Cambodia riding the second wave of startups

Cambodia riding the second wave of startups

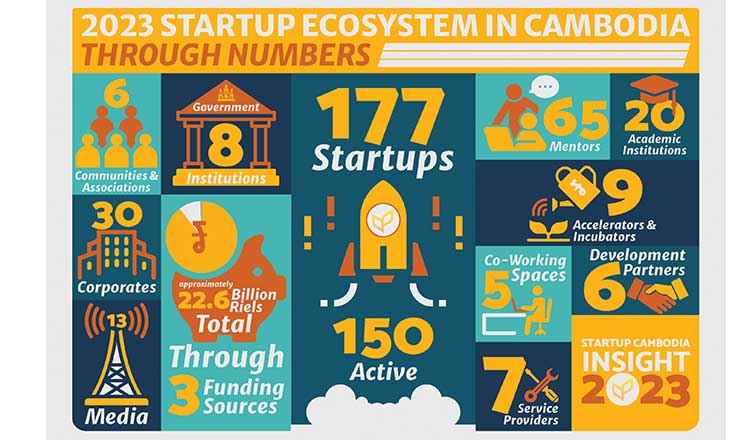

There can be no two opinions that a vibrant startup ecosystem can be a step forward in taking Cambodia to the next level in reviving and promoting the economy. In a short span of time, the country has witnessed as many as 11 accelerators, six incubation centres and six hackathons with total funding of 22.6 billion riels ($5.49 million) and while analysts term Cambodia’s market has not yet matured, it won’t be erroneous to say that the startups in the Kingdom have entered its second wave

The startup ecosystem in Cambodia is dominated by tech startups with a majority of these focused on SaaS and e-commerce. The country as a whole saw 177 startups operational in 2023. Of this 129 were tech startups. The total funding raised by the startup ecosystem in 2023 was around 22.6 billion riels ($5.49 million).

The dominant sector among tech startups is SaaS or Software-as-a-Service. The share of SaaS startups in Cambodia’s overall ecosystem is 17.1 percent, followed by e-commerce with 14 percent.

Put together, SaaS and e-commerce make up nearly one-third of the total ecosystem in Cambodia, as per data from the Ministry of Economy and Finance’s initiative Startup Cambodia.

Startup Cambodia also said that 2023 saw the mushrooming of nearly twice the number of startups as 2022, when 98 startups were functional. Tech seems to rule the roost in 2023 as of total startups of 177, 129 were tech startups and 21 tech-enabled startups.

SaaS leads the race

On why SaaS is so popular, industry insiders say that Cambodia is following a global trend. “Our company is on the SaaS model too. The reason we chose this playbook is because it’s a global trend as it’s easy to adopt, no high overhead and pay what you use. So this is why it’s highly popular,” said George Lee, CEO, Innov8tif, a SaaS-based company with insurance, banks and telecom clients in Cambodia.

SaaS startups in the country include CheckinMe, Jobify, Casstack, Invoice Mouy, LocalizeBook, Kakvei, DelightTech Plc, Khmer Tech Market, Bong IT, eCO app, Kommong, Hor Pao, Optimus, 606 Digital, Digital Mavericks, Polymer Invoice, Campus.by Wonderpass, InsurTech, MGA Cover, Workingna, OceanTechnology Co and Quadusk.

Among the startups on its platform, Startup Cambodia says SaaS companies have emerged as frontrunners. “This trend can be attributed to several interconnected factors. We can feel there are many software solution companies in the market who have been providing software solutions to their business clients,” Nguonly Taing, Executive Director, Techo Startup Center (TSC), told Khmer Times.

This trend is also because Cambodia has a growing pool of IT graduates, eager to translate their skills into entrepreneurial startups. Very often enough, they form a team and provide freelance service as the software solution to the market, too. “So, I can say that initial journeys of SaaS often involve one-off software projects offered by those companies and the group of people I mentioned above. However, this project-based software solution has its own challenges and limitations. It is time-consuming and expensive for maintenance. These challenges of project-based work and client maintenance have steered many towards the SaaS model,” said Taing.

