National Assembly reviews amendments to personal income tax law

National Assembly reviews amendments to personal income tax law

The National Assembly is reviewing amendments to the Law on Personal Income Tax that aim to lower key rates and create a more balanced, progressive tax structure.

On December 2, the National Assembly (NA) Standing Committee examined revisions to the draft amended Personal Income Tax Law during its 52nd session. The proposed changes would reduce tax liabilities for all taxpayers while aligning Vietnam’s system more closely with international progressive tax standards.

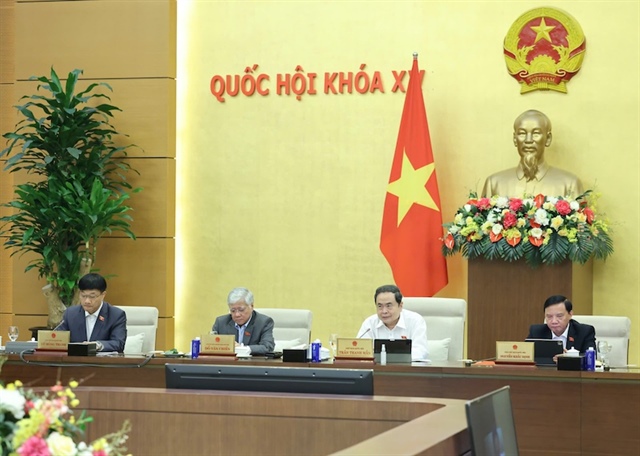

The NA session on December 2. Photo: Duy Linh |

During earlier committee discussions, NA delegates raised concerns about the rationale for adjusting income thresholds and tax rates in the proposed schedule.

They pointed out that gaps between brackets are uneven – for example, the jump between brackets 1, 2, and 3 is 10 per cent, while the difference between brackets 4 and 5 is only 5 per cent. As a result, taxpayers in brackets 2 and 3 face higher tax pressure than under current rules, even though they represent the majority of PIT payers.

Some delegates suggested capping the top rate at 25–30 per cent while raising taxable income thresholds to attract highly skilled workers. Others proposed a top rate of 45 per cent, in line with countries such as China, South Korea, Japan, France, and Australia.

In response, the government revised the progressive tax schedule in the draft Law, reducing two tax rates: the 15 per cent rate (bracket 2) is lowered to 10 per cent, and the 25 per cent rate (bracket 3) is reduced to 20 per cent, as detailed in the table at the end of this article.

Under the new schedule, all individuals currently paying tax at any bracket would see reduced tax liabilities compared with the existing rates. The revised schedule also resolves the issue of abrupt increases between certain brackets, creating a more reasonable and balanced structure.

Regarding the top rate of 35 per cent in bracket 5 for wage and salary income, the government considers this appropriate, as it represents an average level – neither too high nor too low compared with global and ASEAN norms.

Several ASEAN members such as Thailand, Indonesia, and the Philippines also apply a 35 per cent top rate; meanwhile this rate is pegged at 45 per cent for China.

The government further noted that reducing the 35 per cent rate to 30 per cent could be perceived as providing tax cuts for high-income earners.

On family circumstance deductions, some delegates proposed setting deductions for dependents at 50 per cent of the deduction for taxpayers, should the law specify fixed deduction levels.

The government explained that family circumstance deductions consist of a deduction for the taxpayer and a deduction for dependents. The taxpayer deduction essentially serves as the threshold for taxable income and is built around typical consumption needs of individuals earning above the social average.

The dependent deduction applies to individuals whom the taxpayer is legally responsible for supporting.

International practice shows that dependent deductions are lower than taxpayer deductions and often subject to a cap per family, aligning with related social policies.

Dependent deductions typically equal 10 per cent to 50 per cent of the taxpayer’s deduction because household-related expenses – housing, appliances, utilities, and general living costs – are already incorporated into the taxpayer deduction; meanwhile, food, healthcare, and other recurring costs are generally higher for the taxpayer to ensure the reproduction of their labour capacity.

Since the Personal Income Tax Law took effect in 2009, the dependent deduction has remained at 40 per cent of the taxpayer deduction and has been adjusted in line with changes to the taxpayer threshold, the government report noted.

Reporting to the National Assembly Standing Committee, Phan Van Mai, chair of the Committee on Economic and Financial Affairs, stated that most issues raised by lawmakers and the reviewing body have been addressed, clarified, or partially incorporated by the government in the amended draft Law.

Revised progressive tax schedule

|

Tax Bracket |

Taxable Monthly Income (USD) |

Income Range per Bracket (USD) |

Tax Rate (%) |

|

1 |

Up to $400 |

$400 |

5 |

|

2 |

Over $400 to $1,200 |

$800 |

10 |

|

3 |

Over $1,200 to $2,400 |

$1,200 |

20 |

|

4 |

Over $2,400 to $4,000 |

$1,600 |

30 |

|

5 |

Over $4,000 |

– |

35 |

- 19:01 03/12/2025