing of Ho Chi Minh City Development Joint Stock Commercial Bank. The following is brief information:

- Name of the company: Ho Chi Minh City Development Joint Stock Commercial Bank

- Head office: No. 25Bis, Nguyen Thi Minh Khai street, Ben Nghe Ward, District 1, Ho Chi Minh City

- Tel: 028 62 915 916

- Charter capital: VND29,076,321,320,000

- Paid-up charter capital: VND29,076,321,320,000

- Business lines: Other monetary intermediation activities (code 6419)

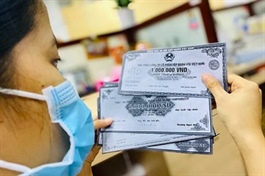

- Name of securities: HDBC7Y202302 bonds

- Type of securities: Non-convertible, unsecured, unwarranted bonds are Subordinated Debt and satisfy the conditions to be included in the Issuer's Tier 2 capital

- Par value of bonds: VND100,000/bond

- Number of bonds registered for listing: 10,000,000 bonds

HNX