Over 50,000 F&B outlets close in first half of 2025

Over 50,000 F&B outlets close in first half of 2025

Vietnam's food and beverage (F&B) sector saw over 50,000 outlets close in the first half of 2025, signalling ongoing volatility in the market.

According to the Vietnam F&B Market Report for the first half of 2025, released on October 10 by iPOS.vn in collaboration with Nestlé Vietnam, more than 50,000 food and beverage outlets shuttered, marking the second major shakeout since early 2024. The report highlights the challenging and unpredictable conditions facing the industry.

|

The report estimates total industry revenue at around $16.2 billion in the first six months of this year, only slightly higher than the $16.1 billion recorded in the same period of 2024. This performance is well below expectations, as surveys at the end of last year projected a growth rate of around 10 per cent for 2025.

Once again, the industry failed to deliver, with rising input costs continuing to erode margins. Rental, raw materials, and labour costs all climbed, with pork prices up 12.75 per cent, food up 4.15 per cent, and housing, electricity, water, and fuel up 5.7 per cent. Under these pressures, many outlets limited promotional activities and discounts, stalling overall revenue growth.

At the business level, performance was uneven. While almost 35 per cent of enterprises reported stable revenue and close to one fifth achieved growth above 5 per cent, 18 per cent saw serious declines, up from 14.3 per cent a year earlier. A positive signal, however, is that Vietnamese consumers have not drastically cut back on dining. A mid-year survey found that more than 54 per cent intend to maintain their food and beverage budgets, while 38 per cent plan to reduce spending. This has supported operator confidence, with just under 68 per cent planning expansion in the second half of the year, compared to 32 per cent taking a cautious approach. Still, given current consumption inertia, researchers forecast that growth in the latter half of 2025 will likely peak at around 9.6 per cent compared to the first half.

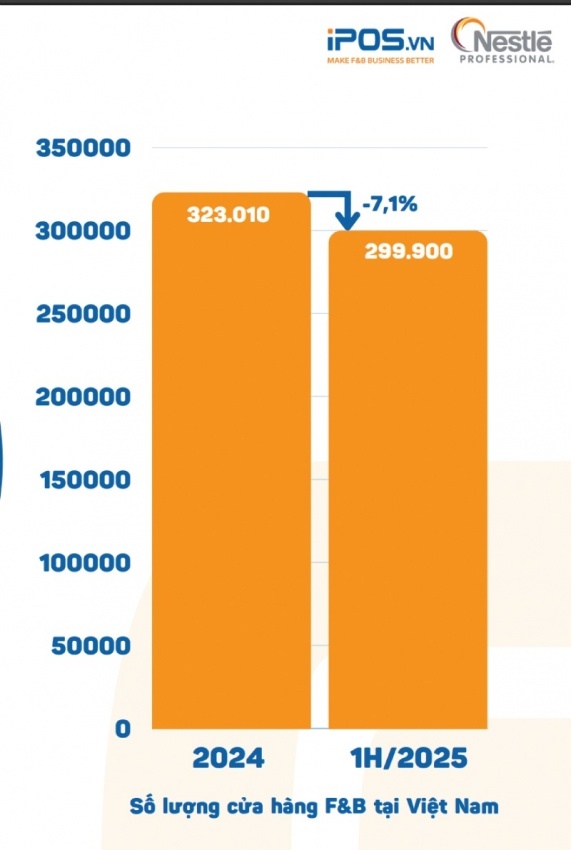

One of the most striking findings is the scale of closures. By June 30, the country counted just under 300,000 active F&B outlets, down 7.1 per cent from 2024, meaning more than 50,000 outlets had disappeared. The steepest contractions occurred in Hanoi and Ho Chi Minh City, both recording declines of more than 11 per cent. This wave far exceeds that of mid-2024, when about 30,000 outlets closed, equivalent to a 4 per cent reduction.

By the end of that year, however, new openings offset the loss, lifting the total to over 323,000 outlets. The latest contraction underscores the 'open fast – close fast – learn fast' phenomenon that has swept through small businesses, with many experimental models lasting only two or three months before shutting down due to limited financial capacity or insufficient market potential.

According to Nguyen Do Anh Quan, brand director of iPOS.vn, "The first half of the year is often a period of natural filtering for the sector, before a new wave of openings and restructuring emerges later on. While smaller outlets have borne the brunt, larger chains have focused on restructuring their portfolios, closing underperforming sites while repositioning in iconic locations and upgrading customer experience."

Another notable trend has been widespread price hikes. Some 45 per cent of businesses increased prices in the first half of 2025, particularly in the mass and mid-tier segments, where adjustments risk customer loss. Among them, almost a third raised prices by less than 5 per cent, just over a tenth by 5–10 per cent, and just over 1 per cent by more than 10 per cent.

Rising input costs were cited as the main driver, with more than 35 per cent pointing to more expensive raw materials, 21 per cent to regulatory changes such as e-invoices and taxation, and 20 per cent to higher labour costs. Rent was also a factor, with almost 14 per cent attributing price increases to rental pressures, while only 3.6 per cent followed pre-set adjustment schedules.

Industry experts stressed that nearly half of operators raising prices in just six months signals a sector-wide trend, not isolated cases. "The F&B sector is entering a stage where pricing power is becoming a measure of adaptability. Companies with strong brands, differentiated products, and loyal customers will find room to increase prices, while those relying heavily on price-sensitive consumers risk losing revenue if they fail to align pricing with strategy," added Quan.

- 19:15 13/10/2025