Consumers in Hanoi use more multiple e-wallets than in other locations: Survey

Consumers in Hanoi use more multiple e-wallets than in other locations: Survey

Half of the surveyed people in Hanoi use single e-wallet like those in Ho Chi Minh City do.

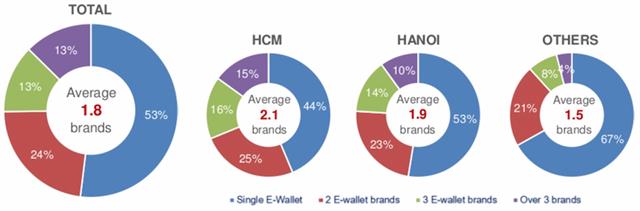

People from Hanoi and Ho Chi Minh city tend to use multiple e-wallets than other locations, according to the latest report by online research market firm Asian Plus.

Source: E-wallet brand in repertoire conducted by Asian Plus. Screenshot: NM

|

Conducted in September, the report entitled “Mobile payment usage in Vietnam 2020” revealed that 31% and 24% respondents use three and more than three e-wallet brands in Ho Chi Minh City and Hanoi, respectively. Meanwhile, the portfolio in other locations is only 12%.

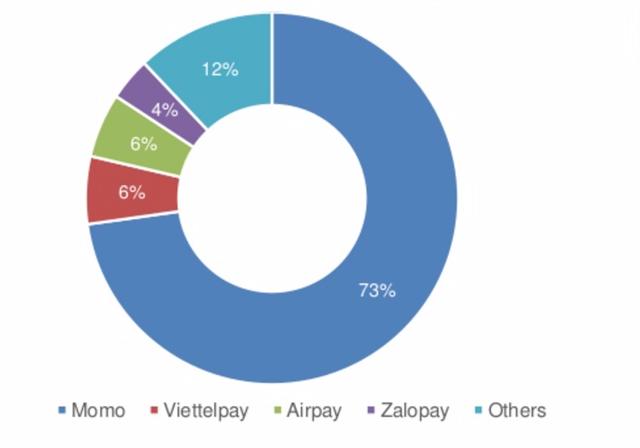

The survey also found that Momo is the dominant player in the e-wallet market, achieving 73% top-of-mind, 94% total awareness and is used most often by 61% of users, followed by Viettelpay, Airpay and Zalopay.

Source: Top-of-mind of e-wallet brand conducted by Asian Plus. Screenshot: NM

|

In terms of brand awareness, Momo mobile payment wins in both gender and cities, however, Viettelpay's position is driven by Hanoians (85% of respondents choose using the mobile payment app).

Zalopay & Airpay gain points from the female respondents with 76% and 64% of the users, respectively. Only more than 20% of respondents know Samsungpay, the lowest portfolio among mobile payment apps in terms of gender and cities.

In terms of usage frequency, Momo stands still in the top position with the highest share and Viettelpay follows with a big gap (15% of respondents with the most often usage). The key task of Airpay and Zalopay is to enhance the base of awareness with only 12% and 6% of respondents, respectively using most often mobile payment.

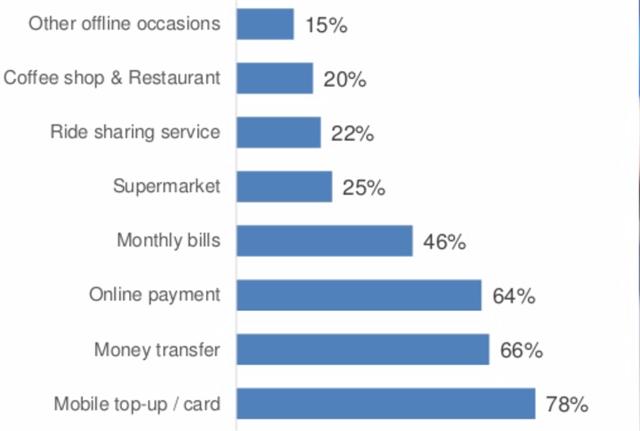

Source: Popular usage conducted by Asian Plus. Screenshot: NM

|

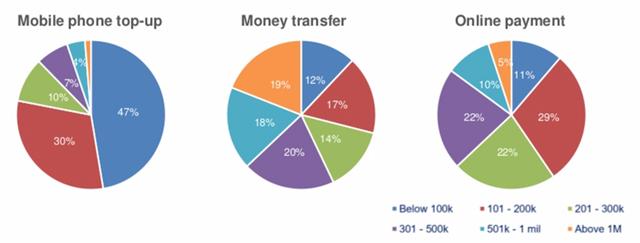

The top usages of mobile payment are top-up and money transfer. The transaction amount is limited, as half of money transferred even is less than VND300,000 (US$12.9). The service has the uniqueness of supporting cashless culture for small amount, the report wrote.

Source: Average amount for transaction conducted by Asian Plus. Screenshot: NM

|

Momo and Zalopay are mostly used for mobile top-up, and money transfer, while 92% of respondents chose using Airpay for online payment (shopping and food delivery), followed by Viettelpay and Zalopay (56% each).

The report found cost, service versatility and membership benefits are three reasons that users consider for the brand selection. Viettelpay has a safe and high security/trust images while Airpay is federated with good benefits.

The highest motivation to use mobile payments is convenience (59%) and promotion (40%). The monetary benefit pushes the users to realize the convenience of the services.

Promotions are one of the strongest factors that triggers the usage of mobile payment. Top preferred promotions are cash back (66%), point accumulation (49%), and discount percent based on transaction amount (46%).