Stable outlook expected for Vietnamese dong

Stable outlook expected for Vietnamese dong

While Vietnam is at risk of being listed as currency manipulator by the US, such a risk appears low, as the US will likely continue to reduce its dependence on Chinese exports by reorganizing its supply chain with other partners.

In the short-term, the State Bank of Vietnam (SBV)’, the country’s central bank, is expected to continue maintaining currency stability to sustain exports competitiveness, according to Fitch Solutions, a subsidiary of Fitch Group.

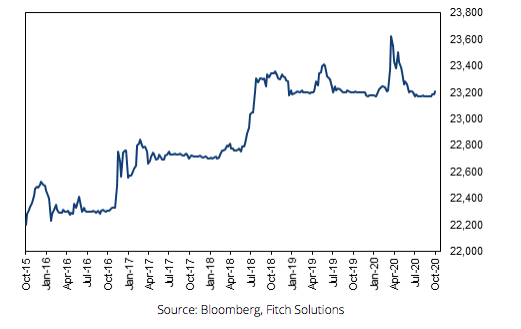

As a result, Fitch Solutions forecast the Vietnamese dong (VND) to average VND23,250/USD in 2020 and VND23,400/USD in 2021. Meanwhile, the VND has remained flat against the US dollar since July and has averaged VND23,255/USD so far this year.

|

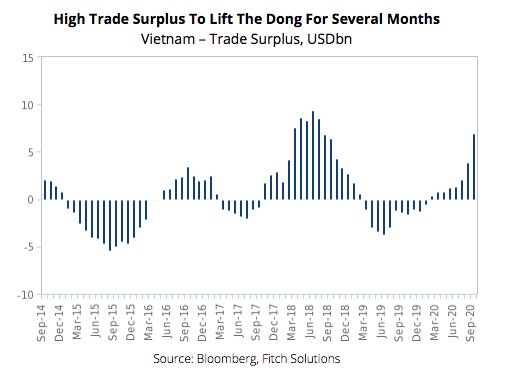

Fitch Solutions expected Vietnam’s trade surplus to remain wide over the near term, as low oil prices do not inflate the import bill, while exports receive a boost from shifts in manufacturing operations to Vietnam over the past two years. In addition, an improved market access to the European Union following the ratification of the EU-Vietnam Free Trade Agreement (EVFTA) in August will also boost exports.

The rising trade surplus will constitute a source of support to the VND, asserted Fitch Solutions.

Meanwhile, foreign direct investment (FDI) inflow is likely to remain only marginally weaker in 2020 relative to 2019, mainly due to Covid-19 related uncertainty and constraints, and this would limit the support to the VND.

To Trade Fairly Flat On Central Bank InterventionVietnam – Exchange Rate, VND/USD

|

Over the first nine months of 2020, total newly registered capital, adjusted capital and capital contribution by foreign investors was recorded at US$21.2 billion, 81.1% of the level of the same period in 2019. That said, capital disbursed over the same period was recorded at US$13.8 billion, 96.8% of the amount of the same period in 2019, indicating no major shock to FDI despite the pandemic.

|

Outbound travel restrictions imposed by countries will continue to hamper on-site visits by potential investors to Vietnam, even though the country is currently allowing business travelers into the country. Travel restrictions will delay investment decision making and weigh on FDI inflow over the coming months, despite government efforts to support FDI decision making through teleconferences.

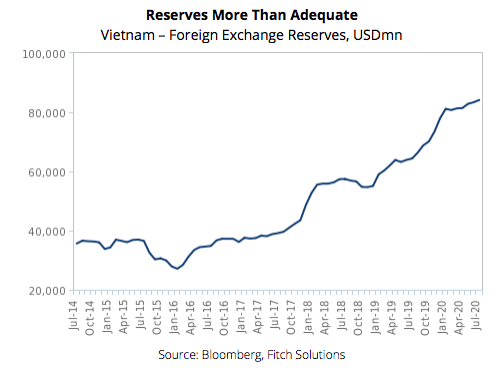

With a foreign reserve position of US$84 billion as of July, representing around 4.0 months of imports, Fitch Solutions expected that the SBV has sufficient firepower to keep the VND stable over the coming months.

|

Moreover, given the above trends, the central bank would be more likely to be buying foreign reserves than to be buying VND. Building up foreign reserves would weaken the VND.

That said, Fitch Solutions believed that any effort, if needed, to weaken the dong, would be mild and gradual, especially as the US has launched a currency manipulation inquiry against Vietnam in August.

Low risk of being listed as currency manipulator

Vietnam has been on the US Treasury’s currency manipulator watchlist for several years, which puts it at risk of coming under punitive tariffs such as those levied on China. However, tariff risks appear low, as the US will likely continue to reduce its dependence on Chinese exports by reorganizing its supply chain with other partners, such as Vietnam.

Meanwhile, strong inflows to Vietnam mean that to maintain exports competitiveness, one-sided interventions will be frequently required. However, Fitch Solutions said that Vietnam’s current account surplus is likely to come down, especially oil prices are set to rise over the coming quarters alongside a global economic recovery, which will raise Vietnam’s import bill.

Given the likely continuation of these violations, Vietnam is at risk of punitive actions from the US, although the US could decide to not pursue the matter further on the back of political considerations that it would require an ally in the region to counter China’s expanding influence.

In long-term outlook, Fitch Solutions expected the VND to remain on a gradual weakening trend against the US dollar due to VND’s persistent overvaluation and higher structural inflation in Vietnam versus the US. As such, Fitch Solutions forecast the unit to average VND/USD23,600 in 2022.