Future Apple Store may fail to bite into retailers

Future Apple Store may fail to bite into retailers

Rumours of Apple setting up a manufacturing base and opening its first Apple Store in Vietnam have sent consumers into frenzy, but local tech retailers and parallel importers do not seem particularly worried over losing a slice of the pie to the United States-based tech titan.

Future Apple Store may fail to bite into retailers, photo Afp

|

The local market last week was sent into panic after Apple posted a string of recruitment notices in Vietnam on LinkedIn in clear indication that it is expanding operations.

This is not the first time Apple has had personnel recruitment in Vietnam. Over past years, the tech giant has employed a handful of staff specialised in retail or business management. However, the latest recruitment notices advertised 12 management and technology positions in Hanoi and Ho Chi Minh City.

Apple is even recruiting senior management positions such as government relations and office management in Hanoi. These signs indicate that Apple may be planning to open a representative office in Vietnam.

According to newswire Techcrunch, Apple has been focusing on Southeast Asia and selected Thailand as its second market (following Singapore) in the region to open an Apple Store two years ago. A similar move would not be out of line in Vietnam where the company already has a major consumer base who would welcome an official channel to buy authentic goods at more reasonable prices.

Local media revealed that in recent months, Apple has been in talks with several mobile phone stores to set up partnerships to sell authentic Apple products in the country.

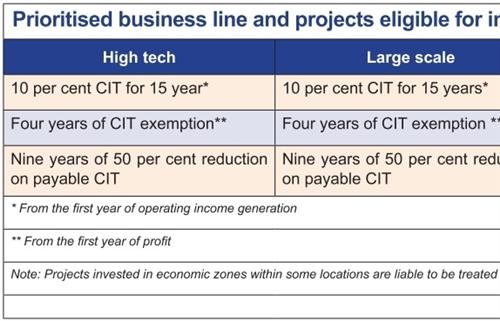

Currently, Mobile World Investment Corporation and FPT Digital Retail JSC are the two most popular electronics retailers for genuine Apple products. However, both trade the devices at a significant premium and prices are hundreds of US dollars higher than in other markets. In contrast with stores specialised in parallel imports which only pay the licence tax, Mobile World and FPT Retail officially import from Apple’s distributors with the tariff of 10 per cent in Vietnam, higher than Singapore’s rate of 7 per cent. Moreover, larger corporations are shouldering larger and more numerous kinds of taxes such as corporate income tax (CIT), natural resources tax, and land use tax.

A representative of Mobile World asserted to VIR that the news will not disrupt the sales of local retailers because even if Apple enters Vietnam, it is unlikely to open more than one or two stores. This is reflected by big markets like Singapore where it has only two. “Mobile World has more than 2,000 stores across the country so we do not expect Apple Stores to have a big impact on our sales,” the representative said.

Despite not expecting much of an impact from Apple’s entry, tech retailers cannot deny slowing business in mobile devices. Indeed, the local demand for new gadgets is not as high as before, so retailers have been looking for new directions.

FPT Retail also feels that the market is reaching saturation. To date, it has 541 FPT shops and 14 Apple Premium Retailer (APR) stores named F.Studio over the country. Thus, as the market has reached the saturation point, F.Studio’s sales will likely be affected by a new Apple Store in Vietnam, which will also likely ruin its reputation as an official distributor partner of Apple.

Since early 2018, Mobile World has also reined in the expansion of thegioididong stores, with no new stores opened and 40 closed to focus on developing the Dien May Xanh electronics chain.

Dang Quoc Tuan, director of iShop Vietnam Ltd., one of the largest parallel Apple products distributors, told VIR that Apple might open an official store in Vietnam. “However, I think it is a move to realise its plan to open more than 600 stores in its global markets instead of directly targeting to conquer Vietnam.”

In reality, there is little to convince customers to switch from parallel imports to Apple Store devices because both have the same guarantees and the price of the former is usually lower. Additionally, when customers buy a device at an Apple Store, they will not likely receive assistance in setting up their devices like they do at parallel import shops due to security concerns, which Tuan believes will be a great disadvantage for any Apple Store in Vietnam. Moreover, these parallel import products could make up 60 per cent of all Apple products on the market, according to Tuan. As a result, he said the dominance of parallel products will not be challenged.

A case demonstrating the slim chances for success of APRs is eDiGi. In 2018 it officially launched in Ho Chi Minh City to provide Apple products and services. Speaking at the launch ceremony, Johnathan Hanh Nguyen, chairman of Imex Pan-Pacific Group, said that at first, eDiGi would not focus on profit but on increasing the number of its stores and market share to compete with parallel imports, which he said currently make up 40 per cent of the market.

“However, since then, the operations of iShop Vietnam and other parallel import sellers remained unaffected. Also, although we don’t know the business results of eDiGi, they have not opened a single store in the past two years, which may give us a measure of the efficiency of tss business model,” Tuan said.