WHA ready to rebound with Vietnam

WHA ready to rebound with Vietnam

With a new post-pandemic wave of investment heading Vietnam’s way, WHA Industrial Zone 1 – Nghe An awaits investors with a powerful set of utilities and infrastructure.

WHA Industrial Zone 1 – Nghe An dazzles investors with its utilities and infrastructure

|

The 3,200-hectare WHA Industrial Zone 1 – Nghe An is located at Dong Nam Nghe An Economic Zone in the central province of Nghe An. After two years of construction, the project has finished 143.5 of the 498ha of the first phase and has already attracted secondary investors from Japan, Thailand and China with its international-standard and modern infrastructure.

The land plots come in all shapes and sizes (500-10,000 square metres), fitting the requirements of any investor.

Moreover, the industrial zone (IZ) also boasts a state-of-the-art water supply system with the daily capacity expandable to beyond 15,000 cubic metres – one of the primary factors ensuring effective production. Additionally, the IZ also has a wastewater treatment plant running on biotechnology, including an underground filtration system (3,200-9,600cu.m a day). The IZ uses a dike holding pond and pumping system to manage storm water.

David Nardone - Group executive, Industrial and International, WHA Industrial Development Plc. Foreign investors are showing strong interest in Vietnam, which is the region’s fastest growing economy. Following the COVID-19 crisis, the country remains a safe and attractive destination, enhanced by its investment-friendly policies of Nghe An province that benefit IZs like ours. |

Another one of WHA IZ 1 – Nghe An’s strengths is its green industrial zone model with the same high environmental standards that WHA applies at its 11 industrial estates in Thailand, with the IZ management board actively promoting eco-friendly and sustainable growth.

Its good performance has boosted WHA IZ 1 – Nghe An’s contribution to the state budget and furthered the ongoing economic restructuring towards higher added value production in the industry, accelerating industrialisation and modernisation in Nghe An province. At the same time, the IZ will create jobs for local residents. WHA has signed agreements with universities and colleges in Nghe An’s Vinh city to recruit personnel. As the whole world is engulfed in the fight against COVID-19, Vietnam emerges as a lucrative investment destination thanks to the local government’s strong efforts to grease the wheels of industry and facilitate a rebound.

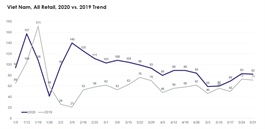

Despite a plunge in total foreign investment during the first months of 2020, the market has retained its good prospects, as reflected by the multitude of foreign investors angling to expand capital at their current projects in the country to capitalise on Vietnam’s growing network of trade agreements.

Additionally, a series of global industry leaders are establishing presence in the country, such as Thailand’s Stark Group which has fully acquired two local metal firms for a total of $240 million.

According to the Vietnamese General Statistics Office, as of May 20, the nation recorded about $13.9 billion in total foreign investment, down 17 per cent on-year. Of this, 436 projects licensed last year expanded capital by $3.5 billion, up 31.4 per cent on-year.

Moreover, through the EU-Vietnam Free Trade Agreement (EVFTA) adopted by the National Assembly (NA) last week, the country is growing more attractive for foreign investors, especially those from the EU. As of late 2019 the EU was the fourth-biggest partner of Vietnam with more than 2,240 projects worth $24.67 billion or 7.6 per cent of the total foreign capital pouring into the market. EU companies tend to invest in high-tech and services such as telecommunications, finance, office leasing, and retail. Accordingly, they are present in 18 of 21 economic sectors in which manufacturing, processing, real estate and communications occupy a major part.

“The EVFTA and other FTAs will likely boost foreign investment in the country. It will also encourage international corporations to expand their investments here and secure their supply chains,” said Nardone.

Currently, Vietnam is trying to making itself a more business-friendly destination. This week, the NA will likely adopt the new Law on Investment and the new Law on Enterprises, among others, further facilitating investors’ projects in the country.

Along with the positive policy changes, the health crisis has accelerated the relocation of many businesses to Vietnam. Specifically, global tech giant Apple has most recently announced to bring about 30 per cent of its AirPods production to Vietnam. Accordingly, Luxshare ICT in the northern province of Bac Giang was selected for the task. With the backdrop of the health crisis, Panasonic in late May declared halting the operations of its washing machine factory in Bangkok to migrate the facility to a branch in Vietnam. The factory, along with a research and development (R&D) centre in Thailand, will be closed by next March.

After shifting to Vietnam, Panasonic could select Thang Long Industrial Park II in Hanoi to integrate its manufacturing lines from Thailand and as a result build the largest washing machine factory and R&D centre in Southeast Asia.

According to consultancy firm Savills Vietnam, nearly 20 overseas companies are following this example. Some of them include South Korean aerospace manufacturer Hanwha Aero Engine, Japanese carmaker Yokowo, and Hong Kong-based textile producer Huafu Industrial, as well as one of Apple’s assembly partners, Chinese Goertek.