VN shares to move narrowly on uncertain investor sentiment

VN shares to move narrowly on uncertain investor sentiment

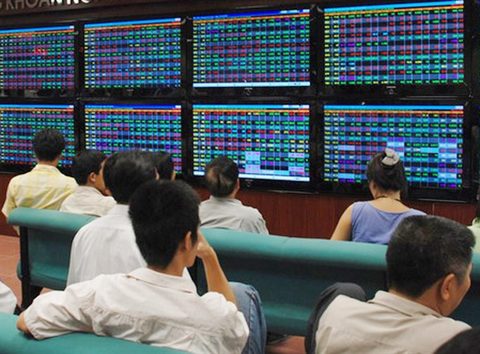

Vietnamese shares traded sluggishly last week on the back of large-cap stocks and the current condition is expected to remain in the coming week, according to analysts and brokerage firms.

The benchmark VN-Index on the HCM Stock Exchange lost 0.25 per cent on Friday to end at 826.84 points. It increased by a total of 0.7 per cent week on week.

The HNX-Index on the Ha Noi Stock Exchange dropped 0.86 per cent to finish last week at 108.14 points, losing a total 1.5 per cent after three sessions.

The three-day losing streak erased the entire increase of the previous three days and resulted in a weekly loss of 0.9 per cent.

An average of 226.2 million shares was traded in each session last week, worth VND4.75 trillion (US$211 million).

The trading figures represented an increase of 20 per cent in volume and 26 per cent in value compared to the previous week.

Foreign investors posted a combined net buy value of VND400 billion on both local exchanges.

Large-cap stocks continued to play an important role in driving the benchmark VN-Index up because the cash flow kept changing constantly among leading sectors and pushed leading stocks up.

Gaining large-cap stocks included financial-banking shares VPBank (VPB), Vietcombank (VCB) and Bank for Investment and Development of Viet Nam (BID), retailer Mobile World (MWG) and FLC Faros Construction Co (ROS).

VCB rose total 3.7 per cent after one week and growth rates of the remainders were 2.7 per cent for VPB, 5.9 per cent for BID, 2 per cent for MWG and nearly 24 per cent for ROS.

However, convergence did not occur between large-cap stocks and others, and the VN-Index suffered from strong profit-taking when it reached the 830-point level.

According to Viet Dragon Securities Co, such conditions could discourage investors, who pull money out of the market to invest it in other options. “The VN-Index signaled it was reaching a short-term peak. The two falls at the 830-point level with high trading liquidity could make investors feel uneasy,” it said in a note.

Ideas of November

Sai Gon-Ha Noi Securities Co (SHS) said the market showed strong divergence last week between the two stock indices, proving the market was in a high risk condition. The VN-Index often performed badly in November of previous years, declining for four of the last five years, SHS said.

Nguyen The Minh, head of the capital market analysis at Saigon Securities Inc, told tinnhanhchungkhoan.vn at a roundtable discussion that the dependence of the VN-Index on large-cap stocks in recent days indicated its short-term growth was weakening. “The benchmark has likely reached its short-term peak,” Minh said, forecasting that it would decline in November before making a slight rebound in December.

Agreeing to the idea of the market settling at the current level, Nguyen Trung Du, head of individual client division at HCM City Securities Co, said most stocks ran out of steam lately as their growth had been priced in earlier.

Several large-cap companies are due to list in the fourth quarter, such as PetroVietnam Oil Corp (PV Oil), PetroVietnam Power Co (PV Power) and Binh Son Refining and Petrochemical Co Ltd (BSR), which are expected to draw investor attention, Du said.