Viet Nam’s capital market increasingly attractive: conference

Viet Nam’s capital market increasingly attractive: conference

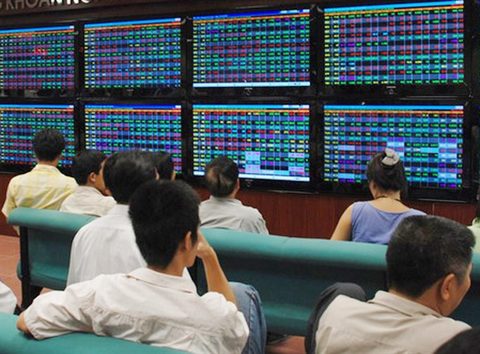

With its steady economic growth, political stability, a youthful population, and equitisation of State-owned enterprises, Viet Nam’s securities market is attractive to investors, the Gateway to Vietnam Conference heard in HCM City on October 25.

Deputy Prime Minister Truong Hoa Binh said the country’s population of nearly 100 million, of whom 60 per cent are under 35, is a source of cheap and skilled labour.

“Besides, Viet Nam has political and economic stability and an improving legal framework to create favourable conditions for investors and businesses to operate in the long run,” he said.

“The investment environment has improved considerably in recent years and will soon see a breakthrough.”

Viet Nam would strive to achieve its GDP growth target of 6.7 per cent this year and maintain the momentum, he said.

It would also focus on reforming the monetary, financial and banking systems, dealing with bad debts, harmonising monetary and fiscal policy to stabilise the economy, and equitising SOEs to reduce the Government’s role in business, he said.

“The Government attaches importance to developing the capital market so that it fulfils its important role of mobilising medium- and long-term funds for the economy,” he said.

Tran Van Dung, chairman of the State Securities Commission (SSC), said the of the stock market has increased three-fold, from making up 22 per cent of GDP in 2006 to more than 63 per cent now.

In 2006 there had been only 192 listed companies and one with a market capitalisation of over US$1 billion, he said. Now there are over 700 listed companies of which 23 have a market cap of over $1 billion, he said.

The market’s liquidity has increased by 50 per cent this year, rising from VND3 trillion last year to VND4.5 trillion now, he said.

Despite the stock market’s modest and ranking among emerging markets, these figures are evidence of its tremendous growth and increasing attractiveness, he said, adding that it was the youngest market, and the fastest growing market in terms of scale and liquidity in ASEAN and East Asia.

Investment opportunities

Talking about the prospects for the Vietnamese securities market, he listed positive factors like high GDP growth, equitisation of hundreds of SoEs, launch of new products, and an improving legal framework.

GDP growth is projected at over 6.7 per cent this year and forecast to remain high for the next five years, while inflation is under control.

In the first nine months of this year the government successfully equitised 34 of 44 targeted SOEs.

Next year the Government plans to equitise another 64, including many large companies such as Vietnam Paper Corporation, Mobifone, and some in jewellery, real estate and power generation, he said

In 2019 though the government plans to equitise only 18 enterprises, many of them are large and attractive names like the Vietnam National Coffee Corporation, Vietnam Post and Telecommunications Corporation, Vietnam National Chemical Group, and Vietnam National Coal and Mineral Industries Group.

“With hundreds of SoEs to be equitised and listed in the next one or two years, the stock market would surely grow in scale and offer great opportunities for both local and foreign investors,” he said.

Some new products like covered warrants and bond futures would be introduced to increase the attractiveness and investment opportunities, he added.

Kyle Kelhofer, country director, International Finance Corporation (IFC), said there is a lot of interest because of Viet Nam’s fundamentals, including high population, unparalleled stability, rising incomes, favourable demographics, and urbanisation, which would drive consumption and profits over a long term.

“Viet Nam is particularly attractive given its unique capability to grow for the past 20-25 years at a consistent 5.5-6.5 per cent rate, giving confidence to investors,” he said.

Talking about selected sectors “to watch”, he listed infrastructure, agriculture and agricultural processing, domestic consumer/retail services, financial services, health services, education, export-oriented manufacturing and disruptive technologies.

He said IFC’s current investment in the country is $700-800 million, and hoped that by the end of 2017 it would be up to around $1 billion and increase to $2 billion in the next 12 to 18 months.

Nguyen Duy Hung, chairman and general director of Saigon Securities Inc, the event’s organiser, said the conference is tailor-made to promote investments into Viet Nam.

Under the theme “Capital Market – A New Driver for Viet Nam’s Economic Growth", the three-day conference will take a close look at capital market and provide an in-depth look into major sectors and industries that have been boosting the economy.

There will also be private meetings to allow direct interaction between investors and companies on the second day to promote investment opportunities and site visits on the last day.