VNPay banking on e-payment strategy

VNPay banking on e-payment strategy

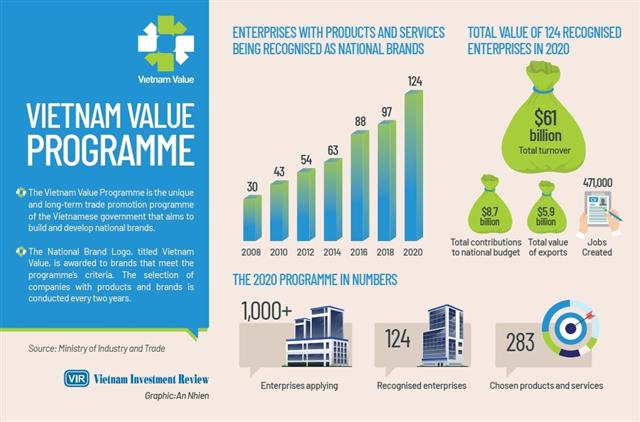

Although most everyday payments are still carried out with paper money in Vietnam, electronic and cashless solutions are on a stellar rise, with companies like electronic payment pioneer Vietnam Payment Solution JSC (VNPay) offering options that are unrivalled in convenience and speed. For the establishment of such future-ready services, VNPay has been recognised in the Vietnam Value Programme.

VNPay banking on e-payment strategy

|

The company is seeing its participation and recognition in the programme as an opportunity to evaluate its activities throughout the last few years, thus reaffirming its core values and promoting its products and services.

With this year’s participation, VNPay hopes to increase awareness for its brand and products, which are offering some of the latest fintech solutions for individuals in businesses in Vietnam.

Right from the first days of its establishment, VNPay has set its vision and goals towards providing convenient and sustainable products and services, which were exactly the criteria that the judges of the programme were looking for.

Up to now, VNPay’s brand and its VNPay QR services have been popular in the national market, providing many services to more than 20 million users, ranging from digital banking utilities and payment solutions to online shopping.

According to the e-Conomy SEA 2020 report by Google, Temasek, and Bain & Company, VNPay has officially become Vietnam’s second technology unicorn after VNG, which provides online entertainment, social networking, and e-commerce to local customers.

VNPay’s QR service has been developed as a payment solution to offer its users a convenient way to handle smaller transactions, in which customers can scan related QR codes and transfer money in the blink of an eye. The company’s QR feature is built into its mobile application for smartphones and seamlessly works together with some of the most popular banking applications from 22 domestic lenders, including major brands like Agribank, Vietcombank, VietinBank, and BIDV.

Through these transactions, VNPay helps around 15 million monthly users to transfer money, pay their bills, book bus and train tickets, and even purchase their groceries. As the company’s payment solution fits the needs of many local enterprises, users can apply VNPay’s QR solutions at many prominent vendors including Aeon, Fahasa, CGV, Media Mart, and Vietnam Airlines.

VNPay’s QR service offers its users a fast and secure payment solution, where they can simply scan another person’s QR code and fulfil easy bank transactions, without entering account information or the presence of an ATM card or the like. In VNPay’s view, this is what defines the quality and convenience of such services in a modern digital environment.

In addition to its focus on convenience, VNPay made sure that all transactions are backed by the latest security standards to ensure smooth and effortless transactions between its services and most banks. Thus, code scanning and data transmission follow the standards of international credit card and other payment organisations.

Moreover, VNPay applies AI to analyse user behaviour and offer smart solutions to help prevent risks in daily usage and authentication. Thanks to these technologies, VNPay can process millions of transactions every day and uphold its promise for a reliable payment solution.

Over the last 13 years of establishment and development, VNPay has also actively built its network and technology infrastructure, connecting with thousands of partners and ecosystems to provide electronic and cashless payments through its platform and services.

As the Vietnamese market is known for its high number of internet users and young population, foreign partners are often eager to join. However, participating in the domestic payment market requires compliance with many state regulations, which are often deemed as too complicated and cumbersome.

Therefore, VNPay believes it is the right time for a local payment service provider to establish a firm foothold and become a force that foreign competitors must reckon with.

By participating in this year’s Vietnam Value Programme and earning its recognition as one of the most-outstanding Vietnamese brands, VNPay aligns with many others that have been honoured for their achievements. Thus, VNPay has proven that it is on track with its strategy.

However, since this year was the first time that the company joined the programme, things were not as easy as anticipated. VNPay spent a long time rearranging and reorganising its products’ presentation to meet the high criteria of the programme. Nevertheless, the company focused on quality and thus realised all necessary changes, thereby earning its place among some of the most-valued Vietnamese brands.

While VNPay is focusing on further perfecting its payment solutions, the Vietnamese state is creating the legal framework necessary for businesses and customers alike to fully and securely use them. Though VNPay’s and similar solutions have just been born, the pace of development is rapid, with many more enterprises wanting to participate.

Thus, VNPay also aims to further improve its service policies, which are already a strong trait of the company. Besides this, investment in its human resources and its professional development and customer-centric approach are priorities. Up to now, VNPay can also pride itself for researching and developing all of its services and solutions locally.