Tasty takeovers sorely lacking as 2020 continues to frustrate

Tasty takeovers sorely lacking as 2020 continues to frustrate

Merger and acquisition deals in Vietnam’s food and beverages arena in the first five months of this year were inevitably subdued due to global slowdowns across the board.

Tasty takeovers sorely lacking as 2020 continues to frustrate, illustration photo, source:MSN

|

Vietnam recorded no megadeals in the given period apart from the noticeable deal from Masan Group. Ardolis Investment Pte., Ltd., a subsidiary of Singapore’s sovereign wealth fund GIC, recently raised its ownership in the consumer staple group from 5.67 to 8.97 per cent after purchasing 38.92 million shares. Following the transaction, the GIC-led consortium has increased its stakes at Masan from 9.7 to 13.03 per cent.

Consolidated net revenues at Masan totalled VND17.63 trillion ($761.74 million) for the first quarter, up 116.1 per cent on-year. The increase was attributable to high double-digit growth at Masan Consumer Holdings and consolidation of newly-acquired VinCommerce.

VinCommerce itself reported revenue growth of 40.3 per cent over last year’s period to VND8.71 trillion ($376.4 million). Meanwhile, Masan’s MEATLife business continued to surge, with net revenues rising by nearly 85 per cent on-quarter to VND453 billion ($19.57 million) in the first quarter of 2020.

In addition, Kido Foods (KDF)and Tuong An Vegetable Oil have submitted proposals to their shareholders about a merger with KIDO Corporation (KDC) at its annual general stakeholder meeting. The move will help the two sail through the tough time, and stimulate growth in the competitive market.

After its initial public offering on the Unlisted Public Company Market (UPCoM) market in 2017, KDF shares have recorded low liquidity and failed to attract the attention of investors. Despite being the leader of the Vietnamese ice cream industry with a 41 per cent market share, the company has seen volatile business. The spread of the COVID-19 pandemic has changed customer behaviour for ice cream and other frozen products. As a result, KDF merged with KDC to take advantage of the latter’s financial and management capabilities to consolidate growth.

Tuong An also faced several challenges in 2020 due to economic turmoil and volatile material prices caused by the pandemic. The competition has become fierce as more vegetable oil brands roll out into the market. Other vegetable oil producers have also reduced prices to capture market share.

“Due to market volatility and global challenges remaining unresolved, in the near term we expect to see a slowdown in the number of high-value merger and acquisition (M&A) transactions in the food sector,” said Seck Yee Chung, partner at Baker & McKenzie Vietnam. “While Vietnam has effectively contained the virus, it has also been significantly affected by the pandemic. Supply chain disruption during this has severely impacted the export of agricultural products and other processed goods to major markets such as China, the United States, and Europe.”

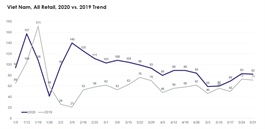

Even through government-enforced travel bans, nationwide social distancing, and restaurant closures, there has been an increase in the demand of food and grocery consumption. However, out-of-home consumption has declined due to the restrictions and the hesitation of middle-income consumers in spending their money during the crisis.

Chung added it is expected the economy will gradually become more vibrant again. In the longer term, and with countries better able to manage the outbreak, easing of travel restrictions, and global supply chains reconnecting, this will help spur the Vietnamese economy – and the overall food and agriculture sector will continue to be of great interest to overseas investors. The technology and logistics platforms that support such growth also present exciting opportunities.

According to FiinGroup, a provider of financial data and business information, food and beverages have always been a magnet for M&A thanks to the sector’s high and stable growth rate, driven by Vietnam’s big population, rapid urbanisation, emerging middle class, and resilient GDP growth. From 2011 to the first half 2019, 245 deals value at $8.95 billion have been recorded, led by major players in the industry such as Masan, KIDO, and The PAN Group.