Vietnam northern industrial property: Demand stays robust despite prolonged pandemic

Vietnam northern industrial property: Demand stays robust despite prolonged pandemic

Tenants are given opportunities to evaluate and secure land from distance thanks to intensified investment in online platforms.

Demand for industrial property in the northern region of Vietnam in the third quarter this year remained strong amidst the prolonged pandemic, according to leading professional real estate services and investment management firm JLL.

Land bank for industrial property in the north is expected to rise in the next five years

|

Travel restrictions during Covid-19 outbreaks have made it difficult for traditional site inspections and direct meetings, but the demand for industrial land kept momentum in the third quarter this year (3Q20) as Vietnam is still a favorable destination for investors.

The main sources of demand for industrial land remained manufacturers who wished to diversify their manufacturing portfolios outside China – especially in high-tech industries. Meanwhile key tenants for ready-built-factory (RBF) continued to be small- and medium-sized enterprises (SMEs).

To support the demand, more and more online platforms have been invested such as site virtual tours, online webinars, upgraded industrial parks (IPs)' websites.

Therefore, tenants still had opportunities to evaluate and secure land from distances. In addition, several transactions started before the outbreak and were only signed in 3Q20, which all brought the average occupancy rate up 74%, up by 160 basic points (bps) from that in 1Q20.

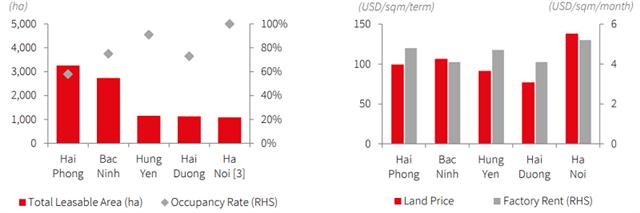

Industrial property in northern Vietnam in third quarter 2020. Chart 1: Total stock and occupancy rate. Chart 2: Average land and factory rents. Source: JLL Research

|

Sufficient land bank for upcoming investments

The supply for industrial land in the north is expected to rise further in the next five years to capitalize on the increasing demand in the region.

With large existing land bank, Haiphong and Bac Ninh were leading localities for industrial land supply in the north.

In anticipation of the upcoming investment waves, northern cities and provinces have planned to open new IPs and expand existing ones, among them Hung Yen and Hai Duong are the most active localities in new IP developments.

Land prices reach new record high

Given Vietnam’s potential as one of the most sustainable manufacturing hubs, most IP developers in northern markets maintained strong bargaining power regardless of Covid-19.

This lifted land prices to a new peak of US$102 per square meter (sqm) per lease term in 3Q20, up 7.1% on-year. RBF rents also inched up slightly, ranging from US$4.1-5.2 per sqm per month in 3Q20, an increase of 2.1% on-year.

Outlook

Although Covid-19 may temporarily disrupt investments in Vietnam, there will remain great interests in the country, which is considered a new regional industrial powerhouse. This will support both demand and supply for industrial properties in Vietnam and the north in future.

Moreover, some innovations during the outbreak including virtual applications and online marketing platforms have shown effective and are expected to get more popular. Therefore, those developers who wish to push forward businesses amidst the rough time should consider seriously such platforms.