Retail properties see vacancies increase

Retail properties see vacancies increase

Savills Hanoi's market brief for the first half of 2024 was released on July 11 and shows that major shopping centres in the capital are witnessing an increase in available leasing space.

Vincom Mega Mall - Royal City has more available space following the departure of Robins Department Store. Vincom Nguyen Chi Thanh also has substantial leasable areas available, providing an attractive option for retail businesses.

The thriving food and beverages (F&B) sector has benefited from the nearby residential and office buildings, indicating opportunities for both new and expanding businesses, with Pizza 4P's expansion in Lotte Centre doubling its area.

Gyu Shige, a Japanese grill restaurant chain, opened its first location at Lancaster Luminaire in Hanoi after having a good reception in Ho Chi Minh City. In addition, Mak Mak Thai Kitchen and Manwah Taiwanese Hotpot are coming soon to Vincom Centre Nguyen Chi Thanh.

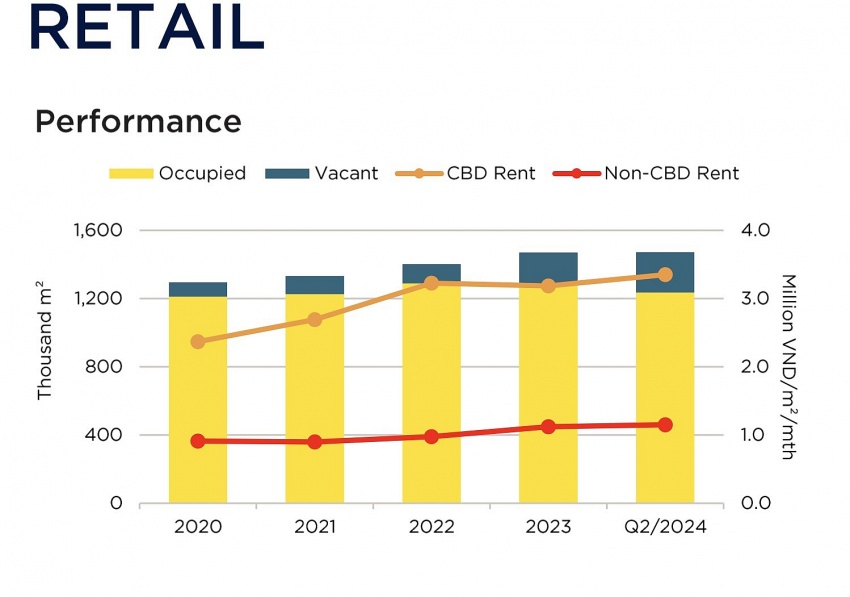

In general, the overall value of the retail segment decreased by 1 per cent on-quarter but increased by 4 per cent on-year, primarily due to the closure of net lettable areas (NLA) such as Robins Department Store. Over the past five years, retail stocks have grown 3 per cent a year on average.

Shopping centres dominated with 63 per cent of the share, with 1.1 million square metres of NLA, while retail podiums and department stores made up 17 per cent and 3 per cent, respectively.

"There was fluctuating demand for clinics and supermarkets, while new brands still face challenges in securing space in shopping centres," Trinh Huynh Mai, associate director of Savills Hanoi's Commercial Leasing.

Savills may have reported lower occupancy rates, but they also reported higher rents. Specifically, gross ground floor rents increased by 2 per cent on-quarter and 13 per cent on-year, mainly due to increased rents from department stores, reaching VND2 million ($80) per sq.m per month, and shopping centres, which paid VND1.3 million ($52) per sq.m. In the central business districts, rent was VND3.4 million ($136) per sq.m.

Occupancy lowered by 3 percentage points on-quarter and 2 percentage points on-year to 84 per cent. Retail podiums increased 7 percentage points on-year, while shopping centres declined by 4 percentage points. Department stores were stable over the same period.

Take-up fell by 49,800 sq.m with a significant decrease of 54,000 sq.m of NLA among shopping centres. Retail podiums had the largest take-up of 13,900sq.m of NLA.

Savills forecasts new supply between 2024 and 2026 will consist of 288,795 sq.m from six shopping centres and 11 retail podiums. Shopping centres will dominate with a 68 per cent supply and retail podiums will have a 32 per cent share.