Early gains lost on foreign selling

Early gains lost on foreign selling

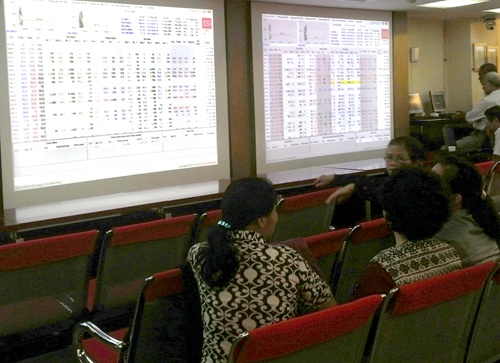

Shares on the HCM Stock Exchange lost early gains in the morning trade yesterday as increased foreign selling continued to weigh on large-cap stocks.

The VN-Index, the measure of 311 stocks on the HCM City's exchange, inched down 0.1 per cent to close at 656.2 points. It decreased 0.5 per cent yesterday.

On the smaller exchange in Ha Noi, the HNX-Index tracking 379 stocks was down 0.6 per cent to end at 82.9 points. It also lost 0.6 per cent on Wednesday.

Foreign investors continued to offload local shares yesterday, primarily focusing on large-cap stocks. They sold shares worth a net value of VND149 billion (US$6.7 million) in HCM City's market, up nearly 250 per cent over Wednesday's level and recording their 12th consecutive net selling session. Their total net sell value reached VND1.6 trillion in the last 12 trading days.

Eight of the top 10 shares most sold by foreign investors yesterday were among the 30 highest-valued stocks on the market.

Dairy giant Vinamilk (VNM), the biggest listed stock, continued to top the list with a net sell value of more than VND79 billion. Steelmaker Hoa Phat Group (HPG) and Sai Gon Securities Inc (SSI) followed with net values of VND27.7 billion and VND19.3 billion, respectively.

Half of the list lost value. Vinamilk was down 0.7 per cent, extending losses to 1.3 per cent in the last two settlements. The shares sank in four out of the last five sessions. Sai Gon Securities Inc, Phu My Fertiliser (DPM), Vietcombank (VCB) decreased between 0.7 per cent and 1.4 per cent.

"The reallocation of exchange-traded funds would likely impose negative impact on the movement of the indices as most large-cap stocks in the portfolio of the funds will suffer from a declining exposure when Vinamilk is included," Tran Xuan Bach, stock analyst at Bao Viet Securities Co, wrote in yesterday report.

However, if the market tumbled during their review, investors could make long-term trading for blue chips slumping on Friday, Bach said.

A few bucked the trend such as real estate developer VinGroup (VIC), Hoa Phat Group, Military Bank (MBB), Vietinbank (CTG) and agribusiness Hoang Anh Gia Lai Co (HAG) which cushioned the market.

After ETF trading review, the monetary policy meeting on interest rates of the US Federal Reserve (Fed) which will be held on September 20-21, as well as the meeting of the Organisation of Petroleum Exporting Countries (OPEC) on oil production by the end of next month are forecast to have substantial impact on both global and local stocks.

Liquidity increased with a total of nearly 147 million shares worth VND2.3 trillion being traded in the two markets, up 13 per cent in volume and 9.5 per cent in value compared with the previous session.