Supply of villas and townhouses in Hanoi drops in Q1

Supply of villas and townhouses in Hanoi drops in Q1

The total stock dropped 76% on-quarter due to concerns over the pandemic.

Impacts by Covid-19 and the Lunar New Year holiday brought down supply of villas and townhouses in Hanoi in the first quarter (Q1) this year, Savills has said in a recent report.

Supply of villas and townhouses drops due to the pandemic

|

“Q1 2020 was quiet with supply shortages and low sales. Whilst currently in limbo we expect the sector to pick up quickly as landed properties remain one of the most favoured alternate investments,” said Matthew Powell, director of Savills Hanoi.

Ha Dong, with over 50% share, continued to lead primary supply while Tay Ho and Long Bien districts posted the new launch of Green Center Villas and Him Lam New Star, respectively, both providing a total of 130 dwellings.

Ha Dong district has become the leading primary supply and is expected to continue until the year-end thanks to a shift in focus over the last two quarters. For the last three years, the East, notably Long Bien and Gia Lam districts, has led the primary market with regular launches by major players.

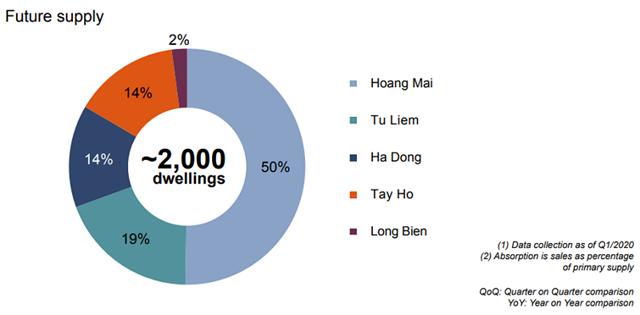

Future supply of villas and townhouses in Hanoi. Source: Savills Research and Consultancy

|

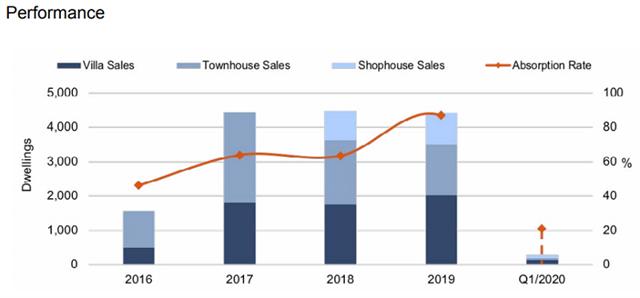

The pandemic put the brakes on transactions during the quarter, sending it down 54% on-quarter with just 281 sales.

Quarterly absorption at 21% was the lowest in three years, falling 27 percentage points (ppts) on-quarter and 16 ppts on-year. Ha Dong with high primary supply, performed best with 46% of the city’s first quarter sales.

The first quarter typically records the lowest absorption of the year, with the highest in the second or fourth quarters. For five years, Q1 has accounted for around 18% of total sales.

Market performance. Source: Savills Research and Consultancy

|

Price stable amidst chaos

By the end of Q1/2020, most developers had yet to reduce asking prices, which led to general price stability and even increases in some projects.

With fluctuating stock and commodity markets, real estate, specifically landed property remains a favored investment channel, Savills said, adding that should the pandemic continue, developers may have to consider price reductions or more flexible payment schedules.

The overall primary price decline resulted from primary supply increases in the lower priced outer urban districts. However, overall average segment secondary prices have increased with villa by 1.2% on-quarter and 7.3% on-year, townhouse 2.8% on-quarter and 4% on-year, and shophouse by 3.1% on-quarter and 3.8% on-year.

Uncertain outlook

New supply dropped 42% on-year from 2019 and will remain steady in 2020. In the next nine months, approximately 13 villa/townhouse projects, providing 2,000 dwellings, will enter the market, mostly in Hoang Mai, Ha Dong, and Tu Liem districts.

The pandemic has forced a minimum year delay in many launches planned for 2020.

A government stimulus package will help spur investment and support recovery. Business continuity initiatives may mitigate any initial damage but in the longer term more property restrictions may need lifting to stimulate the market post Covid-19.