Withstanding the pandemic by diversifying investments

Withstanding the pandemic by diversifying investments

The escalating global health crisis is undoubtedly turning into an economic one as the lack of information has resulted in large amounts of uncertainty in global markets. The full impact of the pandemic is still to be determined, and so far nobody can predict how or when world economies will recover.

Michael Piro COO, Indochina Capital

|

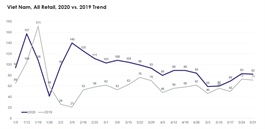

The retail and hospitality sectors have been hit the hardest. With social distancing policies and travel bans enacted, retailers and hoteliers are finding themselves in an increasingly challenging position as the pandemic lingers on. Many retailers across the globe have declared bankruptcy and according to the Vietnam National Administration of Tourism, the number of food and beverage and accommodation businesses halting activities in the first quarter of 2020 increased by 29 per cent on-year. Owners and developers focusing primarily on retail and hospitality projects are finding it difficult to stay afloat, especially those who have had to take out loans from banks or institutional lenders during the development process.

It is safe to say that the pandemic has had long-term implications and forced us to rethink how we go about daily operations, highlighting the need to reevaluate our appetite for risk when managing an investment portfolio. The speed at which market sentiment changes reinforces the importance of diversifying one’s portfolio. In general, developers have been investing in residential, hospitality or commercial properties. In recent years, we have observed a considerable rise in the number of new developers with no track record entering coastal hospitality and the low to mid-end residential segments. Due to the COVID-19 pandemic, many, including the largest local developers, have come to the realisation that it is equally important to look for opportunities in logistics, healthcare, education, and infrastructure.

Steps towards portfolio diversification

Investors and developers who would want to reposition and diversify their portfolio should first focus on reassessing their current projects. This includes thoroughly reviewing their balance sheets, calibrating costs through benchmarking, and engaging a consultant to examine the financial performance of their projects and determine a path forward. Sales and leasebacks can be considered if there are too many liquidity constraints hindering short-term operations.

When investing outside of your comfort zone and expertise for diversification, detailed research, analysis, and planning must be done before exploring a new segment. Exhaustive returns on investment analysis, establishment of clear risk-return metrics, financial modeling, and forecasting are highly recommended, not to mention a clear grasp of the segment.

Investors can also opt for localised strategies when diversifying: joint ventures or strategic partnerships with groups who have experience in a specific segment or geographic region can significantly improve chances of success. With current travel restrictions and the inability to access and assess certain markets, such partnerships can be extremely valuable.

Segments with prospects for income stability and growth

The logistics and residential sectors have proved to be resilient in face of the pandemic, and some developers have already initiated their pivot. Warehousing, industrial parks, and e-commerce in Vietnam have held up relatively well against the disruption in supply chains. Double digit growth rates can be expected in these segments for the next decade, as new multilateral trade agreements and the relocation of manufacturers from China to Southeast Asia have boosted optimism in a segment that was already performing well.

The residential sector also remains relatively stable in light of COVID-19. According to the first quarter of 2020 report from the Ministry of Construction, apartment prices in Hanoi and Ho Chi Minh City increased on-year, and both local and foreign interest have remained constant throughout the lockdown period, and have picked up in major cities since the loosening of social distancing in Vietnam. That said, an important caveat to note is that high-end residential products have recorded much less sales relative to their more affordable counterparts, suggesting that buyers are not spending as much as they were a year ago.

Furthermore, Vietnam’s domestic tourism has already shown signs of recovery, as evidenced by the surge of travel to coastal cities during the April 30-May 1 holiday weekend. The local market was a major driving force during the 2003 SARS outbreak and the 2008 financial crisis, and we expect history to repeat itself once again. The Ministry of Culture Sport and Tourism has also submitted plans for recovery, focusing on domestic and business travel.

With the current climate of uncertainty, hospitality asset valuations will be adjusted. According to data from recent real estate transactions, hotels were offered at close to 14 times their earnings before interest, taxes, depreciation and amortisation (EBITDA) when tourism was at its peak, while current offers are closer to 10-fold of EBITDA. This creates opportunities for long-term investors with strong balance sheets to purchase assets at lower prices. Vietnam’s response to COVID-19 has been celebrated locally and recognised internationally, and we believe that tourism is likely to rebound in Vietnam faster than other destinations.

Investment diversification will play a key role in reducing risk, whether embraced as a long-term strategy or as a tactical approach against COVID-19. But, given the devastation caused by the pandemic, you will be hard pressed to find a more attractive investment destination than Vietnam in the coming months.

We recommend that businesses review their investment strategy and start to explore new markets. In order to take full advantage of the current economic climate, you must act quickly before the window of opportunities closes and the world re-opens.