Association proposed to tax apartment rental business on Airbnb

Association proposed to tax apartment rental business on Airbnb

The HCM City Real Estate Association has proposed the short-term apartment rental business be taxed, to better manage business operations on Airbnb and similar online platforms which is developing rapidly in big cities.

The association said that recent years saw a boom in the short-term rental business in major cities but the current established laws, including the Law on Housing 2014 and the Law on Real Estate Business 2014, does not have regulations in place for the operation of this business.

The Law on Housing 2014 banned the use of apartments for non-residential purposes. The problem was the law recognised landlord’s leasing rights but did not allow using apartments to be used as places for business registration.

The association said in many countries, landlords who ran short-term rental business on Airbnb must register their business and pay tax. In addition, their apartments could be used for lease in certain times of the year following the agreements with the local authorities or with the affected neighbours.

Viet Nam does not have the correct legal framework for this kind of business, the association said.

Chairman Le Hoang Chau said established laws should be amended towards the short-term rental business and landlords must register their business and pay taxes.

It could be put into consideration that Airbnb landlords must also pay additional fees for apartment operation management services.

Chau said this was a business model of a sharing economy in the industry 4.0, adding that Government should develop legal framework to manage this operation.

“An adequate and proper legal framework for short-term rental business will not only help promote the positive development of the sharing economy business model but also generate revenue for the State,” Chau said.

Senior director of Savills Vietnam Su Ngoc Khuong said the short-term apartment rental business had benefits, including providing more accommodation options and increase accommodation capacity to attract more tourists. In addition, landlords could earn income from renting houses.

“If this business model is well managed, Viet Nam can earn a large amounts of foreign currency and the collect more tax,” he said.

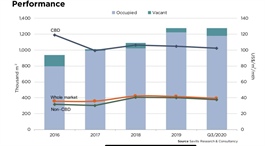

A report by Grant Thornton in 2019 showed the Airbnb rental market saw rapid growth in Viet Nam with the participation of about 30,000 housing units, from 6,500 units in 2016 and 16,000 in 2017.

Despite taking a hit by the COVID-19 pandemic, experts predicted the business would soon recover along with the tourism industry.