Domestic businesses face severe cash shortages

Domestic businesses face severe cash shortages

A lack of capital is making it difficult for businesses to maintain operations.

The National Private Economic Development Research Board (Board IV), managed by the Government’s Advisory Council for Administrative Procedure Reform, has received much feedback from businesses over the last month, showing that a lack of capital has pushed them into difficulties affecting the competitiveness of many industries and the country's economy.

Enterprises said that due to the lack of capital, it is difficult for them to maintain production and business, purchase materials for next year's production, and retain jobs. This problem is serious because cash flows have dried up over two years during the pandemic.

In the steel manufacturing industry, due to the supply surplus crisis, businesses have been selling at 30-40 per cent lower than the cost to have operating cash flow and pay very high-interest amounts while waiting for the next credit target allocation.

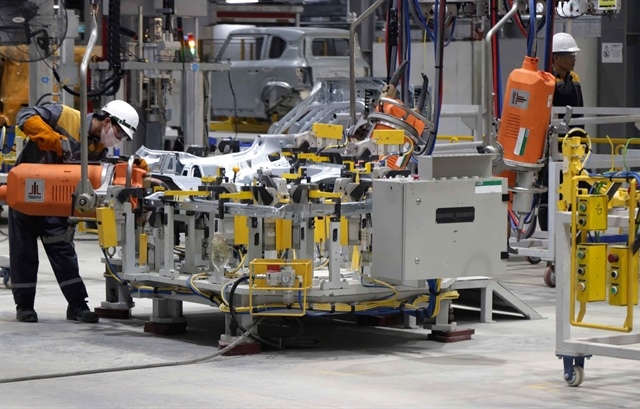

In supporting industries, businesses said that in the past, they could use signed contracts or mortgage their real estate to borrow capital, but now banks do not disburse because of the limitation on credit. They cannot maintain their position in the supply chain due to the lack of capital to invest in new machinery and technologies after requirements from difficult markets.

In agricultural production, businesses have no money to purchase when some agricultural products (especially seeds and materials) have a concentrated purchasing period in the last months of 2022 and early 2023. In a short time and with a large amount of capital needed, local enterprises cannot compete with FDI enterprises without credit loans.

According to Board IV, "capital hunger" has left most businesses in a "precarious position to maintain a part of their operations without expecting a recovery."

Meanwhile, foreign-invested enterprises, which have a better foundation, were less severely affected by COVID-19 and do not depend on loans from domestic and commercial banks, which have more advantages.

Export data as of September 2022 from the General Statistics Office confirmed that exports of local enterprises decreased by 1.6 per cent on year, while foreign-invested enterprises kept a growth rate of 14.1 per cent.

"If prolonged, it will create increasingly large gaps and disparities between the two economic sectors, reducing the intrinsic competitiveness of local enterprises and the economy," said Board IV.

"If prolonged, it will create increasingly large gaps and disparities between the two economic sectors, reducing the intrinsic competitiveness of local enterprises and the economy," said Board IV.

In the medium and long term, shortcomings in capital mobilisation will affect investment expansion and business recovery. The effect of declining confidence in real estate businesses has spread to all businesses in other industries, and bond mobilisation will not be a channel for them to call money in the short term. Some have to spend a lot of money to buy back bonds before maturity.

According to Board IV, in the context of low market confidence, lack of working capital, and lack of investment flows, the assets of enterprises are at risk of being sold off.

There may be a wave of selling factories/production facilities of local enterprises to foreign investors. Typically, Thai businesses conduct many negotiations to buy and sell factories in textiles and other fields.

To support businesses overcoming cash flow difficulties, Board IV proposed the government consider extending some policies that supported businesses during COVID-19 until the end of 2023, such as a 2 per cent VAT reduction, extension/postponement of the new land rental tariff, rescheduling debt repayment, and keeping in the same debt group.

Regarding the financial market, Board IV proposes special solutions to the government to rescue businesses and the economy at this time. For example, allowing local commercial banks to repurchase maturing bonds and treat them as a special form of credit because the value of upcoming bonds has often exceeded the acquisition ability of state-owned corporations.

In addition, to increase the efficiency of the use of credit in 2023, Board IV proposed preferential credit packages for key manufacturing industries and fields, including loans for small and medium-sized businesses.

On the other hand, to tighten credit for real estate, it is necessary to separate some types of real estates, such as social housing, hospitals, schools, and production infrastructure, that will not be negatively affected by the general policy.