Oil and gas stocks battered as price slump continues

Oil and gas stocks battered as price slump continues

The price of oil has fallen by almost 30 per cent since the beginning of 2015 and by over 60 per cent since its five-year peak in 2011. Earlier this year, it rebounded above $60 per barrel, and there was talk of a recovery, but now it has declined back toward $40.

Many economists say that the price could even head towards $20. This has severely decreased the number of oil rigs in operation on a global scale and markedly discouraged investments into this sector. It is therefore important to understand the implications of lower oil prices for the global economy, the Vietnamese economy and companies in Vietnam’s oil & gas (O&G) sector.

Over the long-run, there are several factors which could keep oil from ever reaching its previous high prices of above $100 per barrel. More efficient cars and planes, new battery technologies and development of alternative sources of energy could permanently limit the demand for oil. However, in the short-run, there are three factors driving the current price trend, mostly targeted at the supply side: (1) refusal of OPEC to reduce volume to defend the selling price; (2) new US technology in hydraulic fracturing (fracking), which uses water to extract oil and natural gas from shale rocks, and (3) the new Iran nuclear deal, which will allow the country to increase exports to the world’s markets.

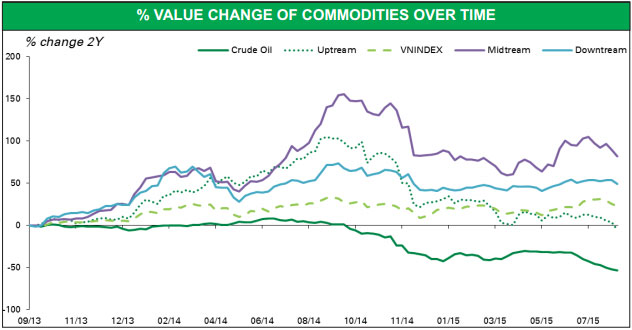

Due to difficult sector conditions, especially since mid-2014, the O&G sector in Vietnam has been affected to a certain degree, depending on certain segments within the O&G sector. This has adversely influenced not just the profit levels of many O&G companies, but also depressed their stock prices on the market. All in all, from the beginning of 2015, performance of the entire Vietnamese O&G sector has underperformed the VN-Index due to the gloomy outlook of the sector on an international scale.

In our opinion, upstream O&G companies such as GAS and PVD have been most seriously affected. As can be seen from the chart above, upstream companies saw great price appreciation during times of high oil prices, but as oil began to collapse by 50 per cent from its peak in July 2014, upstream firms have gone from +100 per cent return to almost zero per cent return, indicating the very strong and direct impact of global oil prices on these types of businesses.

In the upstream segment:

1. GAS is the dominant player in the O&G industry of Vietnam, with the largest market cap. GAS is involved in the entire chain of production including procurement, export-import, transportation, processing/deep processing, stocking, specialised services and commerce. The company is deeply involved in upstream investments as well. The structure of GAS’s revenue is 60 per cent natural gas, 31 per cent liquified petroleum gas , 1.5 per cent condensate, 6 per cent transportation service, and 1.5 per cent other activities. For 2015’s first half, net profit reached VND5.2 trillion ($200 million), declining by 19 per cent year-on-year, and the net margin of GAS reached 16.5 per cent as compared to 18.8 per cent during the first half of 2014. For 2015, we forecast GAS to reach net profit of VND9.81 trillion ($400 million), decreasing by 32 per cent year-on-year.

2. PVD is considered the leading drilling contractor in Vietnam. PVD’s core business includes drilling services and drilling related services such as manpower, mud logging, tubular running, and drilling tool rentals. The company currently has 70 per cent domestic market share in drilling services and 55 to 90 per cent market share in oil drilling-related services. Net profit for this year’s first half reached VND1.012 trillion ($48 million), declining by 23.8 per cent year-on-year due to declining oil prices, leading to lower day rates of PVD’s oil rigs and reduced workload. For 2015, we forecast PVD to reach net profit of VND1.95 trillion ($90 million), declining by 26 per cent year-on-year despite booking a net profit of VND200 billion ($9.2 million) from a joint venture with Baker Hughes in this year’s fourth quarter.

Then come midstream companies such as PVS, PVC, and PGD. The least affected are downstream companies, like PGS, CNG, PGC. Midstream and downstream segments also saw declines in stock returns, but the level of decline is much less pronounced.

In fact, downstream companies may even benefit from production materials dropping in price faster than the selling price of their final oil and gas products, causing their profit margin to potentially improve.

Summing it up, unpredictable and unfavourable oil price shifts created investor pessimism regarding all O&G stocks and shrunk bottom lines for some companies, causing the entire sector to underperform the VN-Index until the end of 2015. However, this is subject to the fickle movements of oil prices, which are influenced by OPEC and a few superpowers.