Vietnam to ease restrictions on foreign stakes in its firms

Vietnam to ease restrictions on foreign stakes in its firms

Vietnam's prime minister approved the scrapping of a 49 percent foreign ownership cap across many listed firms on Friday in one of the country's boldest economic reforms yet, although some sectors will remain restricted.

The communist government is stepping up reforms to the $184 billion economy after years of delay that have frustrated foreign investors keen to tap the potential of its private sector, with future Pacific and European Union free trade pacts adding to the allure.

The decree signed by Prime Minister Nguyen Tan Dung was published late on Friday and will take effect in September.

It is complex and sometimes vague, stating new rules on foreign ownership will apply to sectors Vietnam has committed to open up in its "international agreements", without specifying which agreements.

It said foreign caps of 49 percent would still apply for areas where "conditions" were placed on foreign investments, except for sectors governed by separate ownership regulations, such as banking, where total foreign stakes are limited to 30 percent.

All other equities would have no foreign limits, unless restricted by the companies themselves.

Long criticised for protectionism, Vietnam has eased foreign restrictions in areas such as banking and property and is pursuing the part-privatisation of hundreds of state-run firms, from airports and textile companies to breweries and ports, which will eventually list on its stock markets.

Some experts say the reform momentum reflects support within the ruling party for a more open economic agenda being pursued by its progressives, keen to lure foreign capital to boost local companies and position Vietnam as a manufacturing centre for the likes of Samsung, Microsoft and Intel .

GOOD TIMING

Duong Vuong, a director at asset management firm VinaCapital, said foreigners were interested in the market but had long been shackled by ownership limits. "Everyone has been waiting for this for a long time ... It's good timing with everything going on in Vietnam."

The new decree, however, could have scope for different interpretations in the months ahead, with various legislation being reviewed and international trade deals still under negotiation, adding to a regulatory web that has been blamed for slowing some of Vietnam's reforms.

The new regulation could make Vietnam's market one of the region's most open and similar to Indonesia, which has limits on only certain sectors. Foreign ownership is mostly capped at 40 percent in the Philippines and 49 percent in Thailand.

Debate on raising the ownership cap has dragged on for nearly two years, with the initial plan being to raise the foreign ceiling to 60 percent.

Investors have complained foreign shareholdings in Vietnam's most attractive firms are perennially at the ceiling. Companies in which foreigners have their maximum share include Vinamilk, tech company FPT, Refrigeration Engineering and Ho Chi Minh City Securities.

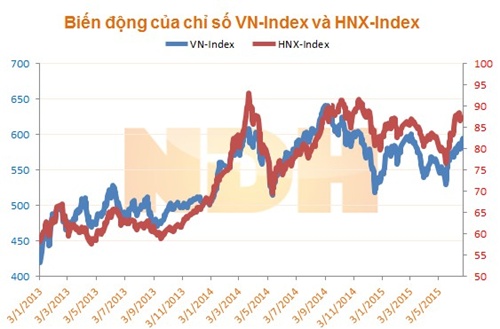

Vietnam has two bourses, the Ho Chi Minh Stock Exchange with a market capitalisation of $50.3 billion, and the smaller Hanoi Stock Exchange, with equities valued at $6.5 billion. That compares with Thailand's $419 billion and Indonesia's $345.7 billion.

VinaCapital said the move would be a game-changer. "It will open Vietnam up to the world making the market more competitive, accessible and investor friendly.