Rumor-mongering rife in all stock exchanges

Rumor-mongering rife in all stock exchanges

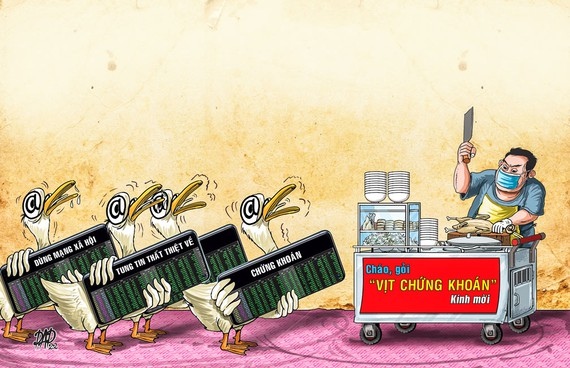

Stock investors must always be prepared to brace themselves for a volley of all sorts of rumors in the current environment prevailing in the stock exchanges.

Illustrative photo. |

Although government agencies are now taking drastic measures to curb rumor-mongers, investors by themselves must prepare to face any adverse situation, if they wish to survive. The situation is getting more complicated now as market management agencies have begun to raise their voice, and investigative police have said they will gather evidence to severely punish those involved in spreading fake information. Now, even Prime Minister Pham Minh Chinh has concerns on this growing problem and has ordered as many as six ministries to look into these issues engulfing the stock exchange.

Handling information

Rumors have always played a part in financial markets as well as in the stock markets. The stock market has for hundreds of years been associated with widespread rumor-mongering. Even well-known financial newspapers like the Wall Street Journal or Business Insider have a column dedicated to ‘Stock Rumors’, ‘Rumors News’, or ‘Heard on Street’. Actually, rumors have some depth of truth in them, but they are considered hearsay until they are confirmed. It is important for investors to identify a rumor from the outset, and to hold themselves accountable until verified otherwise. This is what the stock markets have trained professional investors to do in handling information.

For the Vietnamese market, the recent form of rumor-mongering is related to the behavior of state management agencies and such rumors themselves try to create a credible cover for any information. These rumors are much more influential than small flippant rumors, like those related to individuals or the activities of a single listed company.

Anyone who understands the art of communication knows that a half truth is often a lie. Rumors are often based on a small fabric of truth, which is inherently verifiable. That so-called half-truth itself creates credibility for another half-truth. For instance, a dispatch requesting an inspection of real estate bond issuance activities recently incited a series of rumors about some businesses being specifically targeted. Even more blatantly, it was spread to affect many groups, and as a result, these companies' shares plunged. A rumor could spread about an ordinary inspection at a company which could be labelled as being in connection with real estate bonds, in an attempt to make the recipients develop certain thoughts in a particular way, most often negatively.

Last week, the stock market witnessed a continuous decline and great losses to stock investors in real estate and banking because of such rumors. Never before, even at the time of checking the activity of interest rate compensation in 2010, has the stock market seen such a massive witch hunt. It is the search and roll call for businesses that issue large numbers of real estate bonds, banks that provide big estate loans or are involved in real estate bonds. There have been even comments and analyses from reputable individuals with negative reviews about this field, as though the corporate bond market in general and the real estate bond market in particular were a huge debt bomb that is risky and will explode at any time.

Such information is rife on stock forums and is widespread among closed groups and stock chat rooms. When large groups of people are involved in gossip, this style of communication becomes effective, because these people tend to convince one another.

Relationship with investors

If investors understand that rumors are just part of being in the stock market, they themselves should develop a qualified information filter. Unfortunately, the market has recently exploded with too many rookie investors full of greedy strategy and only hunting for real estate bonds, and speculating based on the advice or information of others. When the process of clarifying and leveling is not completed, rumors from so-called reputable individuals will cause more chaos in the market.

In the midst of a storm of false rumors, listed companies play a pivotal role in providing an official flow of accurate information. However, many businesses still neglect the responsibility of building strong relationships with investors and shareholders. The hotline phone numbers of Investor Relations Department are always busy or the mailboxes are never checked and letters never replied. Such behavior makes it easier for rumors to spread more wildly. The immaturity and inexperience in containing the information even contributes to the reinforcement of more rumors. One company recently got into a panic mode after a rumor had it that there was going to be a takeover. Instead of calmly providing the necessary and accurate information, the company hastily asked the market management agency to check the transaction, and if necessary stop trading of shares and cancel the transaction results. Eventually, there was no takeover transaction in the trading session on that day.

In 2021, the State Securities Commission released a notice to warn rookie investors about chat groups on social networks and forums who were spreading rumors and fake information via documents to entice and incite investors to buy shares. The market regulator was unable to do much on this sort of information. Consequently, the victims raised their voice against the fraud of the chat room owners. Those who broke the law on spreading inaccurate information were punished in accordance with the law. However, monitoring or sanctioning actions are always one step behind reality, and no matter how severe a legal action is taken, it can never prevent this problem. Therefore, business people and investors must brace themselves to face any sudden adverse situation, and learn ways to protect themselves first.