Professional financial advisors key to market development

Professional financial advisors key to market development

The Ministry of Finance (MoF) has praised the contributions of advisory teams from securities companies and fund management firms.

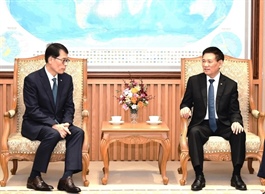

Deputy Minister of Finance Nguyen Thi Bich Ngoc |

Speaking at the Vietnam Wealth Advisory Summit (VWAS) 2025 on September 25, Deputy Minister of Finance Nguyen Thi Bich Ngoc emphasised the critical role of professional financial advisors.

She said that the global economy continues to face difficulties, including trade tensions, geopolitical conflicts, and prolonged political instability in several countries and regions. These factors are significantly affecting economic growth prospects, inflation, and the global investment and business climate. At the same time, international financial and monetary markets are experiencing highly unpredictable fluctuations.

Vietnam has set an economic growth target of 8.3-8.5 per cent this year, using this as a springboard to achieve double-digit growth in the following years. International organisations and many countries have acknowledged that this is an ambitious and challenging goal. Recently, a series of major policy directions and decisions have been introduced to promote new growth drivers and demonstrate a firm commitment to reforming the growth model and restructuring the economy towards sustainable development.

As Vietnam moves towards a new era, the country's financial market is also on the cusp of significant transformation. This includes a wave of institutional breakthroughs: the stock market is nearing an upgrade to emerging market status, digital assets are beginning to be legalised, and international financial centres are being established in Vietnam.

"These reforms and initiatives play a vital role in creating a new momentum for the market, unlocking more opportunities for the economy, investors, and businesses alike," Ngoc emphasised.

"In this context, where numerous variables and opportunities are intertwined, the role of professional financial advisors is more important than ever for the development of the financial sector," she added.

There are also considerable challenges in terms of risk management and system stability. While global economic fluctuations and domestic reforms bring high profit potential, they also carry significant risks for investors. To adapt and succeed, investors need the companionship and guidance of reliable financial experts and advisors.

"We believe the financial advisory community will serve as a critical bridge, helping investors identify key variables, build appropriate asset portfolios, and manage risk effectively," she said.

"Timely, accurate, and effective advisory services can help turn challenges into opportunities, and transform risks into foundations for success," Ngoc stated. "Once again, the MoF highly values the contributions of financial advisors, securities companies, fund managers, banks, and insurers in promoting a healthy and sustainable financial market."

With the theme “New Era, New Springboard”, this year's VWAS has brought together leaders of state management agencies and prominent speakers to engage in in-depth discussions on global economic variables, the outlook for Vietnam's economy, and the financial market.

The summit will feature two discussion sessions:

- Session 1: “The Stock Market Before New Opportunities” will welcome representatives from the State Securities Commission, leading securities companies, and international investment funds. Speakers will debate the outlook for key stock groups, promising sectors, and provide recommendations for investors in a rapidly changing market.

- Session 2: “Breakthroughs in Vietnam's Real Estate and Digital Assets Markets” will spotlight two highly promising sectors of the economy, discussing new policies, emerging trends, and future prospects.

The VWAS 2025 is continuing its mission of equipping investors with knowledge and tools to select transparent, professional financial products and services, while also fostering the sustainable development of the wealth advisory community.

- 15:00 25/09/2025