Bank deposit interest rates keep falling

Bank deposit interest rates keep falling

The highest listed rate for 12-month deposits is around 8 per cent per year.

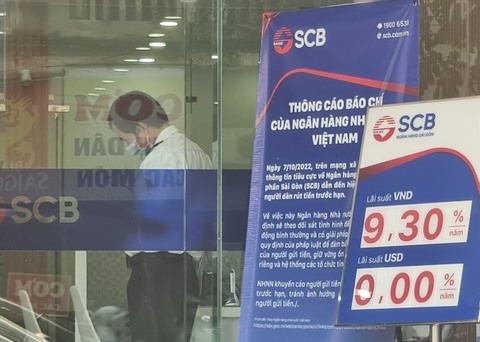

The deposit interest rate list at a Saigon Joint Stock Commercial Bank branch in HCM City’s District 3 on May 8. — VNS Photo Bo Xuan Hiep |

Larger private banks have cut the 12-month rate to below 8 per cent. SHB, Techcombank, ACB, and MB pay between 7.3 per cent and 7.9 per cent.

The four State-owned banks – Agribank, BIDV, Vietcombank, and Vietinbank – continue to pay the lowest rates in the market, around 6 per cent for six to less than 12 months and 7.2 per cent for 12 months.

Smaller banks have also reduced rates significantly since last month.

For 12 months, Bac A Bank’s rate has fallen from 8.6 per cent to 8.3 per cent; KienlongBank’s from 8.5 per cent to 8.2 per cent; and SaigonBank’s from 8.3 per cent to 8 per cent.

Deposit interest rates have been creeping downwards, especially after the central bank cut the operating interest rate on March 15 and April 3.

At the end of last year, almost all private banks offered more than 9 per cent for 12-month deposits.

Smaller banks paid 10 per cent or more.

The high deposit interest rates pushed up lending rates to 13-14 per cent, putting huge pressure on businesses.

According to VNDirect Securities Company, deposit interest rates will continue to fall until the end of 2023, tracking sluggish credit demand due to a slump in economic growth and the property market.

It also said the Government would increase public spending this year to pump more money into the economy.

It expected the 12-month deposit rate to fall to around 7 per cent by the end of 2023.

Lower lending rates

The high lending interest rates are burdening businesses amid declining export orders and weak domestic demand.

But the falling deposit interest rates have raised hopes of a drop in lending rates.

At a meeting last week, central bank deputy governor Dao Minh Tu urged banks to cut operating costs and improve administrative procedures to reduce lending interest rates.

Vietcombank reduced lending rates by 0.5 percentage points last week.

Earlier, Agribank cut them by 1.5 percentage points for dong loans and 1 percentage point for dollar loans.

According to the central bank, deposit interest rates have decreased by 1-1.2 percentage points since the end of last year and loan interest rates by 0.5-0.65 percentage points.

In a related move, the central bank has instructed commercial banks to roll over debts and keep debt classifications unchanged until June 2024 to ease the pressure on borrowers. — VNS

The deposit interest rate list at a Saigon Joint Stock Commercial Bank branch in HCM City’s District 3 on May 8. — VNS Photo Bo Xuan Hiep

HCM CITY — Banks have been steadily cutting deposit interest rates, which have reached around 8 per cent, a move aimed at reducing lending rates to support businesses.

Larger private banks have cut the 12-month rate to below 8 per cent. SHB, Techcombank, ACB, and MB pay between 7.3 per cent and 7.9 per cent.

The four State-owned banks – Agribank, BIDV, Vietcombank, and Vietinbank – continue to pay the lowest rates in the market, around 6 per cent for six to less than 12 months and 7.2 per cent for 12 months.

Smaller banks have also reduced rates significantly since last month.

For 12 months, Bac A Bank’s rate has fallen from 8.6 per cent to 8.3 per cent; KienlongBank’s from 8.5 per cent to 8.2 per cent; and SaigonBank’s from 8.3 per cent to 8 per cent.

Deposit interest rates have been creeping downwards, especially after the central bank cut the operating interest rate on March 15 and April 3.

At the end of last year, almost all private banks offered more than 9 per cent for 12-month deposits.

Smaller banks paid 10 per cent or more.

The high deposit interest rates pushed up lending rates to 13-14 per cent, putting huge pressure on businesses.

According to VNDirect Securities Company, deposit interest rates will continue to fall until the end of 2023, tracking sluggish credit demand due to a slump in economic growth and the property market.

It also said the Government would increase public spending this year to pump more money into the economy.

It expected the 12-month deposit rate to fall to around 7 per cent by the end of 2023.

Lower lending rates

The high lending interest rates are burdening businesses amid declining export orders and weak domestic demand.

But the falling deposit interest rates have raised hopes of a drop in lending rates.

At a meeting last week, central bank deputy governor Dao Minh Tu urged banks to cut operating costs and improve administrative procedures to reduce lending interest rates.

Vietcombank reduced lending rates by 0.5 percentage points last week.

Earlier, Agribank cut them by 1.5 percentage points for dong loans and 1 percentage point for dollar loans.

According to the central bank, deposit interest rates have decreased by 1-1.2 percentage points since the end of last year and loan interest rates by 0.5-0.65 percentage points.

In a related move, the central bank has instructed commercial banks to roll over debts and keep debt classifications unchanged until June 2024 to ease the pressure on borrowers.