Price gap between inner and surrounding area fall in Ha Noi market

Price gap between inner and surrounding area fall in Ha Noi market

A recent survey by Savills found that gap of property prices are narrowing between urban and surrounding areas as more facilities are offered to compensate for outer locations.

The survey also said that property price and size are the key buying influences.

For some apartment projects in My Dinh, the price has increased to VND50-60 million (US$2,128-$2,553) per sq.m.

Savills reported average primary prices in the third quarter of this year on the Ha Noi apartment market moved up 3 per cent quarter on quarter (QoQ) and 10 per cent year on year (YoY) to $1,500 per sq.m. Secondary prices have been more affected by the pandemic and were down 1 per cent QoQ to $1,157 sq.m.

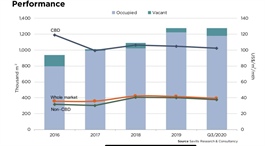

The company said abundant planned infrastructure supports the long term outlook with house prices set to benefit. From 2016 to date, primary prices have increased 5 per cent per annum. As networks improve, supply will increasingly move to newer and further out areas.

"The market remains price sensitive and uncertain with a lack of Grade A apartment supply. There is robust demand for affordable products. Sustained recovery underpinned by long term economic and population growth is anticipated once COVID-19 is under control," said Do Thu Hang, Savills advisory services and research director.

She said that besides foreign investors, the Ha Noi market is attracting domestic investors, especially from HCM City.

There are some reasons for those investors coming to the Ha Noi market. Firstly, investors are reassured by the legal framework.

Second, HCM City-based and foreign investors want to bring a new development trend to Ha Noi's housing market, which will create direct competition with local investors. These investors are all developers with extensive experience in real estate development, Hang said.

Third, the developers themselves have abilities in many aspects to create affordable products meeting investors' expectations.

However, the biggest difficulty of investors from HCM City is to look for potential projects and cooperation opportunities with landowners in Ha Noi. Therefore, they have flexible transaction structures to increase opportunities to cooperate with investors in Ha Noi. For instance, they could reduce the investment ratio to 51 per cent instead of 76 per cent as before.

"The success of investors from HCM City in Ha Noi is still a big question," Hang said.

Customer psychology is one of the major challenges for the property investors from HCM City because they may not understand the market demand. In HCM City, prices of projects in the city centre can be up to $10,000 per sq.m and even higher. However, Ha Noi has few property products with that price and it is difficulty to sell them.

Therefore, despite having a lot of experience in residential real estate development, understanding the Ha Noi market is a challenge for developers, she said.

According to the Savills report on the Ha Noi market in Q3, the apartment segment had about 3,100 units from four new launches, and the next phases of nine existing projects were down to their lowest in five years at 50 per cent QoQ and 60 per cent YoY. Primary supply of 26,800 units was down 8 per cent QoQ and 9 per cent YoY. Uncertainty is delaying project launches.

About 5,200 sales were down 3 per cent QoQ and 44 per cent YoY. Grades B and C accounted for almost all sales. Demand has eased under a lack of new supply and high-priced inventory.

Savills forecasts in Q4, approximately 9,980 units from one existing and 11 future projects will enter the Ha Noi market, with Grade B continuing to dominate. Leading future suppliers will be Gia Lam District with 38 per cent of supply and Tu Liem with 37 per cent.

Urbanisation, strong population growth and shrinking households are all driving the solid housing demand, Savills said.