This transition has also been facilitated by a burgeoning market demand for affordable and scalable software solutions, say industry participants. SaaS offers a compelling proposition for both businesses and startups themselves, said market insiders, adding for business clients, SaaS platforms provide cost-effective, high-quality tools for managing operations through the subscription-based model rather than large upfront payments. “This “pay-as-you-go” model allows them to utilize existing solutions like accounting, HR, sales, inventory management, or even Enterprise Resource Planning (ERP) systems that allow clients to manage all processes in one system, without the burden of maintaining custom software,” Taing added.

Countries like India have seen their SaaS startups like Darwinbox, Livspace, Uniphore and Hasura are valued at more than $1 billion. Zoho, which is the poster boy of success for SaaS in India, is currently valued at $5.93 billion. Given SaaS started in the 2000s in India, Cambodia has some catching up to do, and market participants believe that the country still has the potential to go up the rankings.

“We have expanded rapidly in the last year and we’re seeing hundreds of users benefitting from our services this year,” Sum Sopha, CEO, Jobify, which is one of the leading IT recruitment tech portals in Cambodia, told Khmer Times at the recent Digital Governance Forum, held by the Ministry of IT and Techo Startup Centre in Phnom Penh. “We’re focused on tech talent acquisition and software development. We’re trying to boost tech capabilities of our candidates both onshore and offshore. And we feel our job matching services are specialised and unparalleled,” he added.

Using a SaaS model, insiders say helps Cambodian businesses to build more long-term sustainable business as the revenue is more predictable, and the business model itself has potential for rapid scaling, allowing them to serve not only the local market but potentially expand internationally. Particularly in countries like China, where SaaS is yet to take off in the way it has in India; and where South-East Asian IT firms could prove to have a crucial role.

E-commerce companies

Young Cambodians shopping patterns are what is driving the growth of e-commerce companies, say market participants. Be it food delivery apps, ride-sharing or fashion-focused apps, e-commerce with its click-and-buy and fast checkouts is what is attracting the most eyeballs.

The National Bank of Cambodia’s digital payment system — Bakong also has a huge role to play in the success of e-commerce companies in the country. Payments have never been easier or faster since its launch. As of early January 2024, Bakong boasted over 10 million user accounts and included 70 financial institutions as members. The system processed over 35.6 million transactions, totalling more than $12 billion.

Mobile banking grew 11 percent to 746.7 trillion riel ($164 billion) in 2023 from 672.4 trillion riel ($183 billion) in 2022. The regulator and banks have also worked at promoting higher usage of Bakong, say market participants. “NBC has been at the forefront of this with the Association of Banks in Cambodia (ABC) in promoting and educating the public in using mobile banking via Bakong and the results have been very positive and encouraging. And we are seeing the fruits of this in the increase in mobile banking transactions in Cambodia. In fact, I believe the mobile penetration rate in Cambodia is above 100 percent i.e. 1 person has more than 1 mobile phone in Cambodia,” Bridge Bank CEO Richard H.C. Liew told Khmer Times.

As per a report by Digital 2023 Cambodia, for the first quarter of 2023, Cambodia had a whopping 22.16 million active mobile connections. Given Cambodia’s population is just over 17 million, this figure makes active mobile connections at 131.5 percent of the total population. Meaning for every person in Cambodia; there are 1.3 mobile connections.

As per the Ministry of Telecommunications, internet usage in Cambodia has significantly increased post-Covid 19 pandemic. Online learning and online shopping have become a way of life, said the Ministry in the report, where it said that more Cambodians are now using their mobiles for online learning, food delivery apps, online selling and buying via social media apps, paying utility bills, etc.

The players most benefitting from this digital boom are Cambodia e-commerce startups like VTenh, Kokopon, Khmer24.com, Khmum-eshop, L192, Tenbox, BLOC Mall, Orkun APP, Wefix4u.

There are also other e-commerce players operating on both a B2C (business-to-customer) and a B2B (business-to-business) model. Such hybrid e-commerce startups in Cambodia include Youngsia Purchase, BidNow, ADSA, Atelier, Cloth Bird, PhumCAKE, Phzarlan, HOMEAPP Asia, Eshop855.

E-commerce is a very huge opportunity in every single country and even the world, say market observers. “However, in Cambodia, we haven’t witnessed a dominant player in this industry yet.

Although there are a number of ecommerce platforms in the market right now, I can say that they are not yet able to reach the point where a leading player is crowned as a leader in this sector,” said Nguonly Taing, Executive Director, TSC. “Maybe this absence of a clear leading player is the main reason that likely fuels the continuous influx of startups eager to claim that top spot, even though many face repeated trials and failures,” he added.

