Serving leisure and property through coastal development

Serving leisure and property through coastal development

As one of the most important factors of the coastal economy, properties along the country’s long coast line continue to develop at a rapid rate with various diversified types and large-scale projects in the mix.

VIR editor-in-chief Le Trong Minh (far right) joined experts and business leaders to discuss the importance of Vietnam’s coastal development

|

The coastal economy, covering 28 provinces and cities, now occupies just under half of GDP for the whole country. In the government target for 2030 with a vision to 2045, this rate is hoped to increase to 65-70 per cent.

According to Resolution No.26/NQ-CP issued this year, the central southern provinces will be developed into large scale tourism centres, with the aim of setting a good foundation for Vietnam to establish an urban coastal system on a major scale with functions to serve tourism, leisure, and property purchasing.

“The booming tourism industry and rapidly-growing middle class and wealthy people, as well as developing modern transport infrastructure, are the main reasons that make coastal property increasingly diversified and becoming an attractive segment in the real estate market,” said Le Trong Minh, editor-in-chief of Vietnam Investment Review at the Coastal Appeal seminar held by VIR last week to raise opinions from regulators, experts, and businesses looking for new opportunities in the market.

|

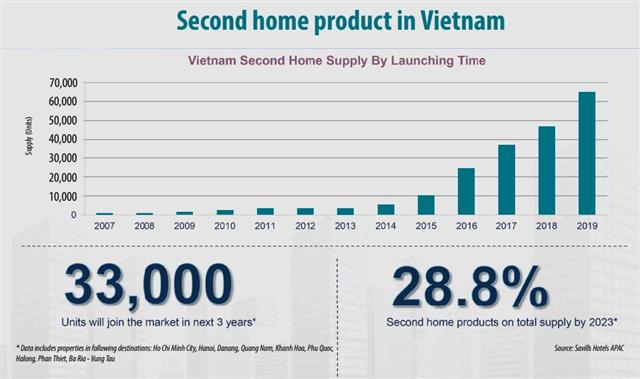

Vietnam’s middle class can account for 25 per cent of the population by 2025, about 25 million people, and many may have demands for owning a second home to relax, put to lease for profit, or simply to have another asset.

According to Do Thien Anh Tuan, lecturer at Fulbright University Vietnam, the basis for a confidence in growth is the rapidly-growing middle class. “This class is capable of catching up with newly-industrialising countries. Specifically, Vietnam has had the second-fastest growth rate of super-rich people in the world in the past decade,” Tuan said.

Vietnam ranked second globally in terms of super-rich growth between 2012 and 2017, and Forbes expects the growth rate of the super-rich in Vietnam by 2026 to be around 170 per cent. The demand is encouraged by the increasing completion of traffic infrastructure of expressways, airways, and waterways that close the distance between traditional and coastal cities.

From a legal perspective, Vu Van Phan, deputy director of the Department of Housing and Real Estate Market Management under the Ministry of Construction (MoC), said that coastal properties would become much more attractive for foreign investors and buyers because the ministry is suggesting to the government to revise the 2014 Law on Real Estate Business so that non-nationals and organisations can buy and own tourism property in certain projects.

The Ministry of Natural Resources and Environment is finalising a draft decree amending other decrees guiding implementation of the Law on Land, which contains the content of creating an open legal corridor for the ownership of coastal real estate products as directed by Deputy Prime Minister Trinh Dinh Dung at the National Housing Steering Committee meeting held in early October.

“To anticipate the opportunity in the new development cycle, it is high time for coastal real estate project developers and individual investors to make their decisions right now,” Phan suggested.

Strong progress

Many coastal real estate projects and urban areas with a scale of hundreds to thousands of hectares have been announced to the market. For example, Novaworld Phan Thiet developed by Novaland Group is now under construction. This project is located over 1,000ha and is now developing into a large-scale coastal urban area with more than 1,000 facilities. Novaworld Phan Thiet will not only serve for accommodation but also offer many facilities for leisure and entertainment.

Novaland is also developing Novaworld Ho Tram in the southern province of Ba Ria-Vung Tau, a complex of premier resort entertainment complexes also over 1,000ha.

Meanwhile Danh Khoi Group is developing Aria Danang Hotel and Resort. Located in the heart of the central city, Aria Danang Hotel and Resort combines resort villas and condotels.

Nam Group has also recently started Thanh Long Bay – an urban complex of watersports and resort located in the central province of Binh Thuan. Its first part, named The Sound, is set to launch this month.

Also on the cards is Mui Ne Summerland Resort – a Las Vegas-inspired complex invested in by Hung Loc Phat which is to open at the end of 2022.

