Hanoi office market: Highest vacancy rate in three years

Hanoi office market: Highest vacancy rate in three years

The reality is largely attributed to Covid-19 impacts.

The vacancy rate of Hanoi’s office market in the first nine months this year hit a three-year low, according to JLL, a leading professional services firm that specializes in real estate and investment management.

Vacancy of Hanoi's office between January and September hits record low

|

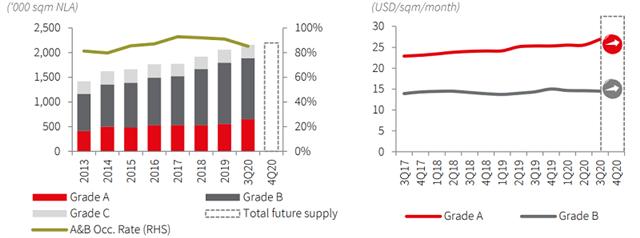

The new launch and the weak take-up during the quarter brought up the market average vacancy rate to 14.9% in the third quarter this year (3Q20), the highest vacancy rate since 2017, JLL has said in a recent report.

Three projects started operation in Hanoi in 3Q20, providing more than 122,000 square meters (sqm) of space, 75% of which came from Capital Place, a high-quality Grade A building.

Three new projects are scheduled for completion in the fourth quarter this year, bringing the total stock up to 2.2 million sqm by end-2020.

This is likely to drive up market vacancy, resulting in landlords more willing to negotiate with tenants. As tenants are likely to tighten their budgets until the pandemic is globally contained, market rents are expected to stabilize or even decrease in the near term, JLL predicted.

Office total stock and office average rents in Hanoi. Source: JLL Research

|

Note:

[1] Rent refers to average net rent of Grade A and B office markets, excluding VAT and service charges.

[2] CBD area consists of Hoan Kiem (core CBD), Dong Da, Ba Dinh and Hai Ba Trung. Non-CBD area refers to the rest of the city.

Demand continues to weaken

Demand for office in Hanoi in Q3 remained weak across the market. Most of the existing buildings recorded negative net absorption as tenants continued to either relocate to the buildings with lower rents or scale down their sizes.

During the period, three new completions were less than 20% occupied with notably low pre-commitment rate. This phenomenon has not been seen for a while with most new buildings during 2018-2019 period managing to record pre-commitment of more than 46% on average at the opening date.

Net absorption returned to positive territory in Q3, at around 19,500 sqm, which was mainly contributed by the take-ups in the new completions.

Rental rates remain unchanged

The average net rent of Grade A increased by 5.8% on-quarter to US$26.9 per sqm per month in 3Q20, which was due to the completion of the high-quality Capital Place project with higher-than-average rent.

Meanwhile, most buildings in the segment kept their asking rents constant yet with more flexible leasing terms to support the tenants.

Rental growth in Grade B has also slowed to almost a standstill since the first outbreak of Covid-19, given the softening occupier demand as they turned cautious amid uncertain situation. Rents therefore were kept unchanged at around US$14.5/sqm/month in 3Q20.

Generally, although the demand softened, landlords were not ready to reduce rents to a large extent yet as the average occupancy rate, albeit lower than before, remained at a fair level of more than 85%.