SSC advises against making hasty invesments amidst market turmoil

SSC advises against making hasty invesments amidst market turmoil

The State Securities Commission (SSC) has reassured investors and asked them to not make hasty investments amidst the stock market turmoil of the past month.

The SSC said in a press release, issued late Thursday following another steep plunge in the market, that the macroeconomic condition had improved substantially this year. In addition, the business performance of the listed companies reflected positive changes. Therefore, both domestic and foreign institutions should maintain optimistic views about the country's economic recovery.

The watchdog pointed out that interest rates and prices of raw input materials on the world market would continue to decline in the long term, which would help cut back on production costs and improve business efficiency and profitability.

Liquidity has increased despite the declines in stock indices due to the active purchasing activities of securities companies and investment funds.

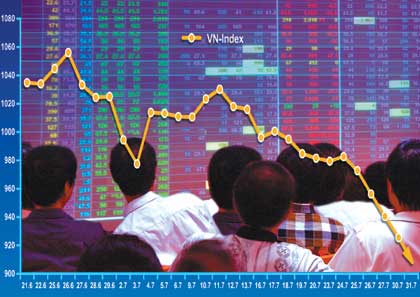

Viet Nam's stock market was recently hit by a number of difficulties, including constant slides in the global oil price and stricter bank lending terms for securities investment. Both VN-Index in HCM City and HNX-Index in Ha Noi lost more than 10 per cent in value over the past month.

According to analysts, recent steep slumps in the market may have been the result of the massive selling of mortgaged shares by securities companies. It may also be partly due to the predatory short sells of several "shark" investors as part of efforts to further depress the stock prices.

The SSC said that it was closely monitoring movements in the market. It would also promptly handle any violations it discovers to ensure the sound development of the market.

The Ministry of Finance has affirmed that the declines in oil prices had negatively affected the state's budget. However, the whole economy is benefiting from this trend due to the higher value of gasoline imports compared with the export value of crude oil.

The ministry's data show that total imports of gasoline in the first 10 months reached US$7.2 billion, while exports of crude oil earned the country $6.3 billion.

The impact of Circular 36, which restricted lending to stock investments to only five per cent of the banks' charter capital, remains unclear due to inadequate stock lending information in the market. However, the market watchdog said that it would observe the market's development to make recommendations following the circular's enactment.

The stock market has more than 700 companies and 80 securities companies listed. The business performance of most companies have substantially improved compared with the past year. Data show that the nine-month profitability of these companies rose to over 10 per cent year-on-year.

Many large companies, such as PV Gas (GAS), PetroVietnam Drilling and Wells Service Corp (PVD), Hoa Phat Group (HPG) and Hoa Sen Group (HSG), have even completed and surpassed their profit targets for this year.