TSC pointed to the example of Nham24, which is a home-grown startup, that has successfully established itself as a leader in the food-delivery space. When NHAM24 recently hit the 1 million user milestone, NHAM’s CEO and Founder Borima Chann told Khmer Times, “Surpassing 1 million users marks a significant turning point in our journey.” “NHAM24 can hold its stand and be able to compete with the international giant companies, like Grab and foodpanda. Similarly, in the e-commerce sector, the race to become the leading platform is still wide open, so many startups have been striving to seize this crown. Besides these reasons, it is essential to acknowledge the broader context,” said TSC Executive Director Taing.

“The government in Cambodia has placed a significant emphasis on advancing the digital economy as one of the key priorities. The government has also put a lot of effort and support in terms of supportive policies, improving digital infrastructure, and encouraging digital adoption for citizens and businesses. All of these have collectively created a fertile ground for innovation and provide startups more opportunities to grow in the market,” said Taing.

NBC in its annual report said, “Payment amount through the QR code and Bakong system jumped by 7 times and 2.7 times, respectively in 2023, reflecting the growing confidence and adoption among the public.” So with this wider adoption of Bakong and digital payments, TSC said that looking ahead to 2025, it believes e-commerce and SaaS are likely to stay strong in 2025 due to demands and opportunities. “However, we also see potential for growth in other sectors too, including online media, fintech, agritech, and transportation,” said Taing.

Tech-enabled startups

Apart from SaaS and ecommerce, the other upcoming sectors in Cambodia are online media, Cleantech, EdTech, Fintech, influencer economy, transport and delivery, healthtech, Podcasts, Online Travel, AgriTech and Blockchain.

To promote innovation, Startup Cambodia said the country has seen as many as 11 accelerators, six incubation centres and six hackathons conducted.

When it came to total funding of 22.6 billion riels ($5.49 million riels), the Startup Cambodia Insight Report said most of the funding is in seed, pre-seed and series-A funding levels. Cambodia’s market has not yet matured, despite “having high growth potential,” said the report. The country is yet to see funding in the levels of B to H which is common in more developed economies like Singapore and Malaysia.

When it came to AgriTech, the most popular startups are those with a hybrid B2B and B2C model like Angkor Salad, CAM-Science, DamDoh App, FlexFloc and Greenovator. Agritech startups are also gaining prominence, leveraging technology to address challenges faced by the agricultural sector. “We know that agriculture is the driving force of Cambodia in growing the economy; however, the modernization and innovation in this sector now is still not enough. We can see that both the government and development partners have put their strong attention to developing this sector, allowing more opportunities for those who want to startup businesses in this sector,” said Taing.

TSC also talked of the government’s efforts in this director. “Recognizing the sector’s potential and importance, we can see both the government and development partners have put their attention in contributing to modernizing and innovating the agricultural landscape,” said the TSC Executive Director, adding, “As the government and development partners continue to prioritize the agricultural sector, agritech startups are well-positioned to capitalize on emerging opportunities and drive transformation within the industry.”

The Cleantech space has also seen the mushrooming of many startups like Khmer Solar, RUY REACH, SE Cambodia, MAUSO, SOGE Cambodia, EcoBatt Energy Cambodia, Pteah Baitong, EcoSun Solar Cambodia, AET JAY.

So far the startup ecosystem in Cambodia has seen more than 75 programme — some national (55), some international (20), 96 events, 65 mentors and nine stakeholders participating in it in 2023. In support of these startups, Cambodia has five co-working spaces, seven service providers and 30 corporates partnering with them, as per the report Startup Cambodia Insight 2023.

“Creating a vibrant startup ecosystem that can face high growth of both startups and SMEs is a key driver in contributing to the revival and promotion of Cambodia’s economy and society,” Aun Pornmoniroth, Deputy Prime Minister and Minister of Economy and Finance, has said about the Startup Cambodia initiative.

Jointly coordinated by Techo Startup Centre (TSC) and Khmer Enterprise (KE), Startup Cambodia initiative got its approval to function in 2019 that fulfill the policy objectives of the Cambodia Digital Economy and Society Policy Framework 2021-2035.