Black credit increases at year end

Black credit increases at year end

That interest rate was ten times higher than the banks’ rates but many people still accepted to borrow because they could not borrow from banks.

Demand for consumer loans often increases at the end of the year when it is also time for black credit activities with sophisticated traps that troubles borrowers.

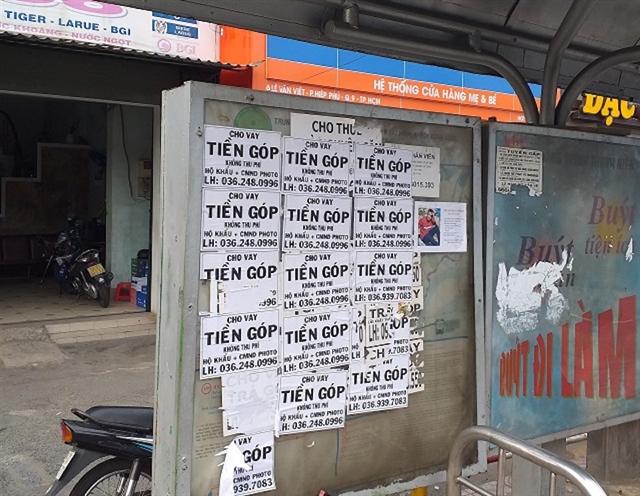

Consumer loan advertising. Photo: Bich Ngoc

|

The number of people looking for services was quite good at the year end, according to the owner of a pawnshop, who wanted to remain anonymous, in Lang street, Hanoi.

“On average, there are seven or eight customers asking for a loan every day,” he said.

He said the interest could range from VND5,000 (US$0.2)-VND7,000 (US$0.3) for each VND1 million (US$43.1) loan per day.

"That interest rate was ten times higher than the banks’ rates but many people still accepted to borrow because they could not borrow from banks," he said.

Not only in pawnshops, with the development of technology, black credit work actively online via apps or through the internet.

After continuously receiving links offering the loans online recently, Nguyen Tuyet Minh, a resident in Hanoi, followed the requirements of the app such as taking a portrait photo, allowing the app to access her phone contacts, Facebook. Minh received VND3 million (US$129.5) in just ten minutes later into her account with the interest rate of up to 5% per day.

Insiders have said that the number of people who borrow through the app like Minh is increasing rapidly due to the convenience and speed of transactions. Borrowers do not have to go anywhere nor prove their assets and income to borrow money.

At the same time, as most of the loan amounts were quite small, the borrowers often think they could repay it easily. However, in cases that the loans were not repaid on time, the high interest rate would be a big trouble.

A director of a commercial bank in Hanoi, who wanted to be anonymous, said black credit operates the most powerfully at the end of the year when demand for cash could grow five or ten times.

"Loan sharks have many ways to approach workers and students, especially those who are experiencing unexpected difficulties such as parents with sick children, students who need to pay rents," he said.

"In addition to exorbitant interest rates, black credit is also associated with violent acts and illegally appropriating property when collecting debts from borrowers,” Lieutenant Colonel Ngo Hong Vuong, Head of Crimical Justive Division, Department of Criminal Police (Ministry of Public Security), said.

Need for synchronous solutions

Though some online lending apps such as VN online, Moreloan, Vaytocdo have been detected and handled by authorities, there are still other exorbitant lending apps on the market which are trying to get borrowers via social networks.

The current law of Vietnam does not prohibit individuals from lending to individuals, but it also specifies organizations or individuals cannot provide loans with interest rates exceeding the lawful rate or they will be criminally prosecuted for the crime of usury.

The Ministry of Public Security recommended people be carefully studying the lending regulations of the apps to choose a reputable loan app which comply with the regulations with interest rates of below 20% per year.

Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu said the central bank is actively checking hot spots for black credit in some cities and province to discuss solutions to increase the access to loans for people.

At the same time, the SBV issued action plans to implement the Sandbox for Fintech operations in the banking sector to provide small value loans for people through the form of Mobile Money.