Two major shareholders leave Vinaconex (VCG)

Two major shareholders leave Vinaconex (VCG)

Cuong Vu Real Estate and Star Invest are no longer major shareholders at the Vietnam Construction and Import-Export Joint Stock Corporation (Vinaconex), according to the Ha Noi Stock Exchange.

The northern market regulator said on Tuesday that the two limited liability companies had sold their stakes in Vinaconex on August 14.

Cuong Vu Real Estate Co Ltd sold 94 million shares, or a 21.28 per cent stake, it had owned in Vinaconex. Star Invest Co Ltd offloaded all 33.44 million shares, equal to a 7.57 per cent stake.

The shares were transferred via put-through transactions on August 13-14, worth nearly VND3 trillion (US$129.4 million).

The identity of the buyers remains confidential.

Vinaconex shares soared total 20.8 per cent in the two days. Its shares rose 1.2 per cent to end Tuesday at VND32,400 ($1.40) apiece.

Cuong Vu Real Estate and Star Invest became major shareholders at Vinaconex in late 2018 when the latter was equitised.

The State Capital Investment Corporation (SCIC), representing the Government to control the State capital in State-owned enterprises, decided to sell 254.9 million Vinaconex shares or 57.71 per cent of the company’s charter capital in November 2018.

The shares were purchased by the An Quy Hung-led consortium at VND28,900 per share.

After the IPO, the military telecommunications group Viettel offered 94 million Vinaconex shares for sale and the investment fund Pyn Elite also wanted to offload 33.44 million shares.

Then the shares were absorbed by Cuong Vu Real Estate and Star Invest, becoming the major shareholders with total 28.8 per cent stakes.

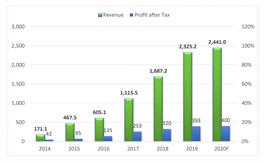

In the second quarter of 2020, Vinaconex posted a 30 per cent annual decrease in revenue, which dropped to VND1.59 trillion.

However, the collection of VND287 billion worth of doubtful debts helped boost the firm’s post-tax profit by 51.3 per cent on-year to VND321.6 billion in the second quarter.

In the first six months of the year, Vinaconex reported a total revenue of VND2.59 trillion, down 34.3 per cent year on year, and a post-tax profit of VND385 billion, up 23.4 per cent year on year.

Vinaconex blamed the downturn of the real estate market and construction sector for lower revenue in the first half of the year.

The construction and real estate firm targets VND9.53 trillion worth of total revenue in 2020, down 4 per cent year on year and VND820 billion worth of total post-tax profit, up 4 per cent on-year.

On June 30, Vinaconex had VND18.64 trillion worth of total asset, including VND11.47 trillion worth of short-term assets.

Nearly 64 per cent of the short-term assets was doubtful short-term debts, worth VND7.31 trillion. Vinaconex has made a provision worth VND551 billion for those debts.