UOB raises Vietnam GDP growth forecast for 2021 to 7.1%

UOB raises Vietnam GDP growth forecast for 2021 to 7.1%

Assuming there is no further massive outbreak domestically, it is expected the recovery to extend further in the fourth quarter.

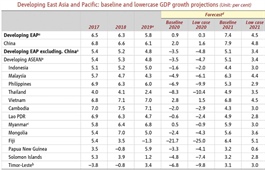

Despite lowering Vietnam’s GDP forecast in 2020 from 3.5% to 2.8%, Singapore-based United Overseas Bank (UOB) has raised its prediction for the country’s economic growth in 2021 from 6.6% to 7.1%.

|

While the worst of the impact from Covid-19 pandemic looks to be over, it is, however, still a long way before Vietnam’s economy could return to its full capacity, stated UOB in its latest report, adding the rebound in both the manufacturing sector and domestic consumption remains weak so far and border closures have reduced tourist arrivals to a trickle.

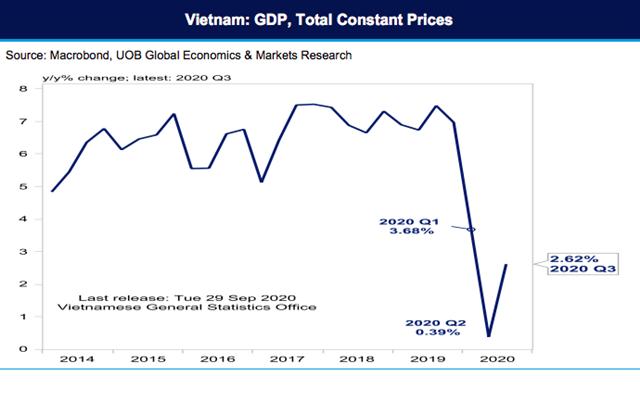

After the slump caused by the pandemic in the first half of 2020, Vietnam’s economic growth picked up momentum in the third quarter with a gain of 2.62% year-on-year, compared to the revised 0.39% growth in the previous ones.

Assuming there is no further massive outbreak domestically, UOB expected the recovery to extend further in the fourth quarter but the pace is likely to be restrained against a backdrop of ongoing global Covid-19 pandemic. This resulted in UOB’s forecast for Vietnam’s fourth quarter GDP growth at 4% year-on-year.

|

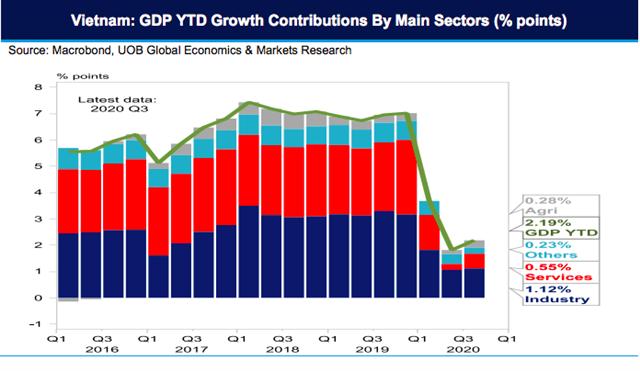

For the first three quarters of 2020, headline GDP rose 2.12% year-on-year, with industrial sector contributing 1.12 percentage points, or more than half of the gain, while services sector rebuilt its momentum with a 0.55 percentage-point contribution.

As industrial sector (including construction) and services account for a large portion of Vietnam’s economy (about 35% and 37% share of GDP, respectively), their performances will influence headline growth significantly, stated the UOB.

Data releases so far showed an anemic recovery for these indicators. Industrial output expanded 3.8% year-on-year in September, despite after a deep decline in April, and is far below the double-digit pace in the past several years. Retail sales just managed to turn in a positive reading 0.7% year-on-year in September, after five consecutive months of declines.

According to UOB, one key driver for Vietnam’s services sector is inbound tourism, which accounts for the largest share relative to the country’s GDP among the ASEAN countries.

Vietnam reported visitor arrivals of less than 14,000 in September compared to nearly two million in January 2020. While this is not surprising given the border closures around the world to contain the spread of Covid-19, the impact on services sector is clearly felt and such a dismal state could continue for some time.

The Vietnamese government has recently reduced the country’s growth target to 2% in normal conditions and 2.5% if favorable factors emerge, while for 2021 it expects economic growth of 6 – 6.5%.

Against this backdrop of uncertainty in the outlook and potential downside risks for the domestic economy, especially after the disruption from the second wave of infections earlier, UOB expected the Vietnamese central bank to take on one more rate cut in the fourth quarter after multiple policy rates cuts previously.