Vietnam’s stock market plunges on negative global, domestic economic developments

Vietnam’s stock market plunges on negative global, domestic economic developments

The Vietnamese stock market on Monday saw one of the worst days in its 15-year history, when both benchmarks, the VN-Index of the Ho Chi Minh Stock Exchange and the HNX-Index of the Hanoi Stock Exchange, closed with sharp drops.

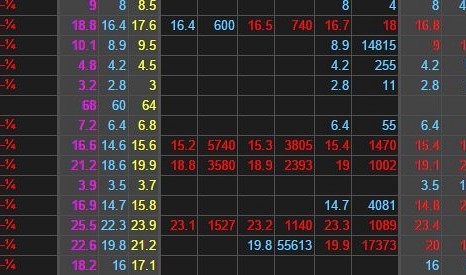

The VN-Index of the southern bourse and HNX-Index of the northern bourse lost around 5.14 percent and 4.57 percent against the previous session, falling to 527.73 points and 74.06 points, respectively.

The VN-Index saw its biggest fall since May 2014, with banks and energy stocks leading most shares down on declines in U.S. stocks and tracking lower global oil prices, Reuters reported.

The index closed the morning session at 527.73 points, on track for the worst single-day percentage loss since May 8, 2014, with as many as 99.72 million shares changing hands, Thomson Reuters data showed.

It is difficult to give any advice to my clients at this time,” N.D.T., a broker on the stock exchange in District 1, Ho Chi Minh City, told Tuoi Tre (Youth) newspaper.

“If I advised them to sell at floor prices, when prices rise they will lose confidence in me, but if I recommend that they retain, there is nothing to ensure that the market will recover tomorrow,” he added.

Trinh Hoai Giang, deputy director of the Ho Chi Minh City Securities Company (HSC), said that the local stock market was strongly affected by the fall in global equity, as well as the net-selling mood of foreign investors recently.

A securities specialist told Tuoi Tre that the fact that Deutsche Asset & Wealth Management (DB) has announced that it will delist 43 exchange-traded funds (ETF) in several exchanges, including the HoSE, from the end of next month to concentrate on trading in other floors with better liquidity, has had a strong impact on the sentiment of both domestic and foreign stock investors.

DB is managing US$371.9 million worth of shares of 16 stocks on the HoSE.

"Many securities investors in Vietnam, including organizational investors, tend to look at the actions of foreign investors, especially ETFs, to trade. Once these funds offload more shares on the market, many investors will also scramble to do so, even if the market does not have much bad news,” he told Tuoi Tre.

Statistics show that foreign investors’ total net-selling value reached nearly VND700 billion ($30.8 million) last week, a small number compared with the scale of foreign capital, which currently stands at $12-13 billion in the Vietnamese stock market.

According to stock expert Hoang Thach Lan, the market declined partly due to brokers selling the shares of clients en masse when those shares reached dangerous price points, which is called a margin call.

After several days of decline, the prices of many shares retreated to these points, the thresholds at which some securities companies are forced to sell shares of clients in order to recover previous lending to them to buy those shares, Lan added.

According to statistics of the HoSE, since August 1, the VN-Index gained in only one session, on August 18, while it fell in the remaining nine sessions, with a total loss of 86.12 points (equivalent to 14.04 percent), and $7.13 billion worth of market capitalization.

According to AFP, on Monday, the stock markets in Shanghai (China) plummeted more than 8 percent, while the Hong Kong market was down 3.91 percent. In Asia, the stock markets in Tokyo (Japan) fell 3.09 percent, Seoul (South Korea) 1.88 percent and Sydney (Australia) 2.89 percent.

Vietnam’s stock market is undergoing adjustments and has declined among the least when compared with other emerging economies, Bloomberg reported.

Fifteen of the 30 largest stock markets of emerging economies have dropped at least 20 percent since their peaks set earlier this year. In particular, Russian and Chinese stocks are leading the decline, with more than 30 percent lost.