Why illegal forex trading is doomed to failure from the start?

Why illegal forex trading is doomed to failure from the start?

Given a high-risk nature, losses are almost inevitable for investors in forex trading.

Unprotected by the law, high financial leverage and promises of skyrocketed profit that are unimaginable at the current business climate are factors that forebode failure for illegal foreign currency traders.

Lan Anh, a broker expert at SSI Securities Corporation, explained to Hanoitimes a bonus of 20 – 40% of the deposit and promises of high profit have clouded investors’ judgment.

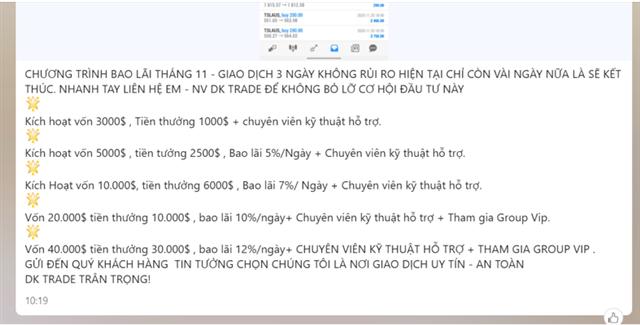

For example, a forex trading floor offers a bonus of US$30,000 for a deposit of US$40,000, including guaranteed profit of 12% per day and other technical support.

High bonuses from illegal trading floors are key to attract investors.

|

“However, the issue is a high financial leverage of 1:500 – 1:3000 in these floors, a fluctuation of just a few basic points, thus, would have significant impacts on an investor’s balance. In case investors leave positions open overnight, high overnight lending rates may already eat up all profits,” noted Mrs. Anh.

To look at the issue from different perspective, the financial leverage amount offered by securities firms for investors in the local stock market is limited at a maximum of 50%, or a maximum ratio of 1:1.

Mrs. Lan Anh also pointed to the fact that the majority of investors joining forex trading floors are unable to make the right decision, given the lack of information and also knowledge on global financial markets.

“A key problem is that investors would not be protected by the law when participating in forex trading floors,” Mr. Lan Anh stressed, referring to some people who have suffered losses up to hundreds of thousands of dollars in just a few weeks.

“Losses are inevitable when investors do not understand how the forex market works, unable to control the risk with a high financial leverage, while high overnight lending rate causes uncontrollable losses amid high market volatility,” Mrs. Lan Anh summarized.

In a recent government’s press briefing, Vice Governor of the State Bank of Vietnam (SBV) Dao Minh Tu informed “local authorities have not issued licence for any forex trading floor, so all transactions on these floors are illegal.”

“Individuals investing in these platforms, seen as violating laws, would not be protected by law,” he noted.

Mr. Tu said during the Covid-19 crisis, legal businesses anywhere around the world could hardly guarantee profit of up to a couple of dozen percent, let alone promises for profit of hundreds of percent per year, which is a sign of fraud.

On this issue, Vice Minister of Industry and Trade Do Thang Hai noted forex trading floors in Vietnam are a form of illegal multi-level marketing activities, warning those participating in illegal forex trading could be subject to a penalty of up to VND5 billion (US$217,500) or five-year jail term,” Mr. Hai stressed.

Forex or stock market

At a time when the Vietnamese government has initially contained the Covid-19 pandemic and is now focusing on economic recovery efforts, the stock market, given its characteristic as one of the most flexible investment channels, has emerged as attractive option for investors amid the current low interest rate trend at the moment.

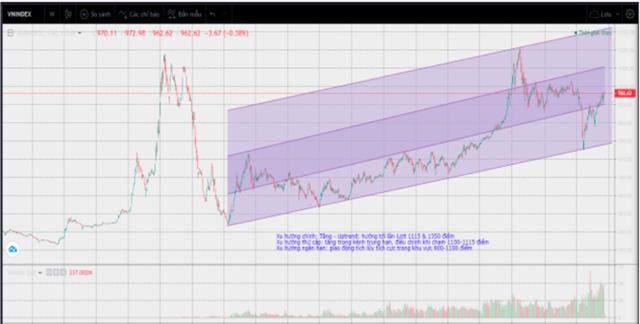

Vn-Index is on the upward trend as Vietnam's economy continues its recovery path. Source: SSI.

|

The benchmark Vn-Index, since its rock bottom in March with a 25% slump, has now recovered by around 400 points to nearly 1,020 as of today [December 4] on the back of high bottom-fishing demand.

“A solid macro-economic foundation and effective supporting measures from the government could lead to an all-time high Vn-Index in the near future,” Mrs. Lan Anh suggested.

Vietnam is currently in the Frontier Market group, and was added to the FTSE Russell’s watchlist for possible upgrade to Secondary Emerging Market in September 2018. However, after one year of review, Vietnam only met seven out of the nine criteria of FTSE.

However, a report from SSI suggested after Kuwait was upgraded to the Emerging Market status, Vietnam is set to benefit the most from the reclassification of the MSCI Frontier Market Index with its weight increasing to 25.2% by December 1 from the previous 18.47% by late October, in turn solidifying the uptrend of the Vn-Index in the coming years.

In particular, capital would flow into stocks in the VN30 Index – formed by the 30 largest and most liquid stocks listed on the Ho Chi Minh Stock Exchange, especially those accounting for a large proportion in MSCI.

Given its position as the most important market in this index, Vietnam is set to follow Kuwait’s footstep in the next full annual review of global provider of financial services FTSE Russell by September 2021, as the country is working to resolve its outstanding issues, said KB Securities Vietnam Company.

“As an emerging market status, Vietnam would further attract more investment capital, and could propel the Vn-Index to a new height of 1,450 and 1,800 points in the next two years,” Mrs. Lan Anh asserted.

“It is entirely feasible for investors to achieve a profit rate of 30 – 120% in the stock market as it is the cases of my customers, so the choice is obvious for investors when looking for viable investment channels,” Mrs. Lan Anh added.