Domestic and int'l travelers to drive Hanoi hotel business’ recovery

Domestic and int'l travelers to drive Hanoi hotel business’ recovery

International tourists from Northeast Asia are expected to be the first to return to Vietnam, once flights are resumed.

The overall performance for Hanoi’s hotel segment is expected to recover once the outbreak is successfully contained, being driven in the early phase mainly by the domestic visitors and to some extent international travelers from Northeast Asia, according to the latest report by CBRE Vietnam.

Source: Hanoi Statistics Office, CBRE Research, Q1 2020. Chart: Nhat Minh

|

2020 will see an unprecedented drop in terms of tourist volume, and consequently a plunge in occupancy levels at hotels, in any scenario. However, “this will be a refining period to select only those resilient and capable investors/developers, helping the market to rebound stronger once the pandemic is over,” said Thuc Nguyen, associate director of CBRE Hotels Vietnam.

According to CBRE’s latest hotel report for the first quarter, after the end of nationwide social isolation period, the general decline of wealth level of foreign travelers and limited international flight connections will push the domestic tourism demand. Corporate transient segment will also be among the first to recover, due to pent-up demand caused by Covid-19. International tourists from Northeast Asia are expected to be the first to return to Vietnam, once flights are resumed.

4-5-star hotel segment in Hanoi

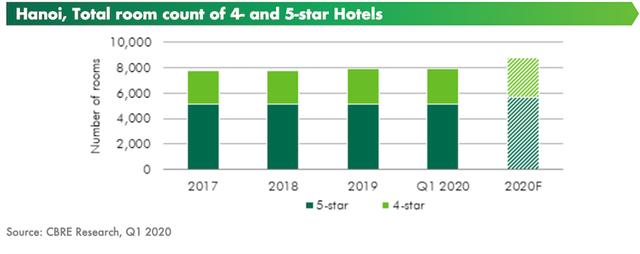

Prior to the Covid-19 outbreak, Hanoi was expected to welcome one 4-star project, Novotel Hanoi Thai Ha Hotel, with 343 keys in the first quarter and two other projects in the remainder of 2020. The rapid spread of the disease caused the city’s government to suspend all hospitality businesses since late March and to halt all construction works in Hanoi during 14 days from April 1.

With heightened uncertainty in market conditions, the opening of pipeline projects in 2020 is unpredictable. As of the first quarter, Hanoi 4-5-star hotel supply stood at 7,882 keys from 35 properties.

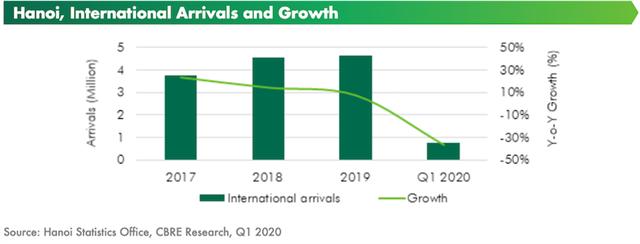

In the first quarter, the city recorded a sharp decrease in international tourist arrivals, down 36.9% year-on-year (y-o-y). Due to international travel restrictions and widespread concerns over the pandemic, the city’s major sports and tourism event of 2020, the Hanoi Formula 1 Grand Prix, was put on hold.

As nationwide social isolation was in place throughout most of April, along with reluctance to travel, it is expected that the city’s tourism sector will take some time to recover.

However, as many projects in Midtown and the West are the ideal location for many foreign corporate clients, the market is expected to pick up its recovery rate once international businesses get back to normal.

Source: CBRE Research, Q1 2020. Chart: Nhat Minh

|

Average Daily Rate (ADR) of Hanoi in the first quarter was recorded at US$115.2, down 6.6% y-o-y. Occupancy was averaged at 51.2%, a drop of 28.9 percentage points (ppts) y-o-y.

Revenue Per Available Room (RevPAR) in the first quarter decreased to US$60.3, down 38.9% y-o-y, which was still better than Ho Chi Minh City.

For scenario one - the disease is contained by June, ADR for 2020 to decrease by 8-13% y-o-y and occupancy rate for 2020 to decrease by 46-51 ppts y-o-y.

For scenario two - the disease is contained by September, ADR for 2020 to decrease by 15-20% y-o-y and occupancy rate for 2020 to decrease by 50-55 ppts y-o-y.

Whole hotel segment

In early the second quarter, CBRE Vietnam observed that there was an increase in inquiries from investors looking for distressed assets, while the number of properties for sale in the 4- and 5-star segments is not significant.

The owners in these segments tend to be big groups with sufficient capital to weather this crisis, the report noted. Some upscale hotels that are currently for sale on the market were actually launched for sale before the outbreak.