Cautious credit policy tests Việt Nam's stock market

Cautious credit policy tests Việt Nam's stock market

The policy not only influences capital flow within the economy but also represents a critical test for the stock market after a year of substantial growth.

A customer deposits money at a bank transaction office in Hà Nội. — VNA/VNS Photo |

The State Bank of Vietnam (SBV) has set a modest credit growth target of about 15 per cent for 2026, signalling a more cautious stance than last year and posing a fresh test for the stock market after a period of strong gains.

The policy will shape capital flows across the economy and influence market expectations. In 2025, credit growth across the financial system reached 19.1 per cent as the SBV sought to support economic expansion amid global uncertainty. With total outstanding credit estimated at around VNĐ18.58 quadrillion (US$708 billion) in 2026, meaning a 15 per cent increase would add roughly VNĐ2.79 quadrillion in new lending.

Bùi Nguyên Khoa, deputy director of the BIDV Securities Analysis Centre, said that while a 15 per cent rise is significant in absolute terms, it contrasts with the Government’s GDP growth target of 10 per cent. This suggests the SBV is opting for a more measured approach, balancing growth support with inflation risk management.

“The SBV’s monetary policy will be less accommodative than in 2025, prioritising macroeconomic stability,” he told tinnhanhchungkhoan.vn.

Khoa added that clearly stating the credit growth direction at the start of the year gives the market a reference point and reduces uncertainty in monetary management. A flexible mechanism for allocating credit quotas also allows the SBV to manage lending flows based on the quality and financial health of individual institutions.

Trần Đức Anh, director of macroeconomics and market strategy at KB Vietnam Securities Co, said the biggest challenge remains the unresolved imbalance between capital mobilisation and lending.

KB Vietnam Securities noted a key change in the credit room allocation formula for 2026, with limits based on the ratings of individual financial institutions and subject to strict supervision.

Any breach of safety criteria could result in reduced credit limits, effectively turning credit allocation from an administrative privilege into a regulatory tool to push banks to strengthen capital buffers and improve asset quality.

In the real estate sector, the central bank will continue to place it under special monitoring, ensuring property lending at each bank does not exceed its overall credit growth in order to curb concentrated risks and potential non-performing loans.

The cautious credit stance is expected to create greater differentiation across sectors and individual businesses.

With tighter limits, bank capital is likely to prioritise core production sectors and financially sound enterprises with stable cash flows, improving the quality of profit growth while reducing excess liquidity in the market.

KB Vietnam Securities said the ratings-based credit allocation mechanism will increasingly reflect differences in management quality, capital safety and funding capacity, which are likely to be priced into bank valuations.

Banks with strong capital bases and stable CASA ratios are expected to retain growth advantages and attract medium- to long-term investment, while those reliant on rapid credit expansion may face downward adjustments to profit expectations.

The continued classification of real estate as a monitored sector suggests bank funding will not be the main driver of a new recovery cycle, dampening speculative behaviour and shifting focus towards firms with clear legal frameworks and sound financial structures.

According to Đức Anh, although overall credit growth exceeded 19 per cent in 2025 and real estate lending surged by 35 per cent, tighter limits in 2026 will inevitably affect the sector’s outlook.

Impact on sectors

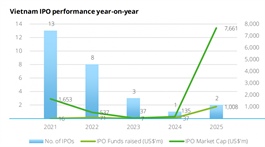

In the stock market, which depends heavily on liquidity and investor sentiment, reduced capital availability compared with 2025 could pose challenges. Brokerage income, margin lending and proprietary trading may come under pressure if liquidity tightens or if the market enters a phase of sharper differentiation.

There is, however, a positive dimension to the cautious approach, as it may serve as a necessary stress test after a period of rapid expansion.

As low-cost funding becomes less accessible, investors are likely to focus more on business fundamentals rather than short-term expectations or speculative momentum.

Khoa said companies with strong financial foundations, prudent capital structures, limited reliance on borrowing and clear tangible assets would be better positioned.

Sectors able to withstand inflation and benefit from long-term investment trends, including energy, logistics and materials, are seen as favourable across the broader market.

As tighter credit controls take effect, capital markets are expected to play a larger role in supporting more sustainable stock market development.

Funds may shift away from leverage-driven growth stories towards businesses with efficient models tied to public investment, domestic consumption and market upgrading. While this may slow headline index growth, it could help foster a more stable and higher-quality expansion over the medium term.

- 09:02 03/02/2026