Chance for another rate cut this year: experts

Chance for another rate cut this year: experts

A high interest rate environment is a great risk to the competitiveness of Vietnamese enterprises, according to economists.

To contain soaring inflation, global central banks, including Viet Nam, have tightened monetary policy since last year with numerous rate hikes.

And the policy really did tame the higher prices.

A recent report from the US Labour Department showed that consumer price inflation increased 4.9 per cent in the last 12 months, but it was the lowest level since April 2021. This marked the tenth consecutive month that inflation has dropped from its peak last summer.

Meanwhile, in Viet Nam, the consumer price index rose 2.81 per cent year-on-year in April, but fell by 0.34 per cent over the previous month.

However, higher interest rates will also greatly affect production and business activities.

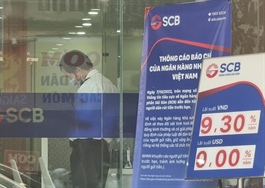

The interest rates of many banks remain high, with many listing the rates at 12-13 per cent, Nguyen Tu Anh, Director General, Department of General Economic Affairs at the Party Central Committee's Economic Commission, said at the workshop on "Impact of High Interest Rates on Macro-economic Stability and Growth Recovery in 2023" on Thursday.

Interest rates were at high levels from July 2022 to February 2023.

"And with average interest rates of 9-10.7 per cent, which are already really high, the competitiveness of Vietnamese enterprises is eroded," Anh added.

In neighbouring country China, the weighted average interest rate was 4.14 per cent in December 2022 and only 5.62 per cent during December, 2008-22. Notably, since the outbreak of COVID-19, interest rates in China have continuously decreased, helping Chinese businesses recover strongly post-pandemic.

Therefore, when compared to their Chinese counterparts’ competitive edges, Vietnamese enterprises mostly have none, Anh said.

"Chinese firms have advantages in domestic supply chains that no other country has, an efficient and extremely competitive logistics system and a higher level of technology than Vietnamese companies. And now our enterprises have to bear interest expenses nearly three times higher than Chinese enterprises," the economist said.

The high interest rate environment also affects the need to start a business, he warned. High interest rates will make start-up costs soar, discouraging those who want to start-up.

"Viet Nam currently has about 900,000 operating businesses, according to data from the General Department of Taxation, while the number of small, medium, and micro enterprises in Thailand is 3.2 million enterprises, and the population of Thailand is only 72 per cent of Viet Nam," said Anh.

"The target of having one million enterprises operating in 2020 was not reached, and with the current interest rate environment, the target of having 1.5 million operating enterprises by 2025 is almost impossible to achieve."

Room for another rate cut

From 2011 to 2020, Viet Nam mainly posted a current account surplus, meaning that it was a capital exporter.

Even though the current account was negative in 2021 and 2022 due to the cost of importing drugs and equipment to prevent the pandemic, as well as skyrocketing transportation costs, in the long-term, Viet Nam will still be a capital exporter. Thereby, the country completely has room to reduce interest rates, Anh said.

At the event, Can Van Luc, BIDV Chief Economist, also said that there is still room for another interest cut this year.

“Interest rates are still high this year because in 2022 the money supply was low while many credit institutions are weak. However, if we can reconcile the policy, we will still have rooms to reduce interest rates, maybe, in the second quarter of 2023,” Luc said.