Stock market Q3 review

Stock market Q3 review

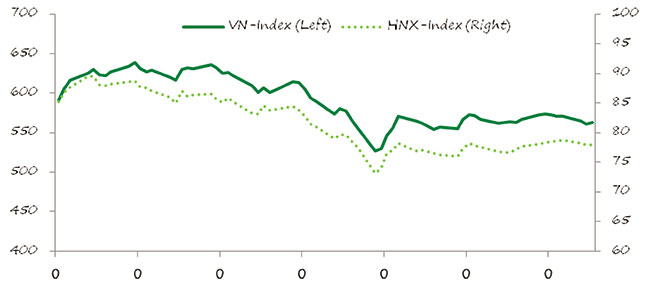

During the third quarter, both indices moved up, but then recorded declines for the period. Daily moves often seemed to be removed from any logical explanations, but there were a few main forces that drove the market during the quarter, including concerns over the value of the dong, driven by movements of the Chinese yuan, the possibility of a US interest rate hike, oil prices, the health of the banking system, and TPP negotiations.

The weakening currency certainly affected equity markets. Coming into the third quarter, the dong was one of the best performing currencies in Southeast Asia, but had already been devalued against the dollar by 2 per cent this year, which was the limit for the year that had been set by the State Bank of Vietnam (SBV). Because of the strengthening dollar and the possibility of a Fed rate increase, most market participants believed there would be some further devaluation before the end of the year. However, the Fed did not raise rates at its July meeting, and the SBV affirmed that it had sufficient reserves to defend the currency in order to stay within its 2 per cent devaluation limit. Just a few weeks later, a new market force emerged to put pressure on the dong. China allowed the yuan to fall approximately 5 per cent over a three day period. The VN-Index reacted by falling more than 3 per cent over two days and, more importantly, diving through the important support level of 600. The following week of August 17, the SBV devalued the dong by 1 per cent and widened the trading band. At the same time, oil dropped to $40 (which we will discuss below), China released more disappointing economic data indicating that more devaluation was possible and Vietnam’s trade deficit widened for the first half of August. Panic ensued on the stock market. The VN-Index fell 9 per cent in three days, including a 5.3 per cent decline on August 24. The silver lining in China’s troubles was that it influenced the Fed to postpone its rate hike. On September 18, the Fed announced there would be no hike and the following day the SBV affirmed that it would support the dong even if there was a hike. Pressures on the currency eased and the market stabilised.

Oil and gas stocks significantly underperformed the overall market during the third quarter and dragged the indices down. During the first week of the quarter, there was some uncertainty regarding the outcome of the Iran nuke negotiations which caused oil and gas stocks to rise. But this was short-lived. An agreement was reached on July 14 and prices plummeted from there. On August 20 (the day after the SBV devalued the dong), oil fell 4.3 per cent to $40 per barrel, which caused oil and gas stocks to contribute heavily to the panic we described above. WTI crude oil did recover back above $45 in September though and oil and gas stocks followed suit.

Bank stocks were in the headlines a lot during the third quarter, but their performance largely mirrored that of the broader market. On July 2, bank stocks lead a market rally due to news of strong performance by the Vietnam Asset Management Company (VAMC) to raise the VN-Index by 2.4 per cent and push through the barrier of 600. September data also showed that with the help of sales to the VAMC, the banking sector had managed to bring its bad debt ratio down to the SBV’s 3 per cent target range. In mid-July, data showed strong credit growth of 7.83 per cent through June 30 and September data showed that, in fact, credit was growing at double last year’s pace. Controversies around EIB and Nam A both contributed to market declines. But the bank that contributed the most to market moves was BIDV. BIDV hit its ceiling on September 8 and continue to rise on the 9th, pulling up bank stocks and the VN-Index. The following week, BID hit its ceiling again when it was added to the VNM and FTSE ETFs. In a bizarre turn of events, both ETF managers announced they had made a mistake and were dropping the stock from their portfolios, at which point BIDV hit its floor price and all bank stocks weakened.

The strongest performers were the Trans-Pacific Partnership benefited stocks. During July they gained 15 per cent. But on August 3, the negotiations in Hawaii failed to reach an agreement, which caused these stocks to follow the market down for the next six weeks. They did build momentum during the final two weeks of the quarter and managed to finish the quarter with an increase of nearly 5 per cent. Of course, after the close of the quarter, the successful agreement in Atlanta would push this group up higher.

One factor that became something of a non-event during the third quarter was Decree 60, which allows for increases in foreign ownership limits (FOL). Circulars that were supposed to clarify the implementation of Decree 60 seemed to lead to more confusion as to what the restricted sectors were and how companies with multiple business lines would deal with situations where one of their businesses was restricted. Furthermore, on September 1, SSI became the first company to increase its FOL to 100 per cent, but had only modest trading with foreign ownership barely breaching the 50 per cent mark. Over time, Decree 60 will certainly open up the market, but it became clear that this will be a long-term development process.