Cen Land (CRE) makes it on Forbes Asia's Best Under a Billion

Cen Land (CRE) makes it on Forbes Asia's Best Under a Billion

Century Land JSC (HSX: CRE, Cen Land) is one of six Vietnamese companies in Forbes Asia's Best Under a Billion list, which highlights the 200 leading public companies in the Asia-Pacific region with annual revenue under $1 billion.

The 2020 ranking includes real estate developers Phat Dat Real Estate Development JSC and Century Land JSC (Cen Land), paper manufacturer Dong Hai JSC Ben Tre, seafood processing firm Nam Viet Corporation, Taseco Air Services JSC, and stationery producer Thien Long Group Corporation. Forbes Asia stated that this year's list incorporated the companies' overall track record in measures such as debt, sales, and earnings per share growth.

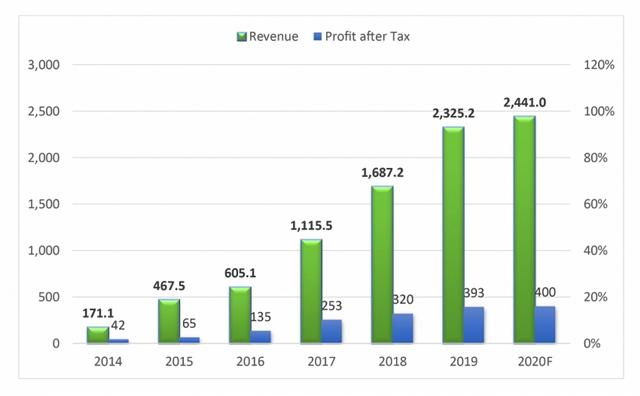

Cen Land is one of the real estate firms to be listed on the Ho Chi Minh City Stock Exchange and highly appreciated by investors. According to the company's 2019 annual report, its total revenue was over VND2.3 trillion ($100 million), reaching 91 per cent of the year's plan. Meanwhile, pre-tax profit was over VND491.2 billion ($21.36 million), reaching 87 per cent of the plan. Finally, after-tax profit was VND392.7 billion ($17.1 million), up 22.7 per cent on-year.

Eurowindow River Park is the first high-rise project in Dong Anh, overlooking the Red River and the Duong River

|

Despite the COVID-19 lockdown, from the outset of this year, Cen Land has achieved breakthroughs thanks to timely and quick response.

In the first six months of the year, revenue from real estate sales and services reached about VND711 billion ($30.9 million). Gross profit from sales and services is VND287 billion ($12.48 million). Total pre-tax profit is VND176 billion ($7.65 million) while after-tax profit is VND139 billion ($6 million).

Cen Land has set big targets for 2020. As such, the company aims for a total revenue of about VND2.4 trillion ($104.35 million), of which revenue from real estate sales and brokerage is to be VND1.3 trillion ($56.5 million); from real estate transfer is to be VND1.1 trillion ($47.83 million); revenue from advertising and event organising services is to be VND42 billion ($1.83 million); and revenue from office leasing and other services is to be VND15 billion ($652,170).

Recently, Cen Land has won the Dot Property Vietnam Awards 2020 for Vietnam's Best Real Estate Agencies and Vietnam's Best Property Consultancy Firms.

Growth strategy

Currently, Cen Land is the leading brokerage firm in the northern market with the highest number of properties for sale. Cen Land has offered 176 projects to the market, with over 20,000 real estate products ranging from apartments, terraced houses, villas, to condotels with a total value of more than VND78 trillion ($3.4 billion).

To expand supply, Cen Land has entered into a co-operation with M.I.K Group to become the sales agency of Imperia Smart City. Cen Land has also been assigned to sell The Terra Hao Nam and Grandeur Palace Giang Vo of the developer Van Phu-Invest. Cen Land is selling real estate projects in key markets such as Hoi An, Nha Trang, and Phu Quoc in the resort real estate segment with Casamia Hoi An and VinWonders Phu Quoc.

Cen Land has just signed the partnership agreement with Dwell Realty Vietnam to distribute 100 apartments for customers from Hong Kong (China).

In addition, the company continues to develop the Cen Homes proptech platform and launch an online real estate valuation tool. After two months of upgrading, the app has more than 15,000 downloads on both iOS and Android with over 90 per cent 5-star reviews.

Revenue and after-tax profit of Cen Land in 2014-2020

|

Capturing the market trends, Cen Land launched Cen Cuckoo – the first large-scale serviced apartment model in Vietnam, which is currently being adopted in Eurowindow River Park apartment buildings (Dong Anh, Hanoi). Cen Land will also expanded its ecosystem with the Cen Zone industrial real estate agency for about 300 industrial parks in Vietnam.

The representative of Cen Land shared in the midst of COVID-19 that many successful transactions have been wrapped up through the Cen Homes proptech platform and the sales force of the company.