Cooking oil stock (TAC) rockets 68% in nine days

Cooking oil stock (TAC) rockets 68% in nine days

Shares of Tuong An Vegetable Oil Joint Stock Company have soared nearly 68 per cent in two trading weeks after the company announced high cash dividend rate.

Tuong An shares soared 6.9 per cent to trade at VND59,100 (US$2.55) apiece on Friday. The stock has rallied total 68 per cent in nine consecutive trading days since August 19.

The company shares reached the daily highest trading limit of 6.9-7.0 per cent in the previous five trading days.

The surge came after Tuong An on August 21 announced it would pay a cash dividend rate of 75 per cent with every shareholder receiving VND7,500 per share.

Tuong An is listing more than 33.8 million shares on the Ho Chi Minh Stock Exchange with code TAC. The upcoming dividend payout is worth more than VND254 billion ($11 million).

Investors will finalise their registration for dividend payout on September 15 and payment will be made on September 30.

At the annual meeting on June 12, Tuong An shareholders approved the plan to merge the company with Kido Group. The company will hold an extraordinary shareholders’ meeting to finalise the detailed plan.

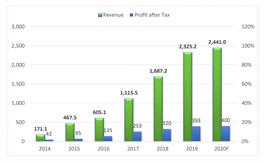

The company estimated its revenue in July gained 40.7 per cent year on year to VND425.9 billion and pre-tax profit surged 231.9 per cent on-year to VND27 billion.

In the seven-month period, Tuong An recorded a total revenue of VND2.6 trillion, up 30 per cent on-year, and a pre-tax profit of VND111.9 billion, soaring by 63.8 per cent on-year.

According to the management board, the company benefited from a panicked market, in which people tried to buy as much as they could on fears that the COVID-19 pandemic would soon shut down the whole economy and put the country in a prolonged lockdown.

In addition, lower management expenses also helped raise the profit for the company in the first seven months.

According to data mining and analysing group Nielsen, the food sector was the best-performing industry among all fast moving consumer goods (FMCG) sectors in the first half of the year.

Total revenue of the food sector increased by 7.3 per cent on-year in the first quarter while that of FMCG sector inched down 0.3 per cent on-year. In the second quarter, total revenue of the food industry lost 4.9 per cent on-year compared to a 14.7 per cent slump for all FMCG sections.

Tuong An in 2020 targets to reach a total revenue of VND4.56 trillion and a post-tax profit of VND193 billion, up 13 per cent on-year. The company plans to pay a 20 per cent cash dividend for this year.

.jpg)