EVFTA brings opportunity to restructure Vietnam textile industry

EVFTA brings opportunity to restructure Vietnam textile industry

The ability for Vietnam’s textile industry to take advantage of the EU – Vietnam trade deal will depend on the local domestic supply chain.

Requirements for product origin under the EU–Vietnam Free Trade Agreement (EVFTA), would bring an opportunity for Vietnam to restructure its textile industry, according to Viet Dragon Securities Company (VDSC).

The EVFTA, scheduled to take effect from August 1, would provide preferential tariffs for Vietnamese goods exported to the EU, including textile and garment products.

|

Bottleneck of weaving and dyeing

However, the EU has set up the so-called origin standard “from fabric onwards” as a technical barrier. Accordingly, fabrics must be produced in Vietnam or EU countries or countries that have free trade agreements (FTA) with both Vietnam and EU such as South Korea.

Additionally, fabrics from some ASEAN countries will also be accepted in the future, when FTAs of EU and these countries are signed.

In fact, Vietnam's current weaving and dyeing capacity is not sufficient to meet the needs of the domestic apparel industry due to (i) local authorities are concerned about environmental pollution and hesitate about allowing projects that have a dyeing part; (ii) the capacity of designing, printing, dyeing and finishing is not high; (iii) according to the Vietnam Cotton & Spinning Association (VCOSA), production technology and wastewater treatment systems make the total investment for weaving and dyeing reach US$200,000 USD per employee, significantly higher than the investment for garment at US$3,000 per employee.

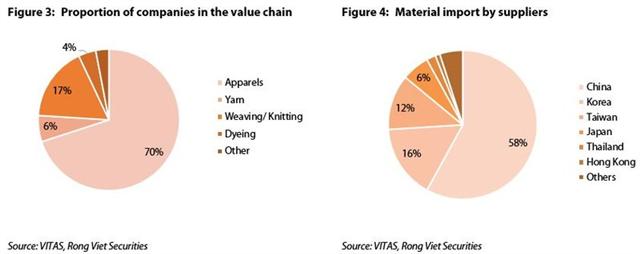

Hence it is not attractive to investors due to the long payback period, stated VDSC. As a result, Vietnamese fabric is still poor in quality, design and output, for which garment companies have to import more than 65% of their needs of input. Dyeing companies only account for 4% of the total number of textile and apparel companies in Vietnam, according to the Vietnam Textile and Apparel Association (VITAS).

China is currently Vietnam’s main source of fabric (58%) due to cheap prices and diversified design. According to some garment companies, Chinese fabric prices are 10%- 40% lower than domestic fabric prices. South Korea, Vietnam's second largest fabric supplier, only accounts for 16% of the total import.

However, the possibility that garment companies increase the use of South Korean fabrics to enjoy EVFTA's tariff incentives is not high as South Korea’s fabric supply capacity is not big enough.

Domestic supply chain for textile production is essential

|

Therefore, the ability to take advantage of the EVFTA will depend on Vietnam’s domestic supply chain for textile production. However, finding a supplier that meets the requirements of price, design, quality, quantity and time is not easy.

This challenge of origin, however, brings an opportunity for restructuring the industry in the direction in which companies cooperate with each other to build production chains of Yarn - Weaving - Dyeing - Sewing to meet origin standards, ensuring consumption and increasing the competitiveness of Vietnam’s textile and garment products.

Amid this situation, VDSC expected garment companies that export a large part of their products to the EU, namely Song Hong Garment, TNG Investment and Trading, Saigon Garmex Manufacturing Trade, and Garment 10, and/or have a full supply chain (Thanh Cong Textile Garment Investment Trading and Phong Phu Corporation) of their own will be able to benefit the most from the EVFTA.

The EU is the second largest market for Vietnam's textile and apparel industry, accounting for 16.3% of the industry's export turnover in 2019. Under the EVFTA, 42.5% of textile and apparel products will be free from tariffs immediately when the deal comes into effect. Tariffs for the rest will be reduced to 0% in the next eight years.

It is worth mentioning that the EU accounts for 34% of the world's total textile imports with demand increasing 3% per year. However, Vietnam only has a 2-3% market share, due to the fierce competition from China, Turkey, Bangladesh, India, Pakistan and Cambodia.