Despite being impacted by the ongoing pandemic, many projects remain in construction. Novaland’s NovaWorld Phan Thiet, NovaWorld Ho Tram, Phat Dat Group’s Nhon Hoi New City, and Nam Group’s Thanh Long Bay are all in good progress, according to the developers. This reaffirms the potential vitality of developers and shows the vision of businesses in preparing for an explosive future of coastal urban products.

In terms of investment needs, buyers now are diversifying their investment in many different types of properties, from hotel and resort project to villas, shophouses, apartments, condotels, and even supported facilities such as schools, hospitals, and beauty facilities.

Another advantage for coastal urban areas is the high connectivity and adaptability of those projects into larger tourism routes, as they are constructed close to current transport infrastructure systems. Therefore, the prospect of keeping to schedules and ensuring efficiency in operations, exploitation, and profitability in all phases of projects is being deemed as feasible in the country.

Emerging destinations

Real estate market researchers and experts at the seminar said that complex coastal urban products will become one of the leading segments of investment trends in the coming time, especially in the context that cash flow is opening up as bank interest rates continue to be locked at a low level and other investment channels have not proven their stability. At the same time, coastal property can be a second home for the purpose of improving the quality of life of high-income people, and it can be a permanent wealth asset, Minh added.

From traditional markets such as Nha Trang, Danang, Phu Quoc, and Halong to emerging markets such as Binh Thuan, Ninh Thuan, Phu Yen, and Binh Dinh with their advantages in natural landscapes and relatively affordabe prices of property, they are all creating a colourful picture for the coastal property market.

At the same time, the presence of large-scale investors with abundant financial potential and long-term visions – who are developing many coastal urban projects and diversifying products and forms of ownership – are also creating new value for tourism and urban development.

From March, all international tourism activities have been halted due to the global health crisis, but according to most international experts, Vietnam’s tourism industry will recover faster than many other countries thanks to efficient pandemic prevention, and impressive growth performance previously.

Vietnam welcomed more than 18 million international visitors and about 85 million domestic tourists in 2019, contributing about four million jobs and $32.8 billion to the national economy, equivalent to 9.2 per cent of GDP.

|

Jun Kato - Urban planner and designer, Nikken Sekkei

In terms of planning, Vietnam has great potential on coastal tourism. In fact, in coastal economic development, the coastal urban areas have greatly contributed to the country’s GDP through the tourism development. In Tokyo, coastal areas are almost fully occupied by industry and port functions. So people in Tokyo need to drive far away to feel the ocean. Vietnam needs to appreciate the fact there are still chances to secure a coastal area and open it to citizens before industrialisation becomes more apparent. We need to provide various options regarding how visitors spend their day and night-time on the coast. Generally, resort hotel operators provide souvenir shops, restaurants, and entertainment near or inside hotels. But visitors often get bored by the next day because the experience is just too artificial and controlled. Thus, operators should offer chances for various activities for visitors such as tennis, golf, and other events. Don Lam - CEO, VinaCapital Group

Vietnam is fortunate to have an abundance of beautiful coastal areas, especially in the central and southern regions. It is little surprise that real estate developers would be interested in building large-scale, mixed-use properties which include hotels and resorts, along with condos and villas, and commercial space. Foreign investors will eventually follow the lead of domestic developers. Overseas investors tend to have a smaller appetite for risk and would likely enter the market at a later stage, when the infrastructure is more developed. That includes accessibility via air and roads, as well as healthcare and education facilities. These later-stage investors will probably pay a higher price but can still likely realise good returns, all while mitigating risk. Because domestic developers enter the market first, their returns tend to be higher than those who enter later. But that’s typical – domestic developers are taking on greater risk in terms of buying land, obtaining the necessary permits, land clearance, and other complex matters that can make or break development plans. The higher the risk, the higher the reward. Mauro Gasparotti - Director, Savills Hotels Asia-Pacific

Without a doubt, improvements in ownership structure will increase the appeal of holiday properties to overseas individuals. However, we believe that right now Vietnamese coastal areas are not yet attractive enough for mass foreign buyers. Therefore, local Vietnamese or expatriates should still be the main targets for the foreseeable future. Vacation properties and second homes are very popular in destinations which have a strong base of repeated foreign visitors. For instance, Thailand and Bali have strong advantages of having developed this kind of repeated clientele. Vietnam is still on the development path, given that property diversity as well as international airport connectivity is not as developed as neighbouring holiday destinations. We believe that until now, the targeted foreign buyers in Vietnam’s market are individuals familiar with our country, perhaps with a Vietnamese spouse or with business here. We expect that luxury products with international brands and developed by well-known developers will gradually become a favourite investment option of foreigners in branded products. One of the most important catalysts for coastal destinations to maintain development growth is infrastructure that would enhance connectivity. This is even inevitable for drive-to destinations like Mui Ne, Ho Tram, Dalat, and Halong Bay, where road connectivity is an essential element. It is also important for destinations like Danang, Cam Ranh and Phu Quoc where airport connectivity to main Asian cities will remain the fundamental element of future growth. Arnaud Ginolin - Director, Boston Consulting Group

