Hanoi apartment market: Supply climbs thanks to Covid-19 containment

Hanoi apartment market: Supply climbs thanks to Covid-19 containment

New apartment launches in the third quarter of 2020 rose 79% on-year.

Supply of apartments in Hanoi rose significantly in the third quarter of 2020 (3Q20) thanks to the containment of the novel coronavirus nationwide.

The new supply surged following virus containment nationwide, adding around 5,219 units to the market, up 79% on-quarter, leading real estate and investment management firm JLL has said.

A luxury apartment complex in Hanoi

|

While Covid-19 outbreak coupled with prolonged approval process stalled most first-time launching properties in previous quarters, the market witnessed six new projects in 3Q20.

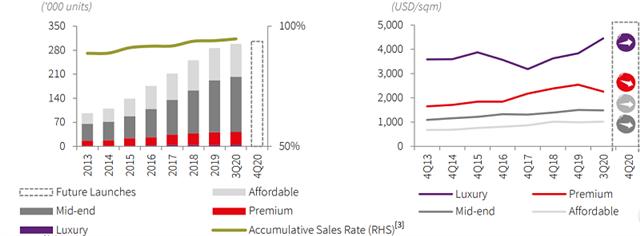

The new supply was predominantly attributed to the affordable and mid-end apartments that accounted for 91% of the total. In high-priced segments, 314 units from two Luxury projects D’ Palais De Louis and Grandeur Palace were released back into the market after a period of being put on hold to complete the legal documents and revise the selling strategy respectively, posting the highest quarterly official launches since 2018.

Hanoi's apartment total launches and average primary prices in third quarter 2020. Source: JLL Research

|

Low and mid-end apartments remain favorable: Although the resurgence of Covid-19 in July and economic uncertainty has weighed on investment sentiment, sturdy demand towards affordable apartments allowed the total sales volume up 3.3% on-year.

Newly launch projects including Vinhomes Smart City, Grand Sapphire, Phuong Dong Green Park and Binh Minh Garden reported a combined sales rate of 74% in the early stage of development thanks to its lower-than-average unit value and convenient location with easy access to main roads. Besides, the encouraging environment for homebuyers was partly supported by the lowered home loan interest rate from commercial banks.

Prices: The average primary price level saw a slight growth of 0.6% on-year and 3.9% on-year thanks to new launches with prices above-average. However, prices declined marginally 0.5% on-quarter on a chainlink basis as some developers with cash flow pressure tried to boost sales via further discount and more relaxed down payment schemes.

Projects that have discount more than 10% were able to clear their inventory faster while those with prices unchanged are struggling to attract buyers.

Outlook: JLL predicted another 5,000-7,000 units are set to be launched in the last quarter of this year, of wchih Vinhomes Smart City will contribute a large proportion and thus more sale activities are expected.

The sale will likely hold steady growth thanks to sustained owner-occupied interest. Besides, the prevailing trend of the township’s primary developers to join hands with sub-investors to develop latter phases of the developments is expected to continue in the near term.