More Cambodian borrowers of MFIs are buying land than selling

More Cambodian borrowers of MFIs are buying land than selling

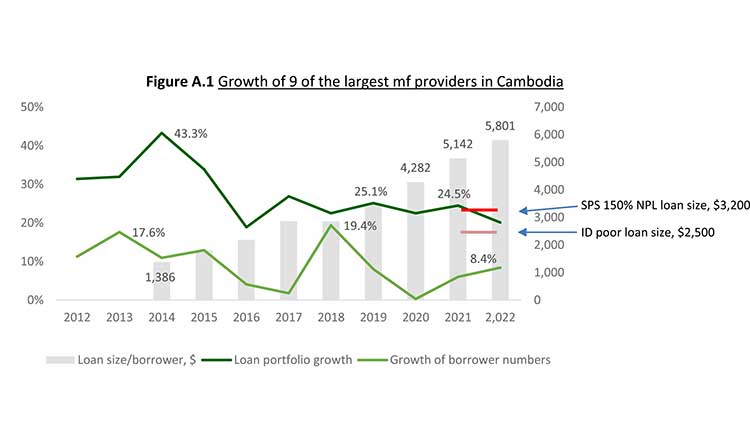

The financial standing of Cambodian borrowers has seen improvement over the years in many cases, as per data with the Cambodian Microfinance Association (CMA).

About 20 percent of microfinance institution (MFI) borrowers have bought land over the last five years, compared to 6 percent who were forced to sell land under distress, said a study by research firm CRIL and CMA, titled, ‘An impact of assessment of microfinance in Cambodia’.

When it came to improved living standards, researchers of the study said some of the aspects they looked at was the children’s access to school, poverty reduction, economic growth, etc. “And on those counts, we saw improvement for 67 percent of borrowers over the past 5 years including 50 percent from very poor households,” Ratika Kathuria, lead researcher, M-CRIL, told Khmer Times.

“The improvements in areas such as children’s access to education, poverty reduction and overall economic growth are testament to the effectiveness of microfinance in driving socio-economic development. These outcomes highlight how access to financial services can lead to significant enhancements in the quality of life for our borrowers, especially the most vulnerable populations,” said Sok Sophal, Deputy CEO, LOLC (Cambodia) Plc.

“At LOLC Cambodia, we are committed to continuing our efforts to provide financial inclusions that support sustainable development and improve the livelihoods of our clients,” he said.

Among those interviewed in the study, about 25 percent said their lives have deteriorates post-borrowing, 8 percent said the impact on their lifestyle was mixed, while of the majority (67 percent) – 36 percent said it has seen some improvement and 31 percent said they had seen substantial economic benefit.

The study also recorded responses of borrowers and about 13 percent said the MFI loans had helped their lives, while about 5 percent said their lives had deteriorated directly to credit.

“The trend where 20 percent of MFI borrowers have purchased land over the last five years, compared to 6 percent who sold land under distress, could indicate improving financial stability among Cambodian borrowers. Investments in land, especially for agricultural purposes, are significant for sustainable economic growth. If these purchases are predominantly investment-driven, and if the percentage of forced sales remains low, this trend is indeed positive,” said Tomas Pokorny, Secretary General and Board Member, Cambodian Association of Finance & Technology (CAFT), adding, “From our (CAFT) perspective, while we are not directly involved with lending businesses, we focus on the digitalization and financial inclusion of finance and technology, and hence view as positive any sign of economic growth.”

The M-CRIL study further said that while there is a degree of such repayment stress, more so among poor households, the concern that this could result in them losing land is overstated. About 24 percent of borrowers reported stress in repayments, as per the study. But for those who reported that their lives have seen improvement, the study found that this was due to economic growth from gainful employment in garment factories, other industries and overseas migrant workers sending home remittances.

“If there are substantial improvements in living standards it underscores the critical role of the banking sector, particularly MFIs, in enhancing the economic and social conditions of lower-income populations. Borrowings that do not lead to over-indebtedness due to their investment nature (creating future income) or those that support transforming non-livable environments (lack of water, electricity, proper facilities) into livable conditions are vital for economic growth and improving living standards,” said CAFT Secretary General Pokorny.

“Acquiring land is often a significant indicator of economic progress and wealth accumulation. It suggests that our borrowers are not only meeting their basic needs but also investing in assets that can provide long-term financial security and potential income generation. This trend underscores the positive impact of microfinance services in enhancing the financial capabilities and livelihoods of our clients,” said Sophal.

M-CRIL in its report says when people are caught in a debt trap “in a vicious cycle of debt” it is not necessarily the fault of the MFI or bank. “Life is complex; there is no straightforward correlation with financial services. And there is no general environment of distress amongst microfinance clients. Nevertheless, some lives have been directly affected by a vicious cycle of debt,” said the report.

Researchers also said that the international media has largely sensationalised the ground situation of MFIs operating in Cambodia. While some MFIs may be guilty of unscrupulous lending and repossession of land from borrowers in the past, that is no longer the case. MFIs are now more keen on alleviating stress levels of their borrowers and ensuring prompt payments, than pushing them deeper into poverty. “When you look at the data, it showed that only 6 percent of borrowers were forced to sell land in the last five years. And this number has fallen to 0.5 percent in the first half of 2023,” Sanjay Sinha, managing director, M-CRIL, told Khmer Times.

When under financial stress, the study found that most borrowers first tried to borrow from relatives, friends or moneylenders. Then it’s possible the household also drastically cuts back on its nutrition and food intake. Then there is the sale of high-value assets like a motorbike, before the borrower considers selling land — which is always the measure of last resort for Cambodians, who traditionally highly value land and house.