To successfully exploit and develop the potential of coastal urban areas we need high aspirational, generational, and public and private strategies. The keys are that we need a clear vision, presence of anchor assets, segment targeting, and phasing. A clear vision enables three things: high level alignment across public and private stakeholders, identifying the right level of ambition, and enabling trade-off between different outcomes (the economic, social, and environmental), as well as sufficient guidance to develop a funding/financing strategy and community engagement. For the Vietnamese market we need to answer key questions – which vision will be suitable for the coastal urban development areas; how to ensure a harmonious development in a comprehensive master plan among different coastal areas of Vietnam in order to avoid internal competition; and ensuring enough attraction for both investors and developers. Tran Le Thanh Hien - CEO, Danh Khoi Viet Group

There are many reasons for the sharpest boom in coastal real estate investment in Vietnam in the last decade. The first is the support for infrastructure, with development of with many highways and airport projects carried out or on the way. The total length of expressways across the country is continuing to expand and will do so over the next few decades. These are favourable conditions to promote resort tourism in destinations that take a few hours by car. On the other hand, car ownership is easier for Vietnamese and helps people with quicker access to holiday getaways more quickly. The resort market has benefited from strong growth in the number of domestic and foreign tourists previously, as well as direct international flights. The trend of tourism and resort real estate investment by the middle-class and the well-off in Vietnam has also had positive changes. In particular, more global hotel brands and investors are pouring into the Vietnamese market as a future hot spot in the region. Do Thien Anh Tuan - Lecturer, Fulbright University

Many tourism assets in Vietnam are developed by small-scale developers who have not enough capacity in finance, governance management, or ambition to develop those assets into “tourism complex” in its exact concept. In reality, the economy needs developers who are good enough in finance and governance management capacity. Large-scale tourism complexes or coastal urban areas must be a combination of both accommodation and other facilities to serve residents – not for accommodation functions only but for leisure and entertainment functions also. Good developers will help build up an exact concept of coastal urban areas. We are hoping that Vietnam’s market can have those big developers who can become anchors of the economy. There is a strategy in the next decade to increase the urbanisation rate. This is not a motivation for local authorities such as Hanoi and Ho Chi Minh City but cover many other cities and provinces, especially those located on the coastline. There are five reasons for investing in second homes in Vietnam: the increase of income, a new investment trend, improving life standards, providing more facilities, and meeting the demand of experienced vacation. In order to develop urbanisation and coastal urban areas, policies must be focused, such as completion of planning and zoning activities, diversifying ownership, and faster improvement of the infrastructure system. Pham Lam - General director, DKRA Vietnam

Between 2015 and 2020, major investors have jumped on the bandwagon to develop large coastal urban projects. Coastal real estate expected fast-paced development in the given period, especially in localities like Quang Nam, Danang, Khanh Hoa, Ba Ria-Vung Tau, and Phu Quoc. In the last two years coastal real estate became more popular in emerging markets like Binh Dinh, Phu Yen, and Ninh Thuan. However, there are only a few projects on a small-scale developed by smaller investors. Developers have rolled out new and versatile properties that reflect progress of the businesses involved. However, local investors have also been active in this market such as Vingroup, Sun Group, CEO Group, BIM Group, and Novaland. The market has also witnessed a boom in supply, especially in condotels. Since 2016, over 40,000 condotels and 7,800 beach villas have been introduced to the market. The projects have been growing in scale, with some ventures spanning up to 1,000 hectares under an integrated resort model. Nguyen Quoc Bao - Deputy general director, Danh Khoi Group

About 10 years ago, coastal resorts were known to the market as a kind of luxury real estate, because this was a game for richer people only. However, in recent years this trend has changed – the coastal real estate has not only become a demand of the vast majority of customers but is also now a “fruitful game” for various interested investors. The trend of developing coastal urban areas and tourism complexes in Vietnam is following the general rules of many countries around the world. Coastal real estate in Vietnam is not only derived from a story of being only for the rich for relaxation purposes, but also is seen as a type of valuable exploited real estate. The coastal real estate market, like many other markets, is facing many difficulties due to the impact of the pandemic, but it is only a temporary difficulty. In the long term there is always a lot of room for development. |