Effective gov’t support mitigates Covid-19 impacts on Vietnam financial industry

Effective gov’t support mitigates Covid-19 impacts on Vietnam financial industry

Incentives timely issued by the government and the central bank to support customers affected by Covid-19 has prevented the type of contagion that occurred during the global financial crisis in 2008.

With the timely and effective support from the Vietnamese government, the financial industry is not seeing any significant downside compared to the rest of the economy, according to Leader of Financial Services at PwC Vietnam Dinh Hong Hanh.

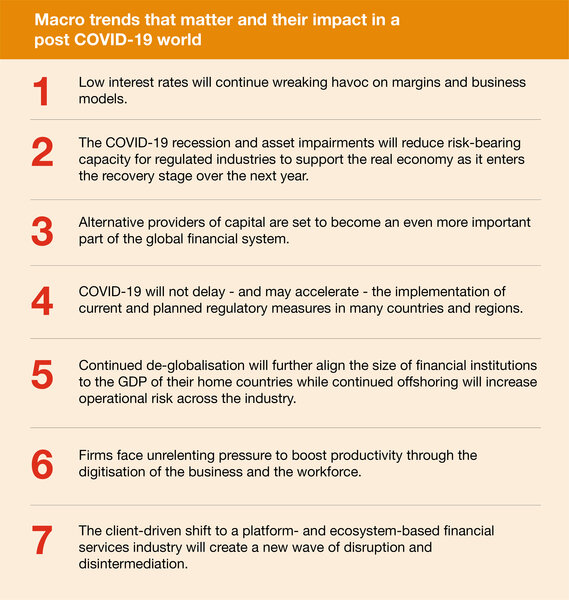

Nevertheless, the Covid-19 pandemic has tangibly affected the pockets of both retail and corporate consumers of financial services, said Hanh at the launch of PwC’s latest report “Securing your tomorrow, today – The future of financial services”, highlighting significant macro trends affecting the financial industry as a whole and their impacts on individual segments. This report is PwC’s analysis based on a wealth of data of global financial institutions in the past three years.

The report findings indicate that even though the pandemic has heavily disrupted many industries, it had a relatively modest and mixed impact on the financial services industry.

Higher trading revenues due to market volatility have boosted capital markets businesses.

Source: PwC.

|

Insurers have benefited from consumers staying close to home and the subsequent reduced claims frequency in personal lines. As for banks, central bank incentives and government support of businesses and individuals have so far limited damage to bank balance sheets.

In Vietnam, notable incentives have been timely issued by the government and the State Bank of Vietnam (SBV), such as deferred tax payment and extension of deadline for land rental payment under Decree 41, and Circular 1 to restructure the repayment periods, waive and reduce the interest and fees to support customers affected by Covid-19. Such relief has prevented the types of contagion that occurred during the global financial crisis in 2008.

The analysis, however, pointed out that the financial services sector will be hardest hit by so-called second-order effects. That is, the deteriorating credit quality of customers, along with the continued low interest rate environment, as the pandemic and its aftereffects will be felt throughout the real economy over the next several years.

“There remain lurking concerns as to what would happen when these delayed impacts materialise,” said Hanh.

While the impacts on different segments of financial services might vary, in the wake of Covid-19, financial services are not exempted from inevitable shifts and trends of transformation to ensure business continuity and prioritise productivity. Accelerating trends have already begun, and there emerge new trajectories.

The move to digital has been accelerated during these disruptive times. The report argues that a combination of near zero interest rates and the rise of digital-only players will create tighter margins across product portfolios, thereby emphasising the need to digitise rapidly, gain cost efficiencies and register real gains in productivity. The shift to a more platform- and ecosystem-based industry, including more digitized client interactions, will create a new set of challenges and opportunities for the industry.

“This is a challenging yet exceptional time. Financial institutions need to re-evaluate and lead the use of technology to develop new capabilities – improve customers’ financial health, inclusion, and protection – at the same time have yourself a sound financial well-being strategy in place,” Hanh asserted.

John Garvey, PwC’s Global Financial Services Leader, stated: “While the financial services industry has stood up well in light of the pandemic, it will likely be hit hardest by second-order effects. The challenge for the financial services industry is in how it is able to navigate this difficult environment while balancing cost cutting and investment. Those that execute best will be the ones to succeed.”