Property in Australia emerging as prime investment opportunity for Vietnamese

Property in Australia emerging as prime investment opportunity for Vietnamese

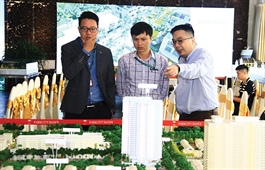

The cheap Australian dollar over the last months and the increasing demand for leasing houses have made Australia a promising destination for Vietnamese investors.

Australia is currently well-situated for Vietnamese investors looking for good property deals

|

At a commercial bank on Monday morning, a VIR reporter met Dinh Hien Van, a female white-collar worker working at a university in Hanoi. She was trying to buy some AUD to pay tuition fee for her son in Australia, as well as invest in some properties in the country.

“This is a good chance for us to invest in overseas properties because foreign currency is quite affordable at present,” said Van.

She has been following the movements of Australian currency carefully because she has to spend a lot on her son’s tuition every term. “Last year, AUD climbed to more than VND20,000. With the current low price of AUD, I can save a lot of money and even consider investing in property in Australia,” she added.

In fact, over the past months, the price of AUD has stayed at an affordable level, at around VND13,000-14,000 last months, and VND15,000-16,000 this time, the best price over the last two years.

“Australian property is one of the fastest earning sectors. The liquidity of the property will rise rapidly when the AUD returns to the average VND22,000, creating great profit for investors because the Australian government always maintains the AUD/USD exchange rate at 1/0.75,” said Van.

In fact, several Vietnamese investors have decided to invest in property in Australia. Moreover, the Australian government's policy of attracting businesses and students to immigrate, live, and study for a long time in the country contributes to increasing the demand for affordable housing, commercial properties, and bring opportunities to investors.

Anna Le, director of Prosper Global Advisory, one of the leading real estate and migration advisory firms in Australia, said that the Victoria Residential Builders Association had asked the government to encourage foreign investors to come to Melbourne after the COVID-19 pandemic. The association proposed to cut home purchasing tax for foreign investors by 8 per cent.

Prosper Global Advisory’s representative also recommended investors to buy houses which are priced lower than the average city home which could appreciate at a better rate, and are easy for lease or sell.

Anna Le said that Vietnamese people are often interested in property in urban areas not very far from the city centre and schools, with good connectivity by public transport, or located next to areas home to the Vietnamese community.

“Prosper Global Advisory can provide useful information and advice to investors who pay attention to the property market as well as looking to migrate to Australia, to choose the best project bringing them the maximum return on investment,” she added.

In fact, the Australian government needs investment to boost the economy after the social distancing period. Foreigners can borrow 60-70 per cent of the total investment cost with competitive interest rates. “Moreover, owners can deduct maintenance and annual depreciation from their income tax from renting which is a tax benefit unobtainable in Vietnam. This is a great benefit to investors,” said Anna Le.

Thus, in addition to sending her son to study abroad, Dinh Hien Van is also on the market for property. “I find the Australian property market very attractive, so I am transferring money to buy property both for my son to live and to rent out. Rental rates at big cities like Sydney, Brisbane, and Melbourne are quite good. I am absolutely confident with this decision,” she said.