Illegal forex activities face fines up to $216,000

Illegal forex activities face fines up to $216,000

The multi-level market forex activities are illegal in Vietnam.

The Vietnam Competition and Consumer Protection Authority (VCCA) under the Ministry of Industry and Trade warns that some financial investment platforms imply potential risks for local investors and they could be subject to a penalty of up to VND5 billion (US$216,000) or five-year jail term.

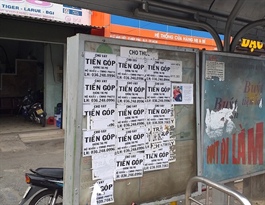

The warning of the VCCA about illegal activities of forex trading.

|

According to the government decree, organizations and individuals recruiting participants to invest through the financial investment platforms can be criminally handled.

The VCCA recently gathered a lot of advertising information, which called for financial investment through financial investment platforms, especially the form of foreign exchange (Forex) or binary options (BO).

Earlier, a representative from the State Bank of Vietnam told local media that anyone trading foreign currencies is involved in illegal activities. The Vietnamese authority has not issued permits to any forex trading platforms.

According to the department, all transactions on the platforms are via the internet while money of local investors is real. Commissions and incomes earned from the websites are virtual currencies or sent through e-wallets, which are not recognized by the Vietnamese regulatory authorities as legal payment. In case there are risks related to the system, the investor’s investments will not be guaranteed.

Besides, investors are also exposed to other risks when participating in the form of financial investment platforms such as disclosing personal information, or the disappearance of the system when the sums collected from the participants are enough to close.

In terms of legal risk, many financial investment platforms showed signs of attracting participants by paying bonuses and commissions from recruiting members participate in investment at levels, branches. As a result, there are signs of illegal trading such as Forex Liber, AFGold, Bitomo.